Enlarge image

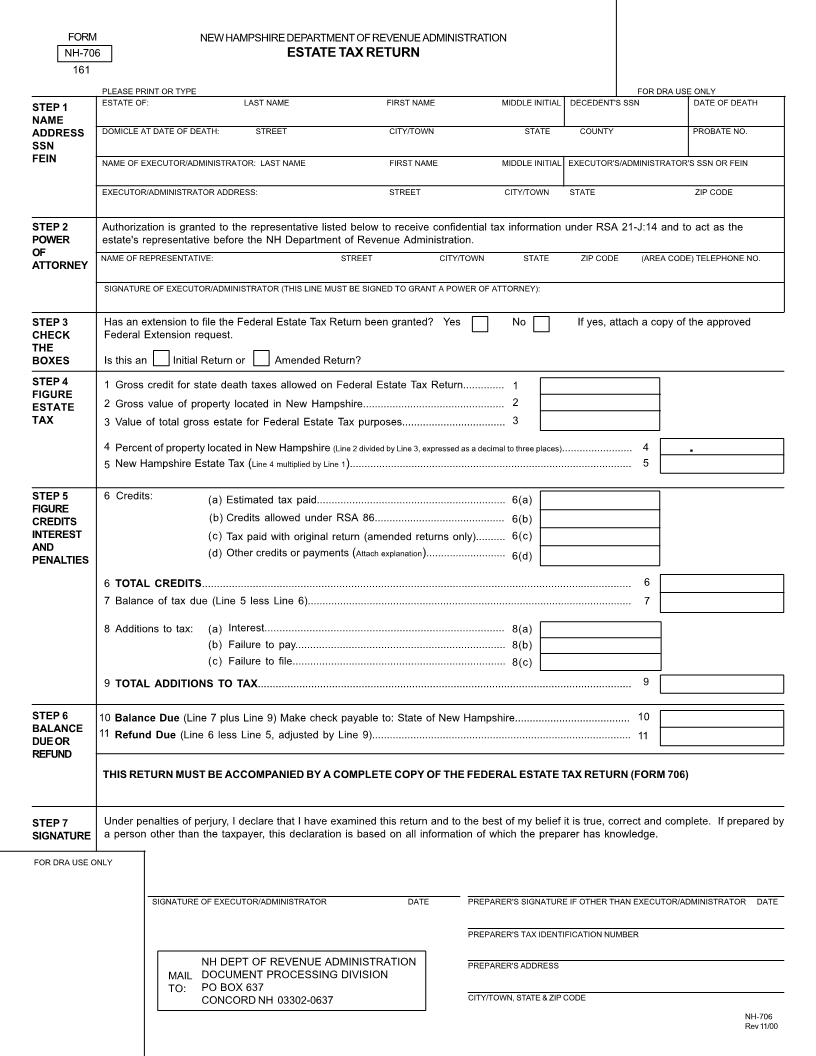

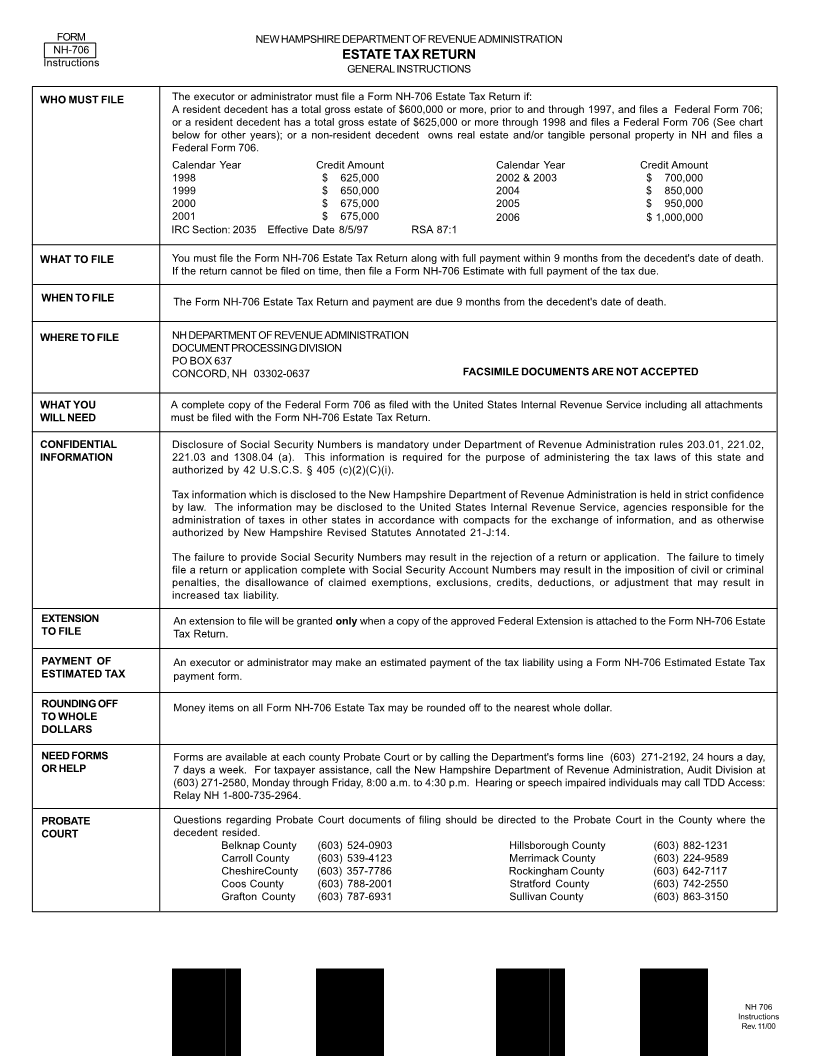

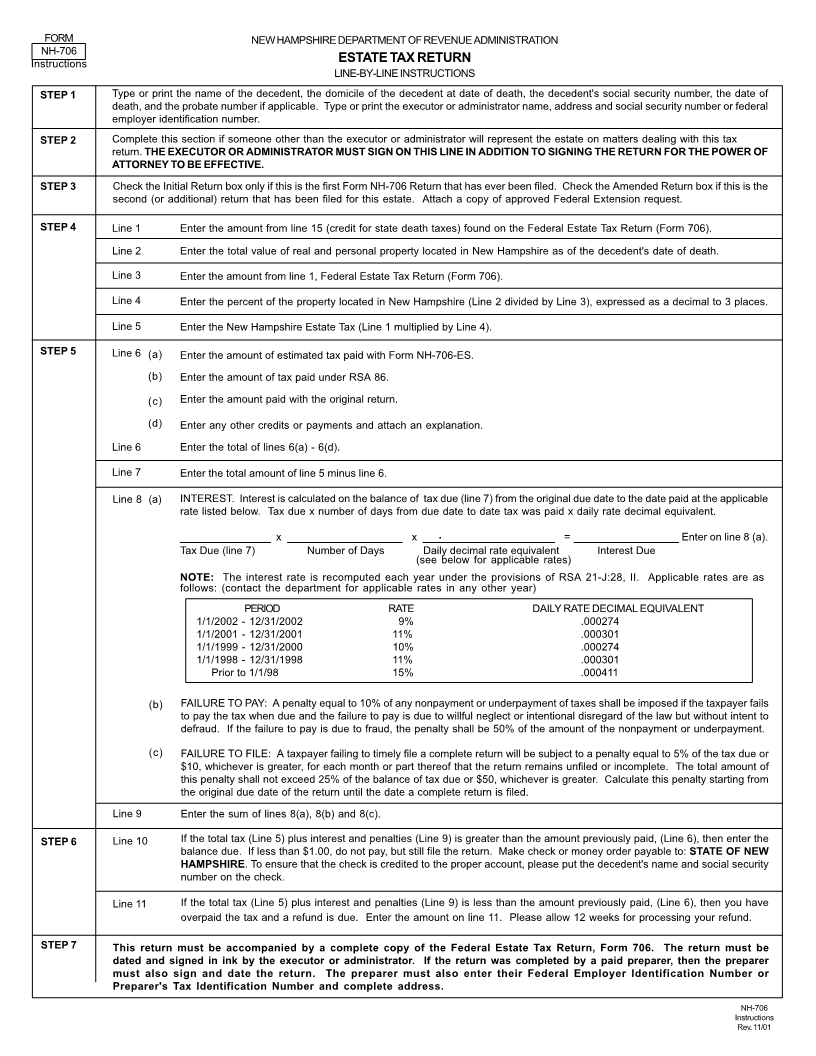

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

45 CHENELL DRIVE

PO BOX 637

CONCORD NH 03302-0637

This booklet contains the Estate Tax Forms and instructions

NEW HAMPSHIRE

necessary for filing the NH Estate Tax Return and estimated payments.

Estate DUE DATE: The return is due no later than 9 months

from the date of death.

Tax Booklet EXTENSIONS: An extension to file the NH-706 Estate Tax Return

may be granted by the Department of Revenue Administration if a

copy of the approved Federal Extension is attached to the tax return

when filed. Please note, however, that an extension of time to file the

return does not extend the time to pay the tax.

NEED HELP OR FORMS: Copies of forms, laws and administrative

This booklet contains: rules may be obtained from our website at http://www.state.nh.us/

revenue, or by calling our forms line at (603) 271-2192 or by contacting

General Instructions the Audit Division taxpayer assistance between 8:00 am and 4:30

pm at (603) 271-2580.

FORM NH-706 Individuals who need auxiliary aids for effective eommunications in

programs and services of the New hampshire Department of Revenue

FORM NH-706-ES Administration are invited to make their needs and preferences known

to the Department. Individuals with hearing or speech impairments

may call TDD Access: Relay NH 1-800-735-2964.