Enlarge image

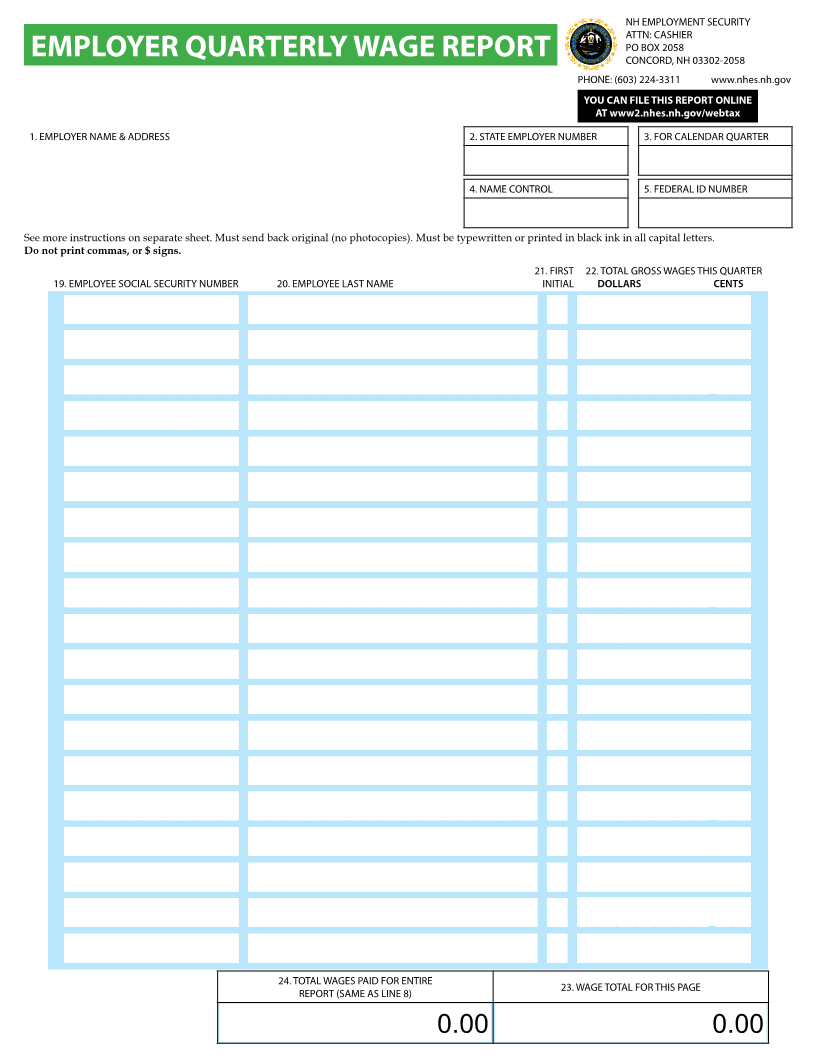

NH EMPLOYMENT SECURITY

ATTN: CASHIER

PO BOX 2058

CONCORD, NH 03302-2058

PHONE: (603) 224-3311 www.nhes.nh.gov

YOU CAN FILE THIS REPORT ONLINE

AT www2.nhes.nh.gov/webtax

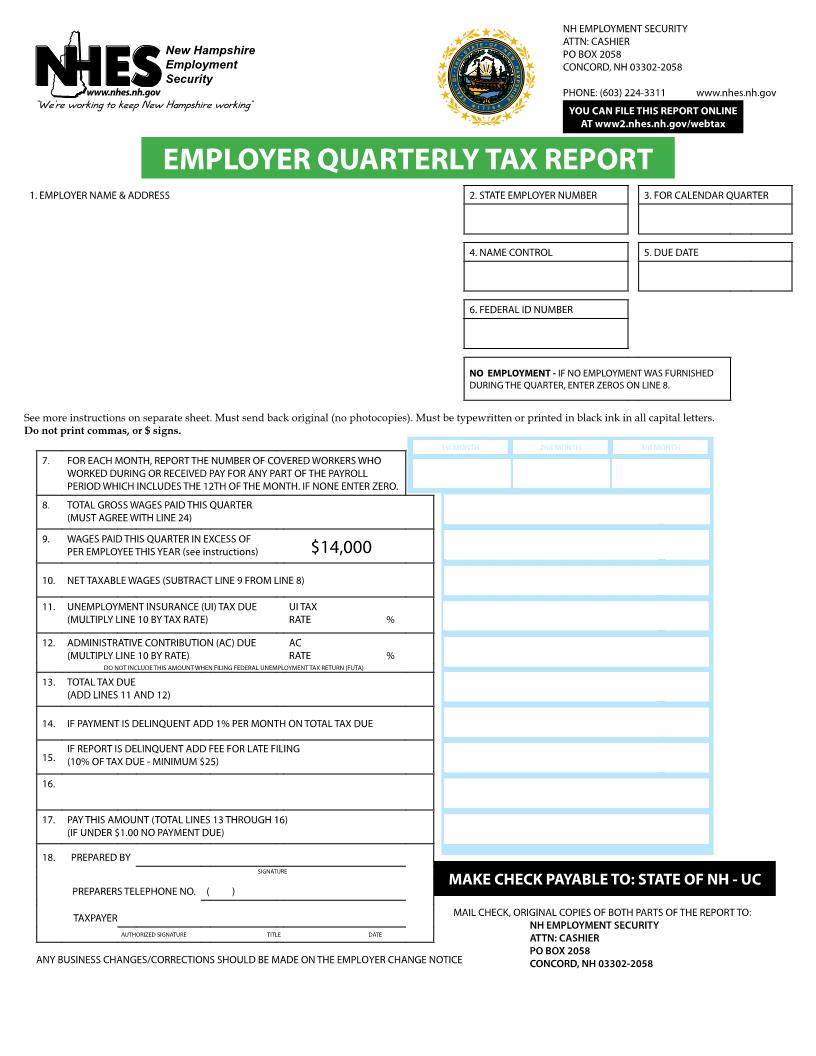

EMPLOYER QUARTERLY TAX REPORT

1. EMPLOYER NAME & ADDRESS 2. STATE EMPLOYER NUMBER 3. FOR CALENDAR QUARTER

4. NAME CONTROL 5. DUE DATE

6. FEDERAL ID NUMBER

NO EMPLOYMENT - IF NO EMPLOYMENT WAS FURNISHED

DURING THE QUARTER, ENTER ZEROS ON LINE 8.

See more instructions on separate sheet. Must send back original (no photocopies). Must be typewritten or printed in black ink in all capital letters.

Do not print commas, or $ signs.

1st MONTH 2nd MONTH 3rd MONTH

7. FOR EACH MONTH, REPORT THE NUMBER OF COVERED WORKERS WHO

WORKED DURING OR RECEIVED PAY FOR ANY PART OF THE PAYROLL

PERIOD WHICH INCLUDES THE 12TH OF THE MONTH. IF NONE ENTER ZERO.

8. TOTAL GROSS WAGES PAID THIS QUARTER

(MUST AGREE WITH LINE 24)

