Enlarge image

TABLE OF CONTENTS

Introduction…………………………………………………………………………………………….…………... 1

Taxes of the State of New Jersey………………………………………………………………………….……….. 2

Instructions for Business Registration Application (NJ-REG)….……………….…………………………….…... 6

Business Registration Application (NJ-REG)……………………….……………………………….……...……... 17

Instructions for Business Entity Public Record Filing…………………………………………………….……….. 21

Business Entity Public Record Filing Application….…………………………………………………….………... 23

Instructions for Registration of Alternate Name (C-150G)……………………………………………………........ 25

Registration of Alternate Name Application (C-150G).…………………………………………..……...………... 26

Instructions for New Hire Reporting………..………………………………………………………….………….. 27

New Hire Reporting Form…………………………………………………………………………………………. 29

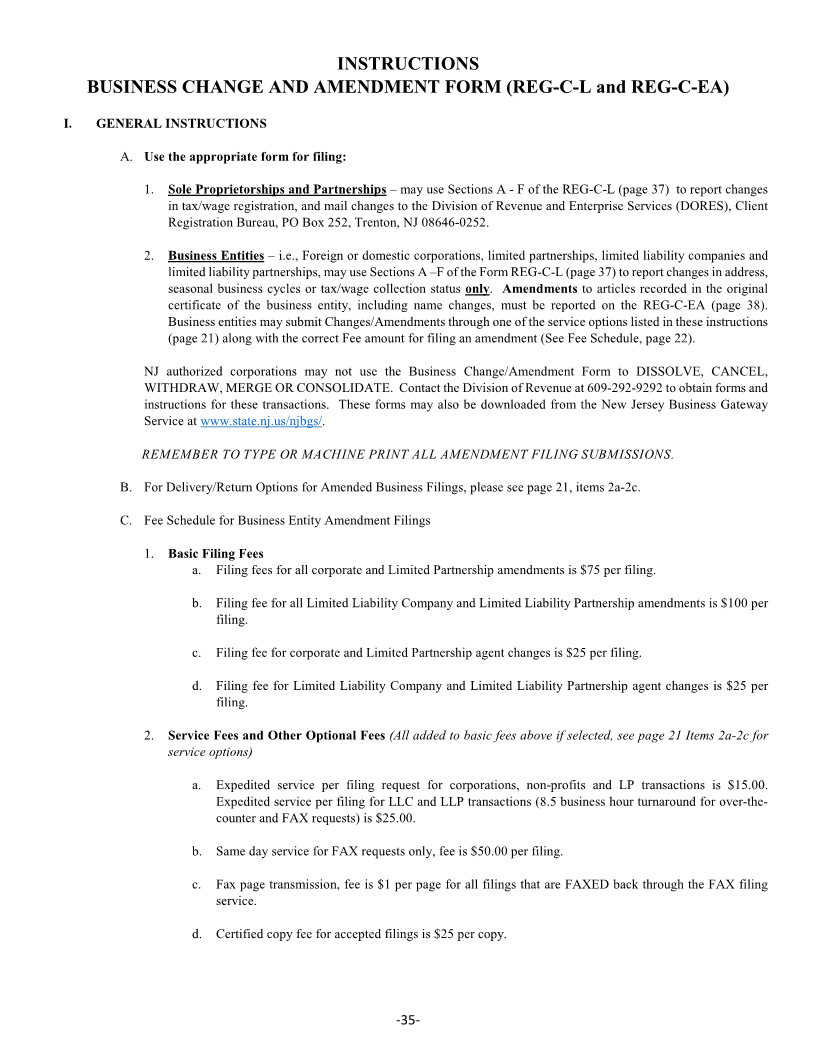

Instructions for Business Change and Amendment Form (REG-C-L and REG-C-EA)………….……….……….. 35

Request for Change of Registration Information Application (REG-C-L)…………………………………………. 37

