Enlarge image

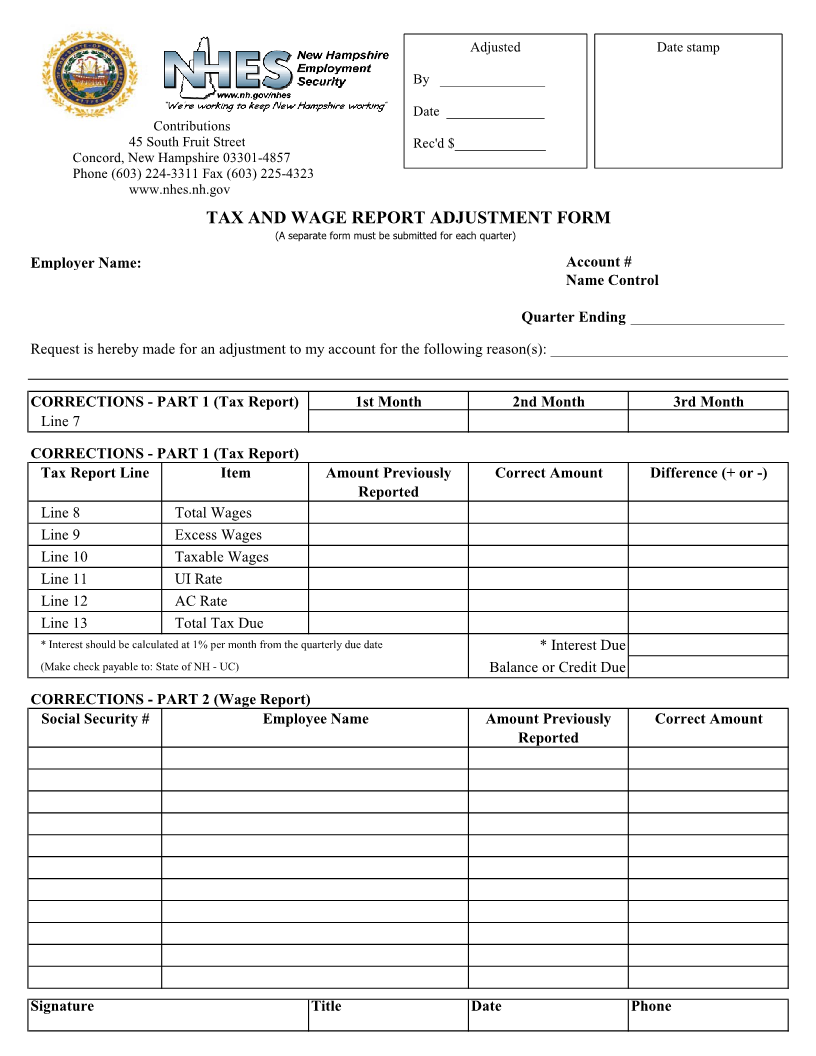

Adjusted Date stamp

By _______________

Date ______________

Contributions

45 South Fruit Street Rec'd $_____________

Concord, New Hampshire 03301-4857

Phone (603) 224-3311 Fax (603) 225-4323

www.nhes.nh.gov

TAX AND WAGE REPORT ADJUSTMENT FORM

(A separate form must be submitted for each quarter)

Employer Name: Account #

Name Control

Quarter Ending ____________________

Request is hereby made for an adjustment to my account for the following reason(s): _______________________________

CORRECTIONS - PART 1 (Tax Report) 1st Month 2nd Month 3rd Month

Line 7

CORRECTIONS - PART 1 (Tax Report)

Tax Report Line Item Amount Previously Correct Amount Difference (+ or -)

Reported

Line 8 Total Wages

Line 9 Excess Wages

Line 10 Taxable Wages

Line 11 UI Rate

Line 12 AC Rate

Line 13 Total Tax Due

* Interest should be calculated at 1% per month from the quarterly due date *Interest Due

(Make check payable to: State of NH - UC) Balance or Credit Due

CORRECTIONS - PART 2 (Wage Report)

Social Security # Employee Name Amount Previously Correct Amount

Reported

Signature Title Date Phone