9. WAGES PAID THIS QUARTER IN EXCESS OF

PER EMPLOYEE THIS YEAR (see instructions) $14,000

10. NET TAXABLE WAGES (SUBTRACT LINE 9 FROM LINE 8)

11. UNEMPLOYMENT INSURANCE (UI) TAX DUE UI TAX

(MULTIPLY LINE 10 BY TAX RATE) RATE %

12. ADMINISTRATIVE CONTRIBUTION (AC) DUE AC

(MULTIPLY LINE 10 BY RATE) RATE %

DO NOT INCLUDE THIS AMOUNT WHEN FILING FEDERAL UNEMPLOYMENT TAX RETURN (FUTA)

13. TOTAL TAX DUE

(ADD LINES 11 AND 12)

14. IF PAYMENT IS DELINQUENT ADD 1% PER MONTH ON TOTAL TAX DUE

IF REPORT IS DELINQUENT ADD FEE FOR LATE FILING

15. (10% OF TAX DUE - MINIMUM $25)

16.

17. PAY THIS AMOUNT (TOTAL LINES 13 THROUGH 16)

(IF UNDER $1.00 NO PAYMENT DUE)

18. PREPARED BY

SIGNATURE

MAKE CHECK PAYABLE TO: STATE OF NH - UC

PREPARERS TELEPHONE NO. ( )

TAXPAYER MAIL CHECK, ORIGINAL COPIES OF BOTH PARTS OF THE REPORT TO:

NH EMPLOYMENT SECURITY

AUTHORIZED SIGNATURE TITLE DATE ATTN: CASHIER

PO BOX 2058

ANY BUSINESS CHANGES/CORRECTIONS SHOULD BE MADE ON THE EMPLOYER CHANGE NOTICE CONCORD, NH 03302-2058