Business Entity Amendment Filing (REG-C-EA).………………………………………………..……………….. 38

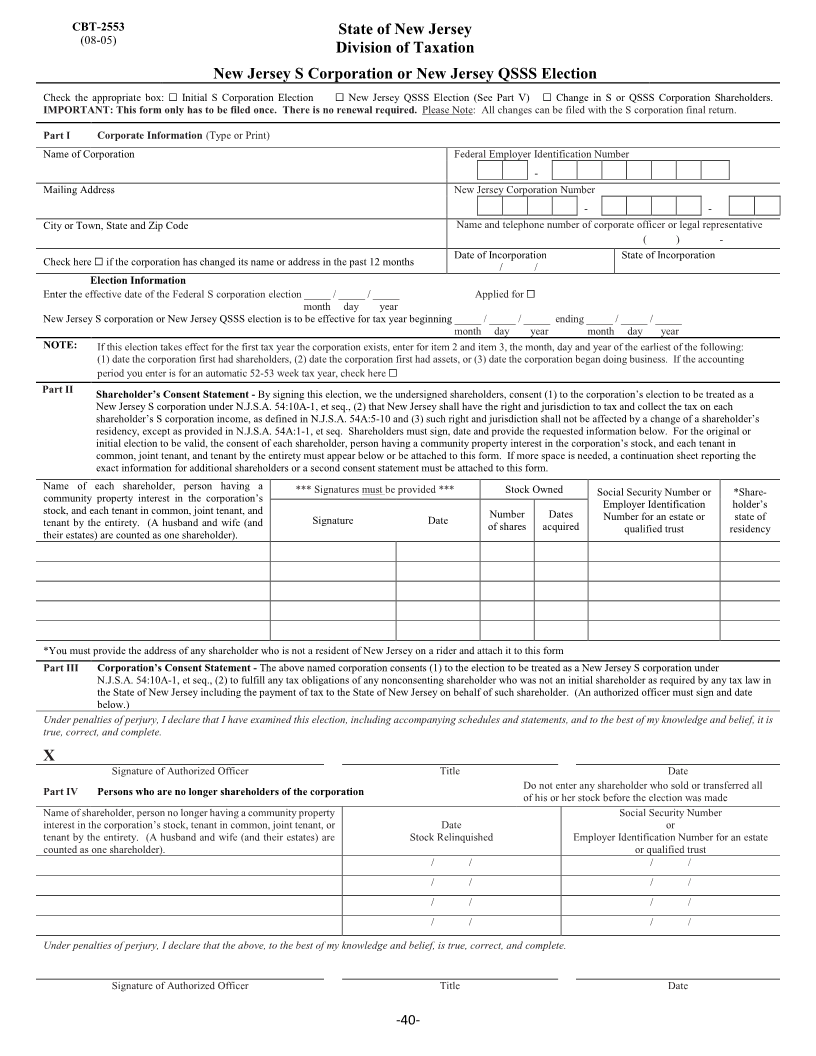

New Jersey S Corporation & QSSS Election Form and Instructions (CBT-2553)………………..……………….. 40

Instructions for New Jersey S Corporation Certification (CBT-2553 Cert)…………..……………………..……... 42

New Jersey S Corporation Certification Application (CBT-2553 Cert)……………………………………….......... 43

Cigarette License Application (CM-100).………………………………………………………………………….. 44

(Cigarette Retail, Vending & Manufacturer Representative Licenses)

