Enlarge image

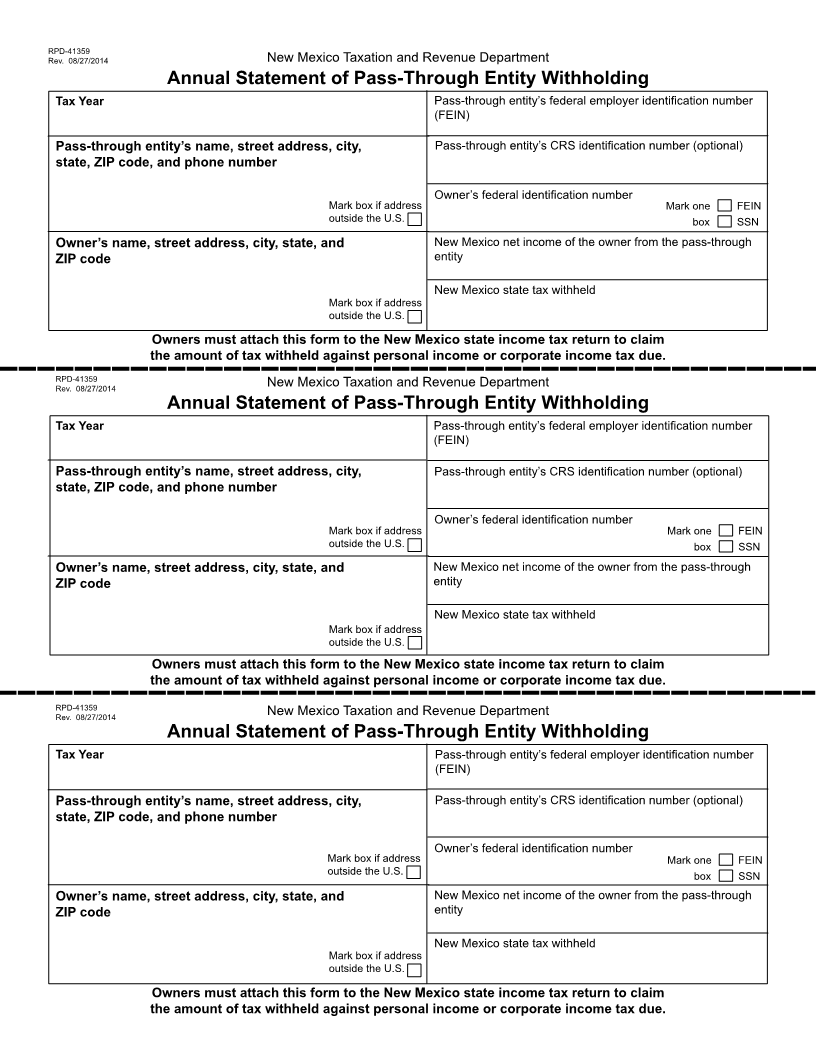

RPD-41359 Rev. 08/27/2014 New Mexico Taxation and Revenue Department Annual Statement of Pass-Through Entity Withholding Tax Year Pass-through entity’s federal employer identification number (FEIN) Pass-through entity’s name, street address, city, Pass-through entity’s CRS identification number (optional) state, ZIP code, and phone number Owner’s federal identification number Mark box if address Mark one FEIN outside the U.S. box SSN Owner’s name, street address, city, state, and New Mexico net income of the owner from the pass-through ZIP code entity New Mexico state tax withheld Mark box if address outside the U.S. Owners must attach this form to the New Mexico state income tax return to claim the amount of tax withheld against personal income or corporate income tax due. RPD-41359 New Mexico Taxation and Revenue Department Rev. 08/27/2014 Annual Statement of Pass-Through Entity Withholding Tax Year Pass-through entity’s federal employer identification number (FEIN) Pass-through entity’s name, street address, city, Pass-through entity’s CRS identification number (optional) state, ZIP code, and phone number Owner’s federal identification number Mark box if address Mark one FEIN outside the U.S. box SSN Owner’s name, street address, city, state, and New Mexico net income of the owner from the pass-through ZIP code entity New Mexico state tax withheld Mark box if address outside the U.S. Owners must attach this form to the New Mexico state income tax return to claim the amount of tax withheld against personal income or corporate income tax due. RPD-41359 New Mexico Taxation and Revenue Department Rev. 08/27/2014 Annual Statement of Pass-Through Entity Withholding Tax Year Pass-through entity’s federal employer identification number (FEIN) Pass-through entity’s name, street address, city, Pass-through entity’s CRS identification number (optional) state, ZIP code, and phone number Owner’s federal identification number Mark box if address Mark one FEIN outside the U.S. box SSN Owner’s name, street address, city, state, and New Mexico net income of the owner from the pass-through ZIP code entity New Mexico state tax withheld Mark box if address outside the U.S. Owners must attach this form to the New Mexico state income tax return to claim the amount of tax withheld against personal income or corporate income tax due.