- 27 -

Enlarge image

|

2022 NJ-1041 Tax Table 27

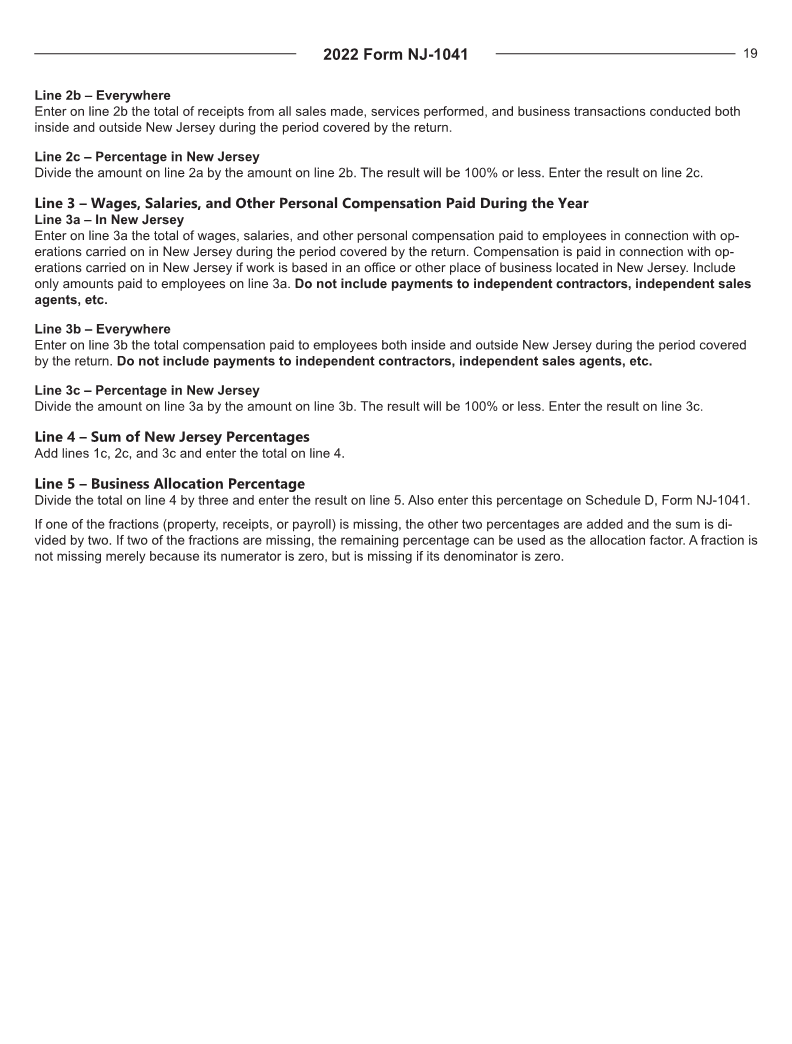

2022 NEW JERSEY TAX TABLE (NJ-1041)

If Line 24 If Line 24 If Line 24 If Line 24 If Line 24

(New Jersey Taxable (New Jersey Taxable (New Jersey Taxable (New Jersey Taxable (New Jersey Taxable

Income) Is — Income) Is — Income) Is — Income) Is — Income) Is —

At But Your At But Your At But Your At But Your At But Your

Least Less Tax Least Less Tax Least Less Tax Least Less Tax Least Less Tax

Than Is: Than Is: Than Is: Than Is: Than Is:

95,000 98,000 101,000 104,000 107,000

95,000 95,050 3,927 98,000 98,050 4,118 101,000 101,050 4,309 104,000 104,050 4,500 107,000 107,050 4,691

95,050 95,100 3,930 98,050 98,100 4,121 101,050 101,100 4,312 104,050 104,100 4,503 107,050 107,100 4,694

95,100 95,150 3,933 98,100 98,150 4,124 101,100 101,150 4,315 104,100 104,150 4,507 107,100 107,150 4,698

95,150 95,200 3,936 98,150 98,200 4,127 101,150 101,200 4,319 104,150 104,200 4,510 107,150 107,200 4,701

95,200 95,250 3,940 98,200 98,250 4,131 101,200 101,250 4,322 104,200 104,250 4,513 107,200 107,250 4,704