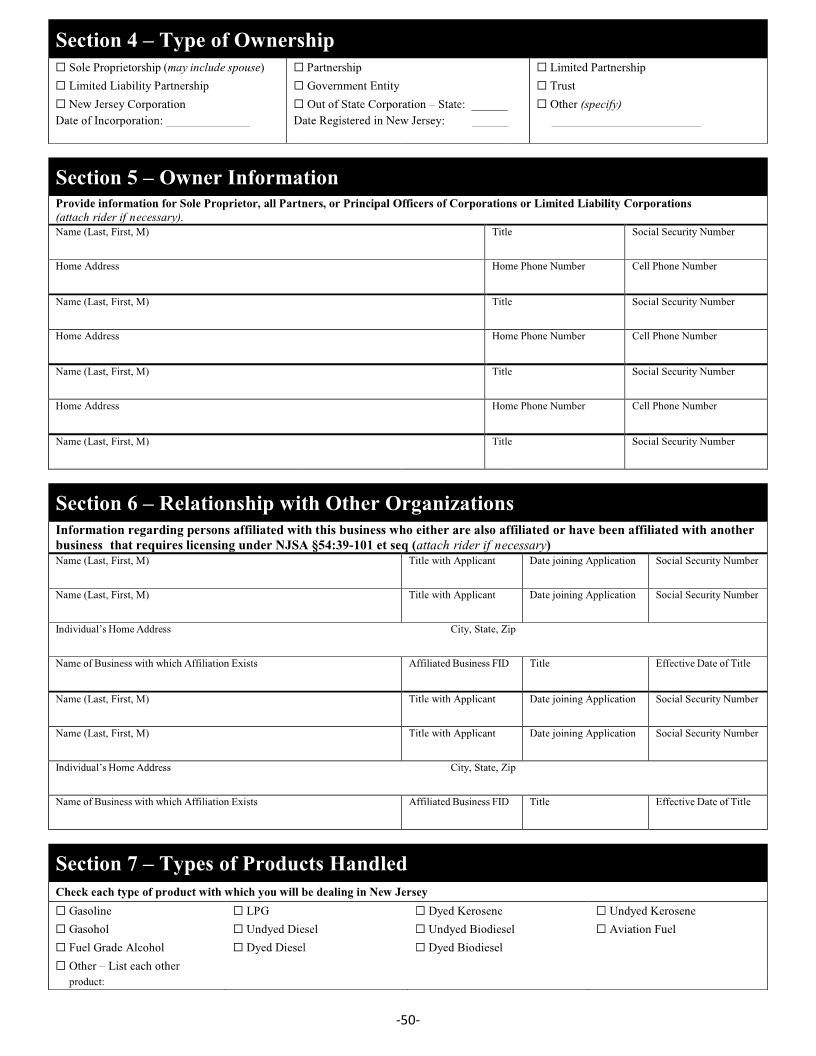

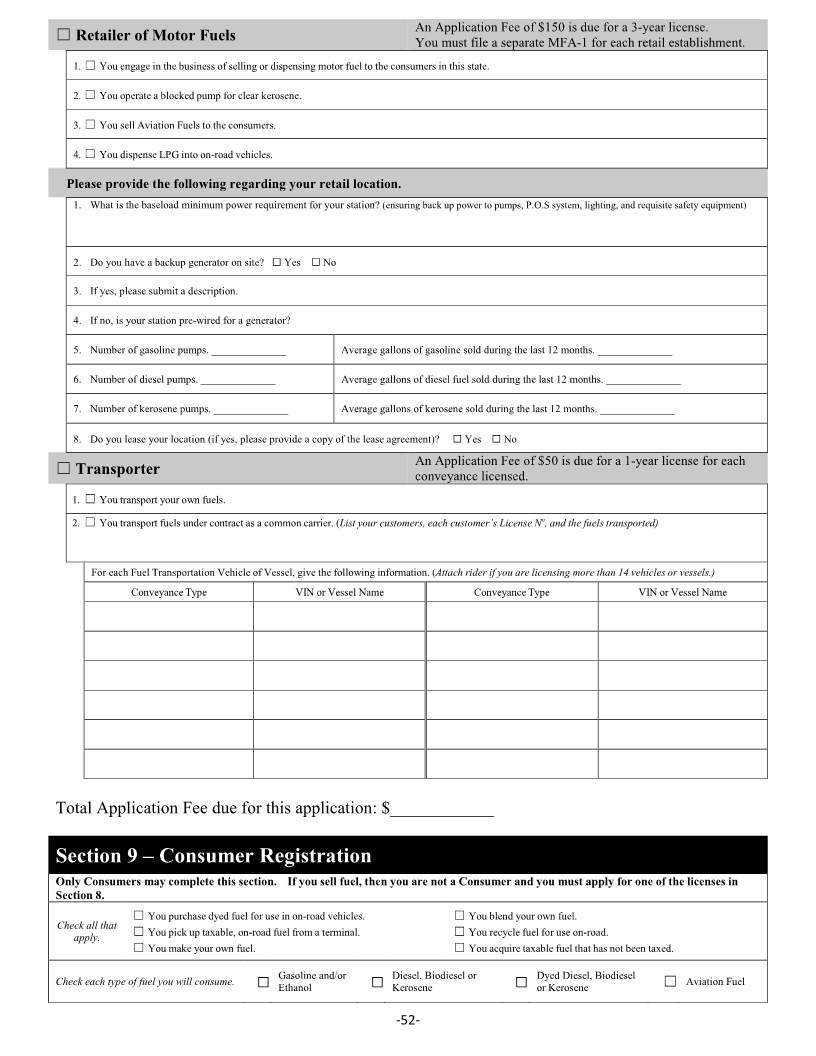

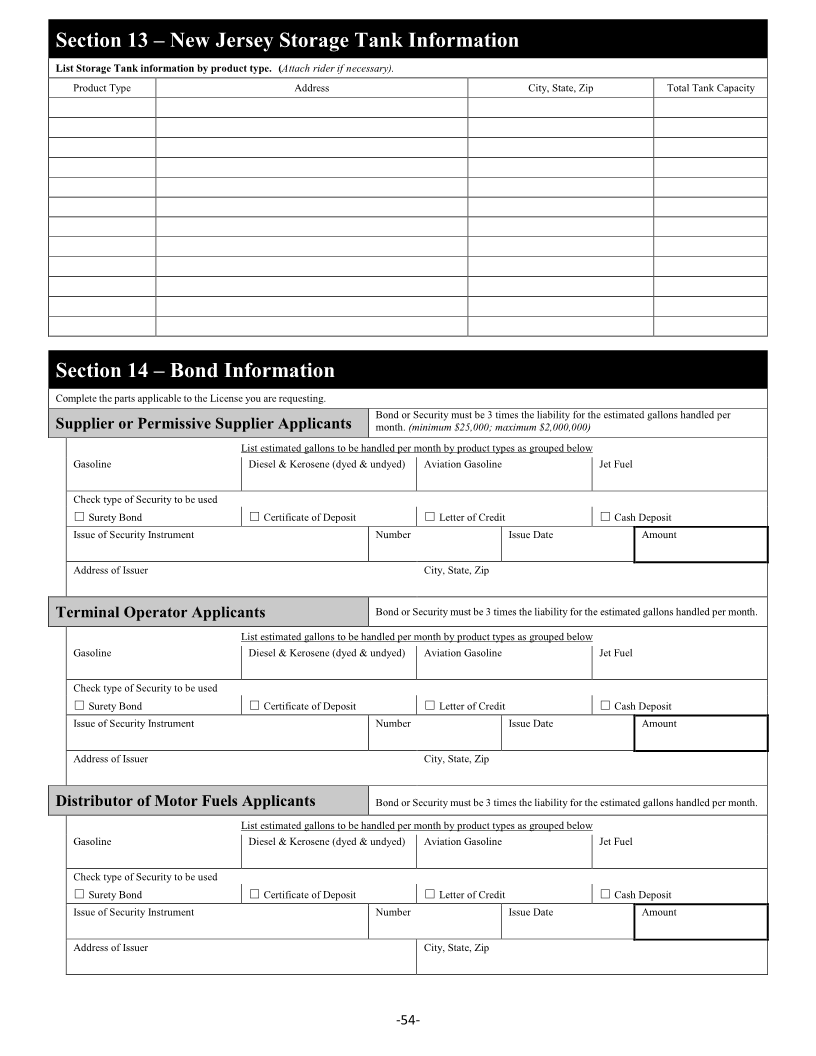

Instructions for Motor Fuel License Application (MFA-1).……………………………………………………….. 45

(Distributor, Permissive Supplier, Retail Dealer, Supplier, Terminal Operator and Transporter)

Motor Fuel License Application (MFA-1)…………………………………………………………………………. 48

INTRODUCTION

BUSINESS REGISTRATION ORMSF AND NFORMATIONI

This packet contains information and forms you will need to register your business with the Division of Revenue and

Enterprise Services (DORES). By completing and filing a Business Registration Application (NJ-REG), a business will be

registered for applicable taxes and related liabilities that are administered by the Department of Labor and Workforce

Development and Division of Taxation. Businesses may register online or may submit form NJ-REG and if applicable,

the Public Records Filing for New Business Entity. After registering, businesses will receive the forms, returns, instructions

and other information required for on-going compliance with New Jersey State taxes. If you are registering for the first

time, you are also required to complete the New Hire Reporting Form (pages 29-30).

Applicants who are registering as Sole Proprietors or Partnerships may file online at

https://www.njportal.com/DOR/BusinessRegistration/ or may file pages 17-19, form NJ-REG. Applicants who are

registering a new business entity (Limited Liability Company, Limited Partnership, Limited Liability Partnership, or a

Corporation), and who have already formed a new business with our Commercial Recording/Corporate Filing Unit, may

