Enlarge image

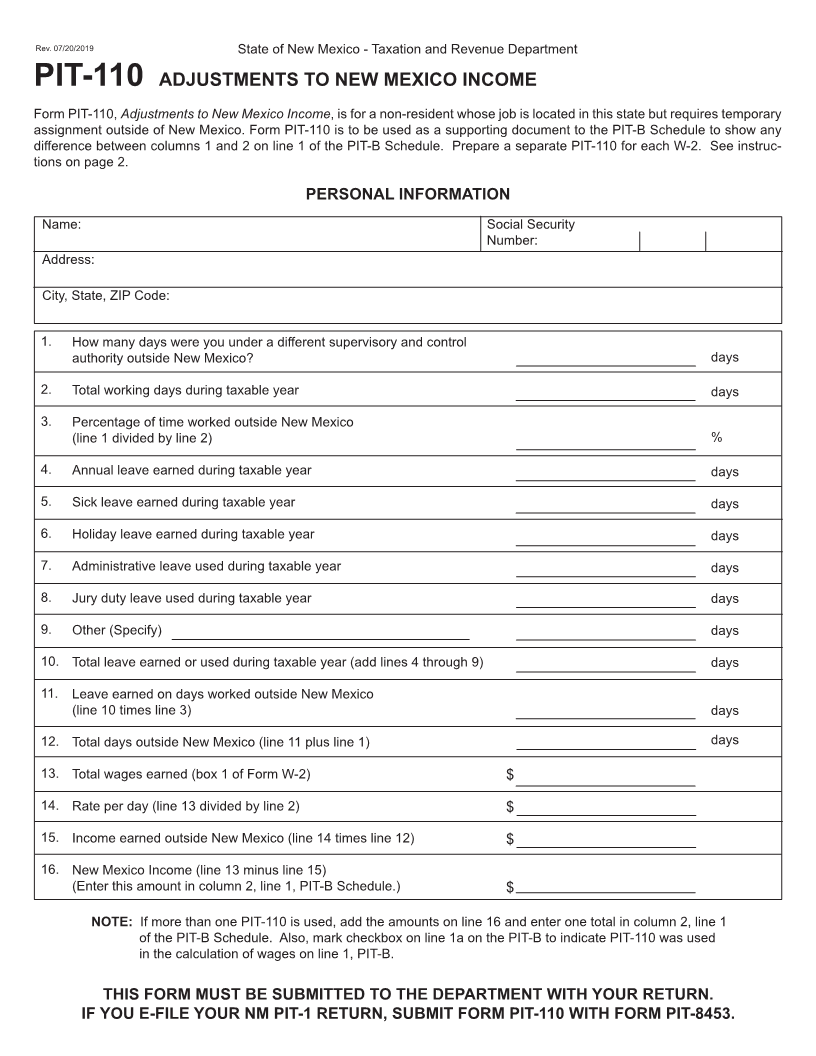

Rev. 07/20/2019 State of New Mexico - Taxation and Revenue Department

PIT-110 ADJUSTMENTS TO NEW MEXICO INCOME

Form PIT-110, Adjustments to New Mexico Income, is for a non-resident whose job is located in this state but requires temporary

assignment outside of New Mexico. Form PIT-110 is to be used as a supporting document to the PIT-B Schedule to show any

difference between columns 1 and 2 on line 1 of the PIT-B Schedule. Prepare a separate PIT-110 for each W-2. See instruc-

tions on page 2.

PERSONAL INFORMATION

Name: Social Security

Number:

Address:

City, State, ZIP Code:

1. How many days were you under a different supervisory and control

authority outside New Mexico? days

2. Total working days during taxable year days

3. Percentage of time worked outside New Mexico

(line 1 divided by line 2) %

4. Annual leave earned during taxable year days

5. Sick leave earned during taxable year days

6. Holiday leave earned during taxable year days

7. Administrative leave used during taxable year days

8. Jury duty leave used during taxable year days

9. Other (Specify) days

10. Total leave earned or used during taxable year (add lines 4 through 9) days

11. Leave earned on days worked outside New Mexico

(line 10 times line 3) days

12. Total days outside New Mexico (line 11 plus line 1) days

13. Total wages earned (box 1 of Form W-2) $

14. Rate per day (line 13 divided by line 2) $

15. Income earned outside New Mexico (line 14 times line 12) $

16. New Mexico Income (line 13 minus line 15)

(Enter this amount in column 2, line 1, PIT-B Schedule.) $

NOTE: If more than one PIT-110 is used, add the amounts on line 16 and enter one total in column 2, line 1

of the PIT-B Schedule. Also, mark checkbox on line 1a on the PIT-B to indicate PIT-110 was used

in the calculation of wages on line 1, PIT-B.

THIS FORM MUST BE SUBMITTED TO THE DEPARTMENT WITH YOUR RETURN.

IF YOU E-FILE YOUR NM PIT-1 RETURN, SUBMIT FORM PIT-110 WITH FORM PIT-8453.