95,250 95,300 3,943 98,250 98,300 4,134 101,250 101,300 4,325 104,250 104,300 4,516 107,250 107,300 4,707

95,300 95,350 3,946 98,300 98,350 4,137 101,300 101,350 4,328 104,300 104,350 4,519 107,300 107,350 4,710

95,350 95,400 3,949 98,350 98,400 4,140 101,350 101,400 4,331 104,350 104,400 4,522 107,350 107,400 4,714

95,400 95,450 3,952 98,400 98,450 4,143 101,400 101,450 4,335 104,400 104,450 4,526 107,400 107,450 4,717

95,450 95,500 3,956 98,450 98,500 4,147 101,450 101,500 4,338 104,450 104,500 4,529 107,450 107,500 4,720

95,500 95,550 3,959 98,500 98,550 4,150 101,500 101,550 4,341 104,500 104,550 4,532 107,500 107,550 4,723

95,550 95,600 3,962 98,550 98,600 4,153 101,550 101,600 4,344 104,550 104,600 4,535 107,550 107,600 4,726

95,600 95,650 3,965 98,600 98,650 4,156 101,600 101,650 4,347 104,600 104,650 4,538 107,600 107,650 4,729

95,650 95,700 3,968 98,650 98,700 4,159 101,650 101,700 4,350 104,650 104,700 4,542 107,650 107,700 4,733

95,700 95,750 3,971 98,700 98,750 4,163 101,700 101,750 4,354 104,700 104,750 4,545 107,700 107,750 4,736

95,750 95,800 3,975 98,750 98,800 4,166 101,750 101,800 4,357 104,750 104,800 4,548 107,750 107,800 4,739

95,800 95,850 3,978 98,800 98,850 4,169 101,800 101,850 4,360 104,800 104,850 4,551 107,800 107,850 4,742

95,850 95,900 3,981 98,850 98,900 4,172 101,850 101,900 4,363 104,850 104,900 4,554 107,850 107,900 4,745

95,900 95,950 3,984 98,900 98,950 4,175 101,900 101,950 4,366 104,900 104,950 4,557 107,900 107,950 4,749

95,950 96,000 3,987 98,950 99,000 4,178 101,950 102,000 4,370 104,950 105,000 4,561 107,950 108,000 4,752

96,000 99,000 102,000 105,000 108,000

96,000 96,050 3,991 99,000 99,050 4,182 102,000 102,050 4,373 105,000 105,050 4,564 108,000 108,050 4,755

96,050 96,100 3,994 99,050 99,100 4,185 102,050 102,100 4,376 105,050 105,100 4,567 108,050 108,100 4,758

96,100 96,150 3,997 99,100 99,150 4,188 102,100 102,150 4,379 105,100 105,150 4,570 108,100 108,150 4,761

96,150 96,200 4,000 99,150 99,200 4,191 102,150 102,200 4,382 105,150 105,200 4,573 108,150 108,200 4,764

96,200 96,250 4,003 99,200 99,250 4,194 102,200 102,250 4,385 105,200 105,250 4,577 108,200 108,250 4,768

96,250 96,300 4,006 99,250 99,300 4,198 102,250 102,300 4,389 105,250 105,300 4,580 108,250 108,300 4,771

96,300 96,350 4,010 99,300 99,350 4,201 102,300 102,350 4,392 105,300 105,350 4,583 108,300 108,350 4,774

96,350 96,400 4,013 99,350 99,400 4,204 102,350 102,400 4,395 105,350 105,400 4,586 108,350 108,400 4,777

96,400 96,450 4,016 99,400 99,450 4,207 102,400 102,450 4,398 105,400 105,450 4,589 108,400 108,450 4,780

96,450 96,500 4,019 99,450 99,500 4,210 102,450 102,500 4,401 105,450 105,500 4,593 108,450 108,500 4,784

96,500 96,550 4,022 99,500 99,550 4,213 102,500 102,550 4,405 105,500 105,550 4,596 108,500 108,550 4,787

96,550 96,600 4,026 99,550 99,600 4,217 102,550 102,600 4,408 105,550 105,600 4,599 108,550 108,600 4,790

