Enlarge image

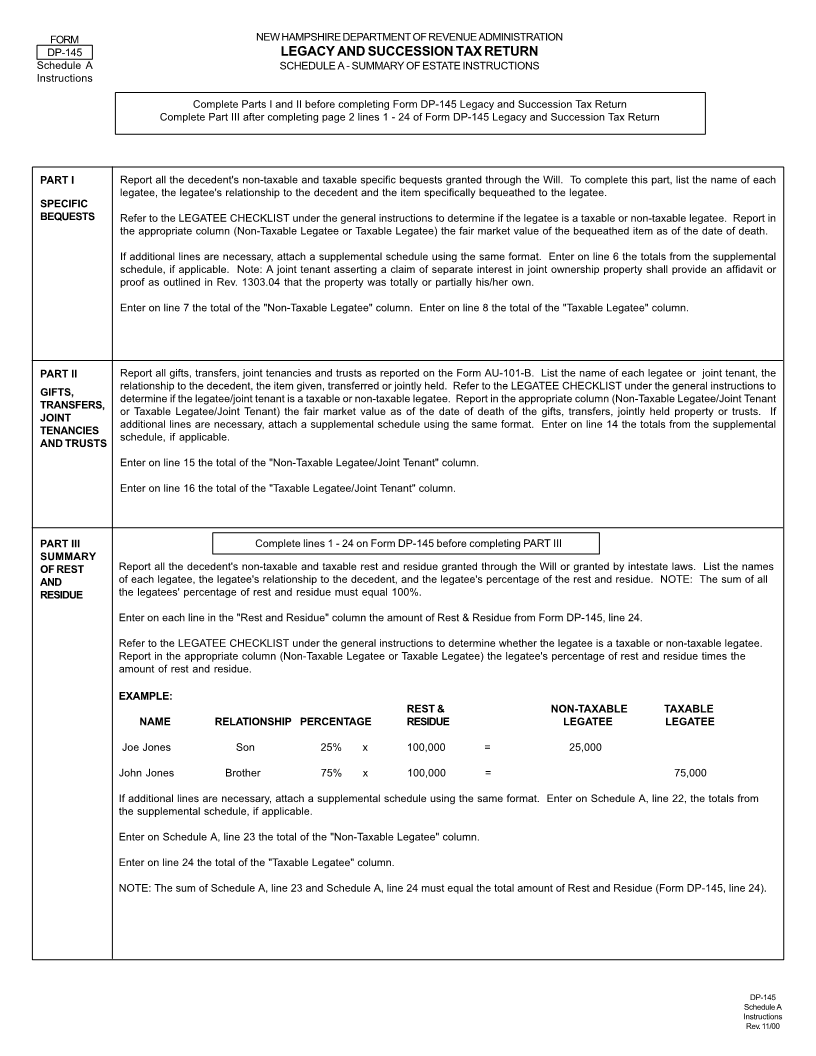

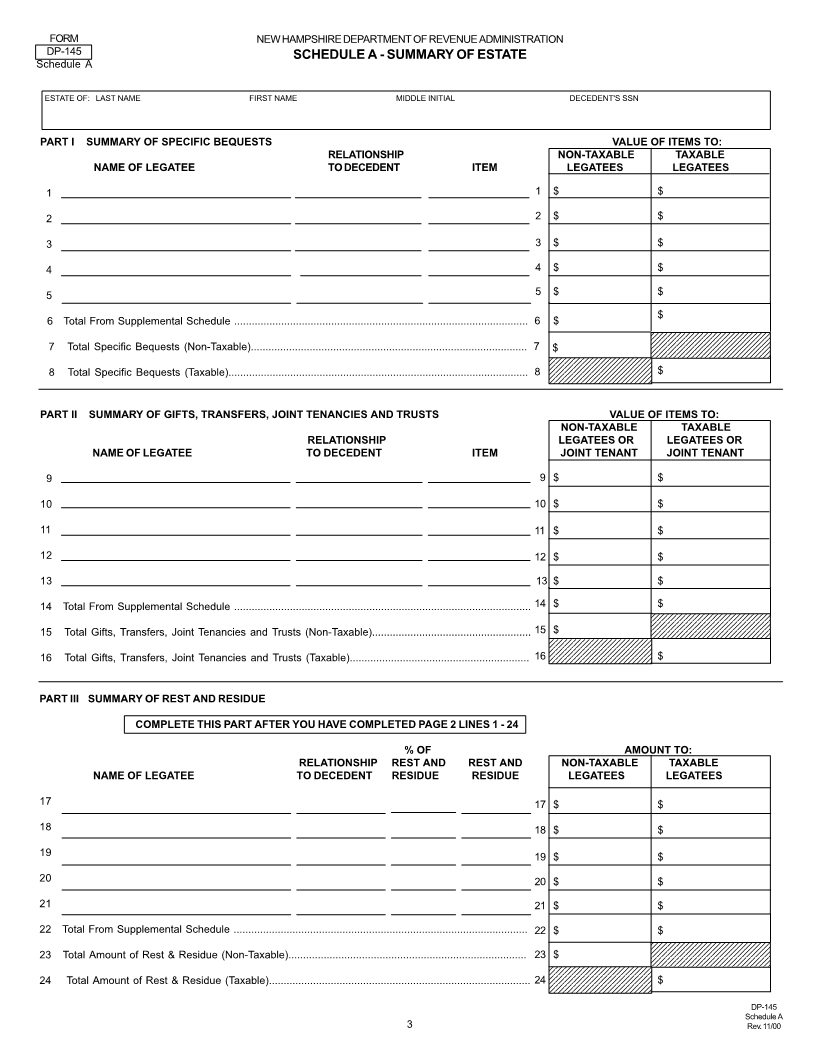

FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-145 SCHEDULE A - SUMMARY OF ESTATE

Schedule A

ESTATE OF: LAST NAME FIRST NAME MIDDLE INITIAL DECEDENT'S SSN

PART I SUMMARY OF SPECIFIC BEQUESTS VALUE OF ITEMS TO:

RELATIONSHIP NON-TAXABLE TAXABLE

NAME OF LEGATEE TO DECEDENT ITEM LEGATEES LEGATEES

1 1 $$

2 2 $$

3 3 $$

4 4 $$

5 5 $$

6 Total From Supplemental Schedule .................................................................................................... 6 $ $

7 Total Specific Bequests (Non-Taxable).............................................................................................. 7 $

8 Total Specific Bequests (Taxable)...................................................................................................... 8 123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567$

PART II SUMMARY OF GIFTS, TRANSFERS, JOINT TENANCIES AND TRUSTS VALUE OF ITEMS TO:

NON-TAXABLE TAXABLE

RELATIONSHIP LEGATEES OR LEGATEES OR

NAME OF LEGATEE TO DECEDENT ITEM JOINT TENANT JOINT TENANT

9 9 $ $

10 10 $$

11 11 $ $

12 12 $ $

13 13 $ $

14 Total From Supplemental Schedule ..................................................................................................... 14 $$

15 Total Gifts, Transfers, Joint Tenancies and Trusts (Non-Taxable)...................................................... 15 $

16 Total Gifts, Transfers, Joint Tenancies and Trusts (Taxable)............................................................. 16123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567$

PART III SUMMARY OF REST AND RESIDUE

COMPLETE THIS PART AFTER YOU HAVE COMPLETED PAGE 2 LINES 1 - 24

% OF AMOUNT TO:

RELATIONSHIP REST AND REST AND NON-TAXABLE TAXABLE

NAME OF LEGATEE TO DECEDENT RESIDUE RESIDUE LEGATEES LEGATEES

17 17 $ $

18 18 $$

19 19 $$

20 20 $$

21 21 $$

22 Total From Supplemental Schedule .................................................................................................... 22 $ $

23 Total Amount of Rest & Residue (Non-Taxable)................................................................................. 23 $

24 Total Amount of Rest & Residue (Taxable)......................................................................................... 24123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567123456789012345678901234567$

DP-145

Schedule A

3 Rev. 11/00