Enlarge image

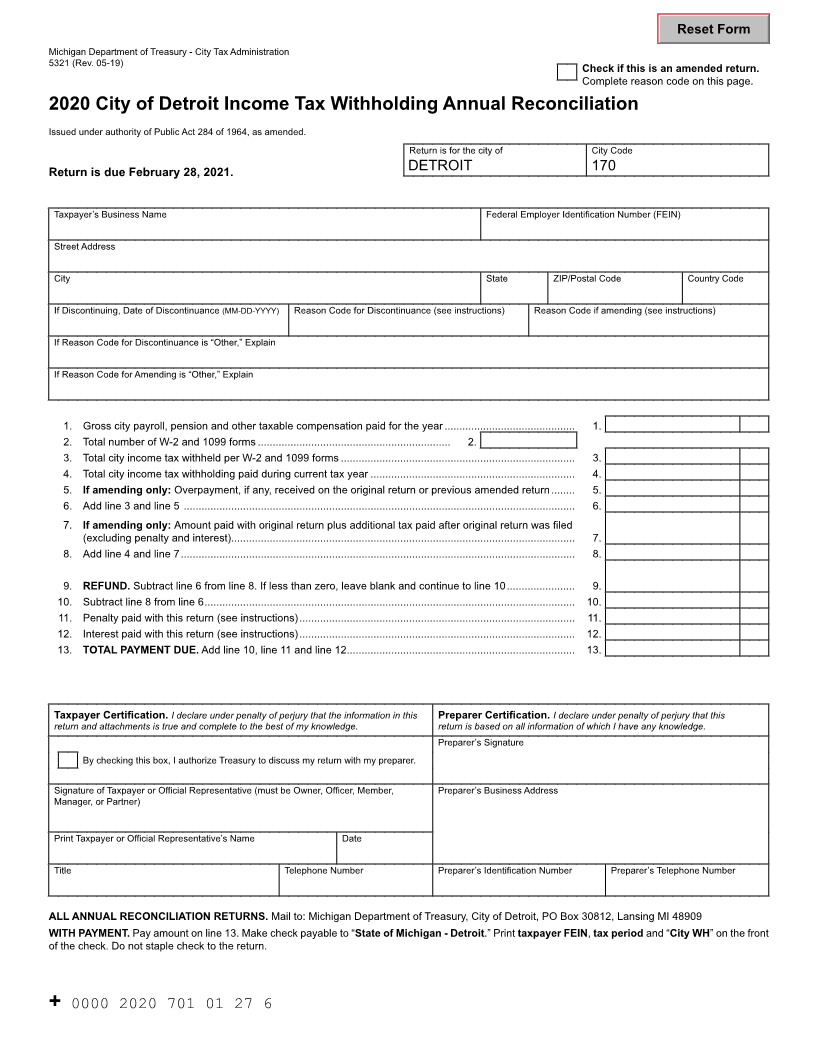

Reset Form

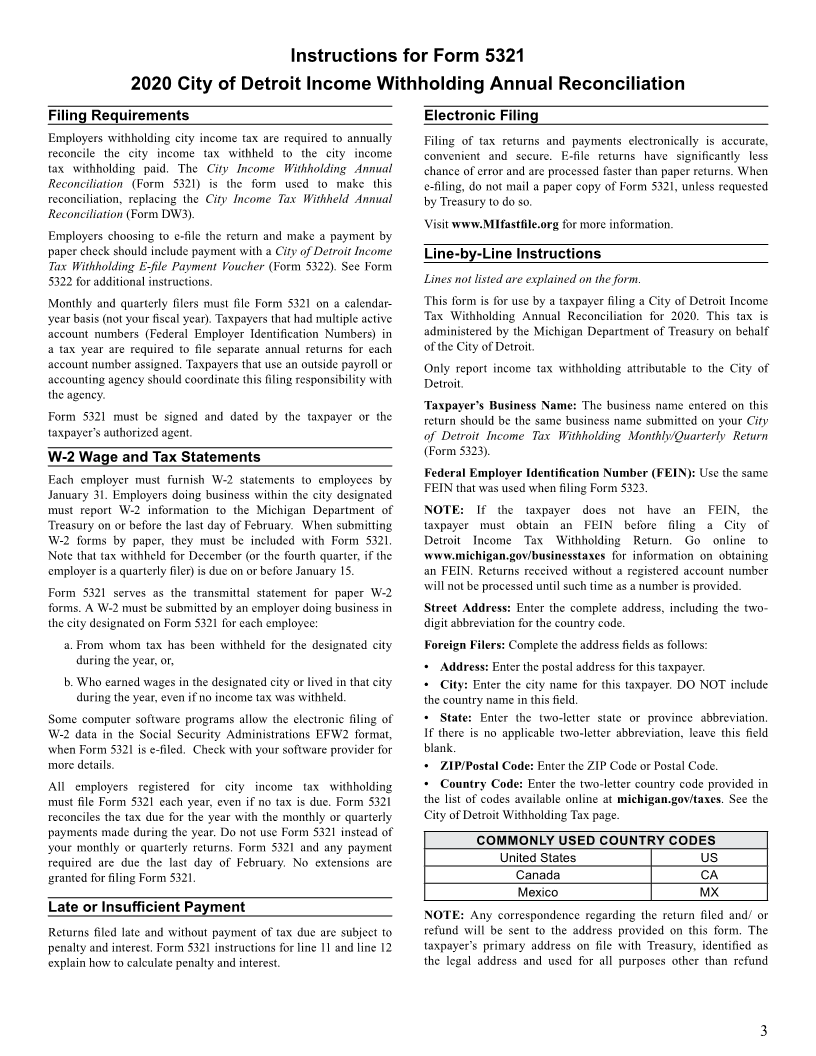

Michigan Department of Treasury - City Tax Administration

5321 (Rev. 05-19)

Check if this is an amended return.