file online at https://www.njportal.com/DOR/BusinessRegistration/ or may file pages 17-19, form NJ-REG. There

is no need to complete pages 23-24 of this package if you have successfully filed with Commercial Recording. Applicants

who are registering as a new Business Entity (Limited Liability Company, Limited Partnership, Limited Liability

Partnership, or a Corporation) may file online at https://www.njportal.com/DOR/BusinessFormation/Home/Welcome or

may complete the Public Records Filing for New Business Entity pages 23-24 in addition to pages 17-19. Please note

that the Public Records Filing should be submitted prior to the completion of form NJ-REG, but form NJ-REG must be

submitted within 60 days of filing the new business entity.

Sales Tax? If you will be collecting Sales Tax, you must submit your NJ-REG at least fifteen days prior to the date of

your first sale, remitting use tax, or using NJ exemption certificates. You will receive a Certificate of Authority for

sales tax indicating the 12-digit identification number assigned to your business.

Federal Identification Number? All corporations and businesses with employees must have a Federal Employer

Identification Number (FEIN). You must apply for your FEIN after you have formed your business entity. Contact the

Internal Revenue Service at 1-800-829-1040 or https://www.irs.gov/.

Questions? Please contact the DORES’ Customer Service Center at 609-292-9292 if you have questions regarding the

filing of the Business Registration Application or the Public Records Filing for New Business Entity.

-1-