Enlarge image

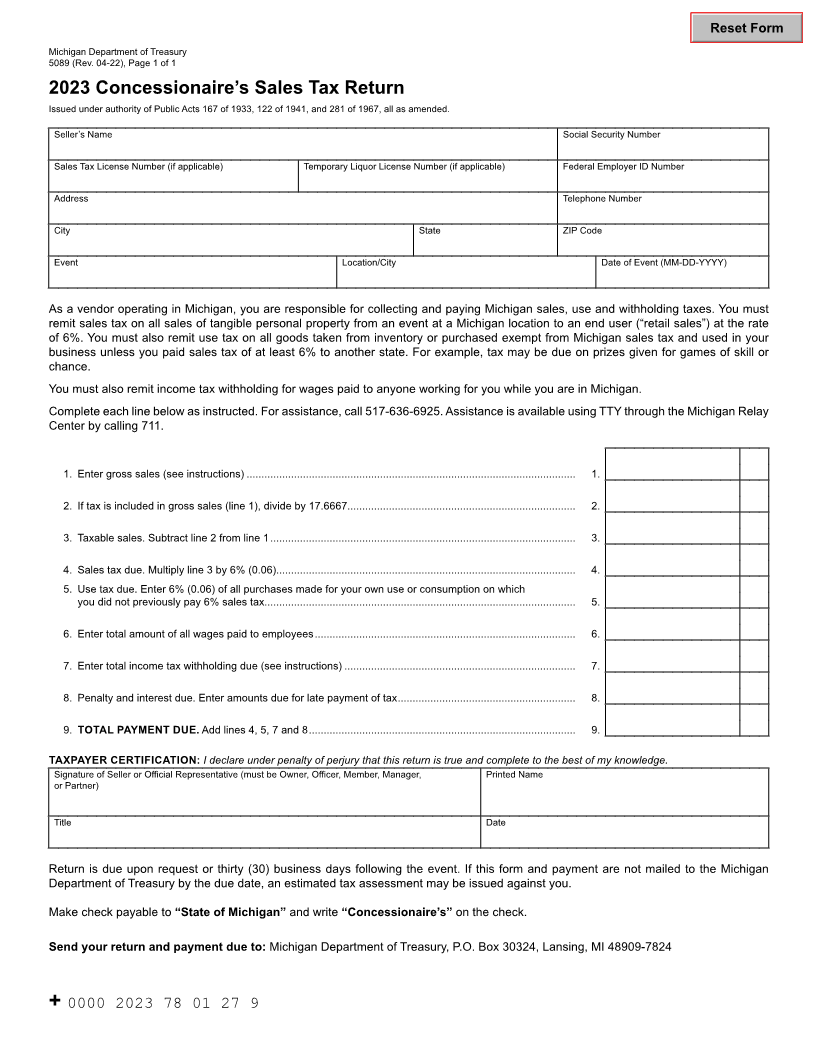

Reset Form

Michigan Department of Treasury

5089 (Rev. 04-22), Page 1 of 1

2023 Concessionaire’s Sales Tax Return

Issued under authority of Public Acts 167 of 1933, 122 of 1941, and 281 of 1967, all as amended.

Seller’s Name Social Security Number

Sales Tax License Number (if applicable) Temporary Liquor License Number (if applicable) Federal Employer ID Number

Address Telephone Number

City State ZIP Code

Event Location/City Date of Event (MM-DD-YYYY)

As a vendor operating in Michigan, you are responsible for collecting and paying Michigan sales, use and withholding taxes. You must

remit sales tax on all sales of tangible personal property from an event at a Michigan location to an end user (“retail sales”) at the rate

of 6%. You must also remit use tax on all goods taken from inventory or purchased exempt from Michigan sales tax and used in your

business unless you paid sales tax of at least 6% to another state. For example, tax may be due on prizes given for games of skill or

chance.

You must also remit income tax withholding for wages paid to anyone working for you while you are in Michigan.

Complete each line below as instructed. For assistance, call 517-636-6925. Assistance is available using TTY through the Michigan Relay

Center by calling 711.

1. Enter gross sales (see instructions) ............................................................................................................... 1.

2. If tax is included in gross sales (line 1), divide by 17.6667............................................................................. 2.

3. Taxable sales. Subtract line 2 from line 1 ....................................................................................................... 3.

4. Sales tax due. Multiply line 3 by 6% (0.06)..................................................................................................... 4.

5. Use tax due. Enter 6% (0.06) of all purchases made for your own use or consumption on which

you did not previously pay 6% sales tax......................................................................................................... 5.

6. Enter total amount of all wages paid to employees ........................................................................................ 6.

7. Enter total income tax withholding due (see instructions) .............................................................................. 7.

8. Penalty and interest due. Enter amounts due for late payment of tax ............................................................ 8.

9. TOTAL PAYMENT DUE. Add lines 4, 5, 7 and 8 .......................................................................................... 9.

TAXPAYER CERTIFICATION: I declare under penalty of perjury that this return is true and complete to the best of my knowledge.

Signature of Seller or Official Representative (must be Owner, Officer, Member, Manager, Printed Name

or Partner)

Title Date

Return is due upon request or thirty (30) business days following the event. If this form and payment are not mailed to the Michigan

Department of Treasury by the due date, an estimated tax assessment may be issued against you.

Make check payable to “State of Michigan” and write “Concessionaire’s” on the check.

Send your return and payment due to: Michigan Department of Treasury, P.O. Box 30324, Lansing, MI 48909-7824

+ 0000 2023 78 01 27 9