Complete reason code on this page.

2020 City of Detroit Income Tax Withholding Annual Reconciliation

Issued under authority of Public Act 284 of 1964, as amended.

Return is for the city of City Code

Return is due February 28, 2021. DETROIT 170

Taxpayer’s Business Name Federal Employer Identification Number (FEIN)

Street Address

City State ZIP/Postal Code Country Code

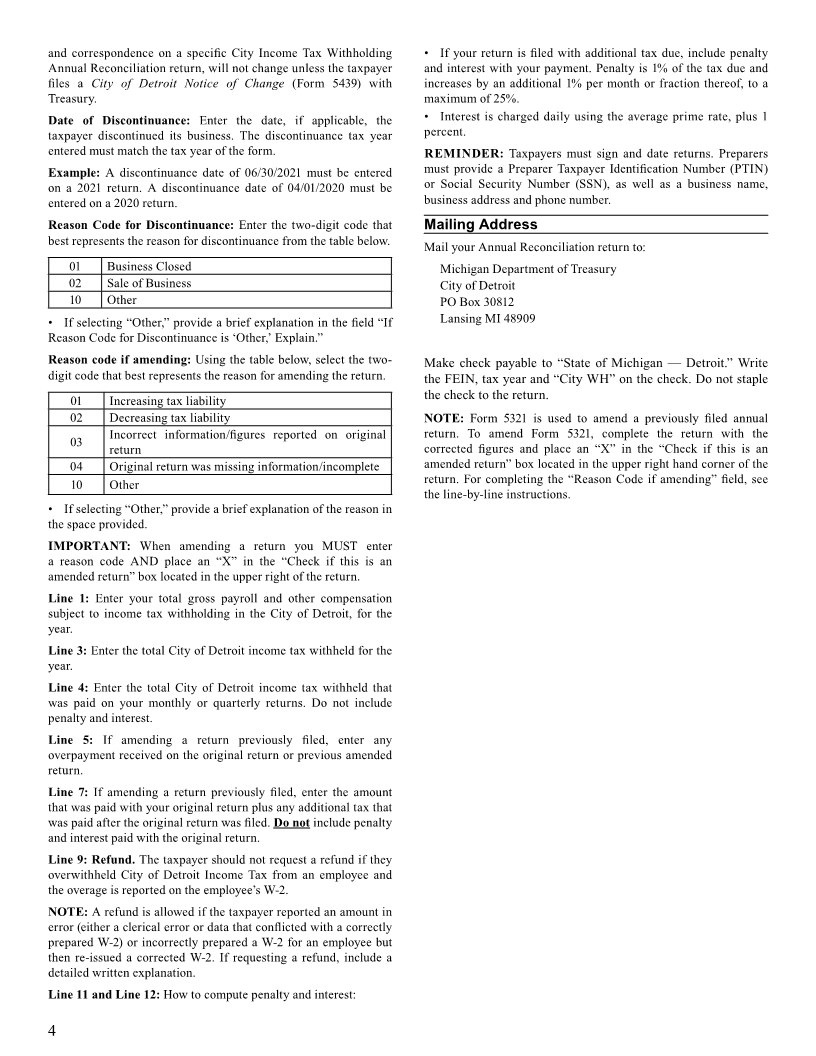

If Discontinuing, Date of Discontinuance (MM-DD-YYYY) Reason Code for Discontinuance (see instructions) Reason Code if amending (see instructions)

If Reason Code for Discontinuance is “Other,” Explain

If Reason Code for Amending is “Other,” Explain

1. Gross city payroll, pension and other taxable compensation paid for the year ............................................ 1.

2. Total number of W-2 and 1099 forms ................................................................. 2.

3. Total city income tax withheld per W-2 and 1099 forms ............................................................................... 3.

4. Total city income tax withholding paid during current tax year ..................................................................... 4.

5. If amending only: Overpayment, if any, received on the original return or previous amended return ........ 5.

6. Add line 3 and line 5 .................................................................................................................................... 6.

7. If amending only: Amount paid with original return plus additional tax paid after original return was filed

(excluding penalty and interest).................................................................................................................... 7.

8. Add line 4 and line 7 ..................................................................................................................................... 8.

9. REFUND. Subtract line 6 from line 8. If less than zero, leave blank and continue to line 10 ....................... 9.

10. Subtract line 8 from line 6 ............................................................................................................................. 10.

11. Penalty paid with this return (see instructions) ............................................................................................. 11.

12. Interest paid with this return (see instructions) ............................................................................................. 12.

13. TOTAL PAYMENT DUE. Add line 10, line 11 and line 12............................................................................. 13.

Taxpayer Certification. I declare under penalty of perjury that the information in this Preparer Certification. I declare under penalty of perjury that this

return and attachments is true and complete to the best of my knowledge. return is based on all information of which I have any knowledge.

Preparer’s Signature

By checking this box, I authorize Treasury to discuss my return with my preparer.

Signature of Taxpayer or Official Representative (must be Owner, Officer, Member, Preparer’s Business Address

Manager, or Partner)

Print Taxpayer or Official Representative’s Name Date

Title Telephone Number Preparer’s Identification Number Preparer’s Telephone Number

ALL ANNUAL RECONCILIATION RETURNS. Mail to: Michigan Department of Treasury, City of Detroit, PO Box 30812, Lansing MI 48909

WITH PAYMENT. Pay amount on line 13. Make check payable toState“ of Michigan - Detroit.” Printtaxpayer FEIN,tax period and “City WH” on the front

of the check. Do not staple check to the return.

+ 0000 2020 701 01 27 6