96,600 96,650 4,029 99,600 99,650 4,220 102,600 102,650 4,411 105,600 105,650 4,602 108,600 108,650 4,793

96,650 96,700 4,032 99,650 99,700 4,223 102,650 102,700 4,414 105,650 105,700 4,605 108,650 108,700 4,796

96,700 96,750 4,035 99,700 99,750 4,226 102,700 102,750 4,417 105,700 105,750 4,608 108,700 108,750 4,800

96,750 96,800 4,038 99,750 99,800 4,229 102,750 102,800 4,421 105,750 105,800 4,612 108,750 108,800 4,803

96,800 96,850 4,042 99,800 99,850 4,233 102,800 102,850 4,424 105,800 105,850 4,615 108,800 108,850 4,806

96,850 96,900 4,045 99,850 99,900 4,236 102,850 102,900 4,427 105,850 105,900 4,618 108,850 108,900 4,809

96,900 96,950 4,048 99,900 99,950 4,239 102,900 102,950 4,430 105,900 105,950 4,621 108,900 108,950 4,812

96,950 97,000 4,051 99,950 100,000 4,242 102,950 103,000 4,433 105,950 106,000 4,624 108,950 109,000 4,815

97,000 100,000 103,000 106,000 109,000

97,000 97,050 4,054 100,000 100,050 4,245 103,000 103,050 4,436 106,000 106,050 4,628 109,000 109,050 4,819

97,050 97,100 4,057 100,050 100,100 4,249 103,050 103,100 4,440 106,050 106,100 4,631 109,050 109,100 4,822

97,100 97,150 4,061 100,100 100,150 4,252 103,100 103,150 4,443 106,100 106,150 4,634 109,100 109,150 4,825

97,150 97,200 4,064 100,150 100,200 4,255 103,150 103,200 4,446 106,150 106,200 4,637 109,150 109,200 4,828

97,200 97,250 4,067 100,200 100,250 4,258 103,200 103,250 4,449 106,200 106,250 4,640 109,200 109,250 4,831

97,250 97,300 4,070 100,250 100,300 4,261 103,250 103,300 4,452 106,250 106,300 4,643 109,250 109,300 4,835

97,300 97,350 4,073 100,300 100,350 4,264 103,300 103,350 4,456 106,300 106,350 4,647 109,300 109,350 4,838

97,350 97,400 4,077 100,350 100,400 4,268 103,350 103,400 4,459 106,350 106,400 4,650 109,350 109,400 4,841

97,400 97,450 4,080 100,400 100,450 4,271 103,400 103,450 4,462 106,400 106,450 4,653 109,400 109,450 4,844

97,450 97,500 4,083 100,450 100,500 4,274 103,450 103,500 4,465 106,450 106,500 4,656 109,450 109,500 4,847

97,500 97,550 4,086 100,500 100,550 4,277 103,500 103,550 4,468 106,500 106,550 4,659 109,500 109,550 4,850

97,550 97,600 4,089 100,550 100,600 4,280 103,550 103,600 4,471 106,550 106,600 4,663 109,550 109,600 4,854

97,600 97,650 4,092 100,600 100,650 4,284 103,600 103,650 4,475 106,600 106,650 4,666 109,600 109,650 4,857

97,650 97,700 4,096 100,650 100,700 4,287 103,650 103,700 4,478 106,650 106,700 4,669 109,650 109,700 4,860

97,700 97,750 4,099 100,700 100,750 4,290 103,700 103,750 4,481 106,700 106,750 4,672 109,700 109,750 4,863

97,750 97,800 4,102 100,750 100,800 4,293 103,750 103,800 4,484 106,750 106,800 4,675 109,750 109,800 4,866

97,800 97,850 4,105 100,800 100,850 4,296 103,800 103,850 4,487 106,800 106,850 4,679 109,800 109,850 4,870

97,850 97,900 4,108 100,850 100,900 4,299 103,850 103,900 4,491 106,850 106,900 4,682 109,850 109,900 4,873

97,900 97,950 4,112 100,900 100,950 4,303 103,900 103,950 4,494 106,900 106,950 4,685 109,900 109,950 4,876

97,950 98,000 4,115 100,950 101,000 4,306 103,950 104,000 4,497 106,950 107,000 4,688 109,950 110,000 4,879

|