Enlarge image

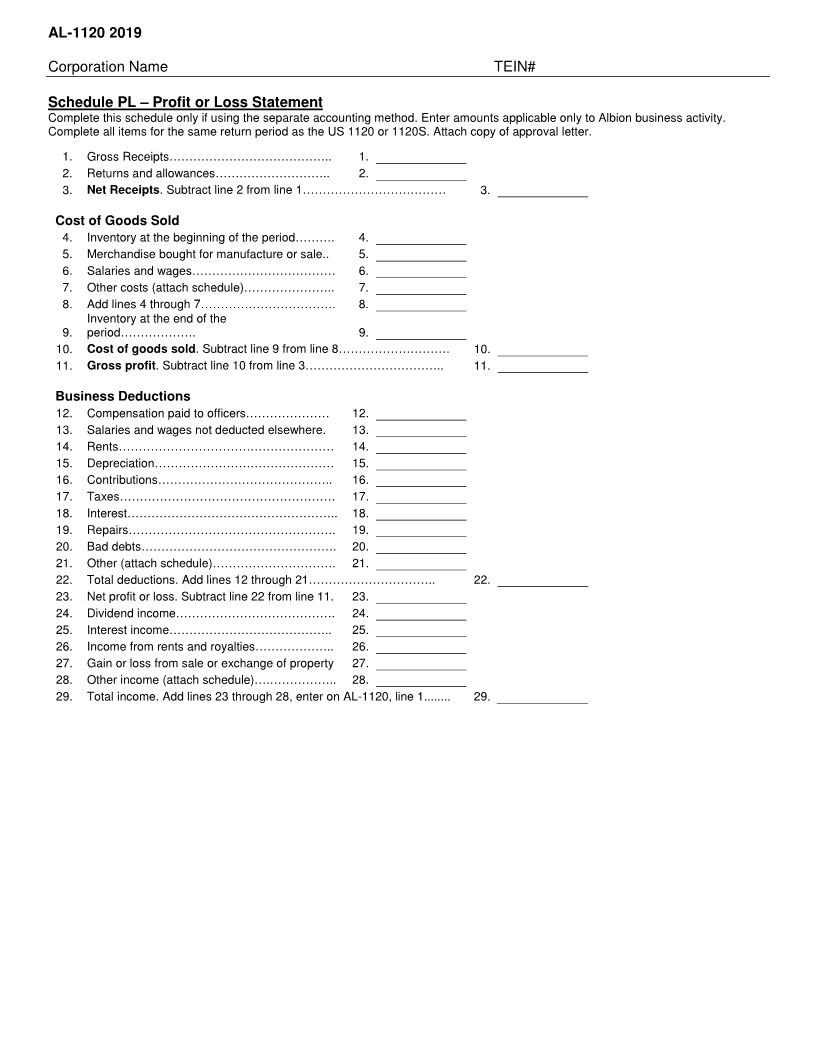

2019 CITY OF ALBION CORPORATE INCOME TAX RETURN

City of Albion

Income Tax Department

112 W. Cass St

Albion, MI 49224

City of Albion (Rev 9/2019 )

2019 CITY OF ALBION

CORPORATE INCOME TAX RETURN

For the 2019 tax year:

The due date for filing the corporate (AL-1120) income tax returns is the last day of

the fourth month following the close of the tax year. If more time is needed, an

extension form (AL-4267) is provided in this booklet.

Important information for Albion taxpayers:

Make all checks and money orders submitted for payment of Albion

income taxes payable to the "City of Albion"

Attach a copy of your 2019 federal income tax return (i.e. 1120, 1120S)

as filed with the IRS to your Albion return.

Estimated payments must be made if the corporation's income tax

liability exceeds $250.00. Estimate vouchers (AL-1120ES) are

included in this booklet.

We look forward to continuing to serve Albion Taxpayers.

Sincerely

David Atchison

Mayor of Albion