Enlarge image

Print Form Reset Form

New Hampshire

Department of ED-03

Revenue Administration 00ED032011862

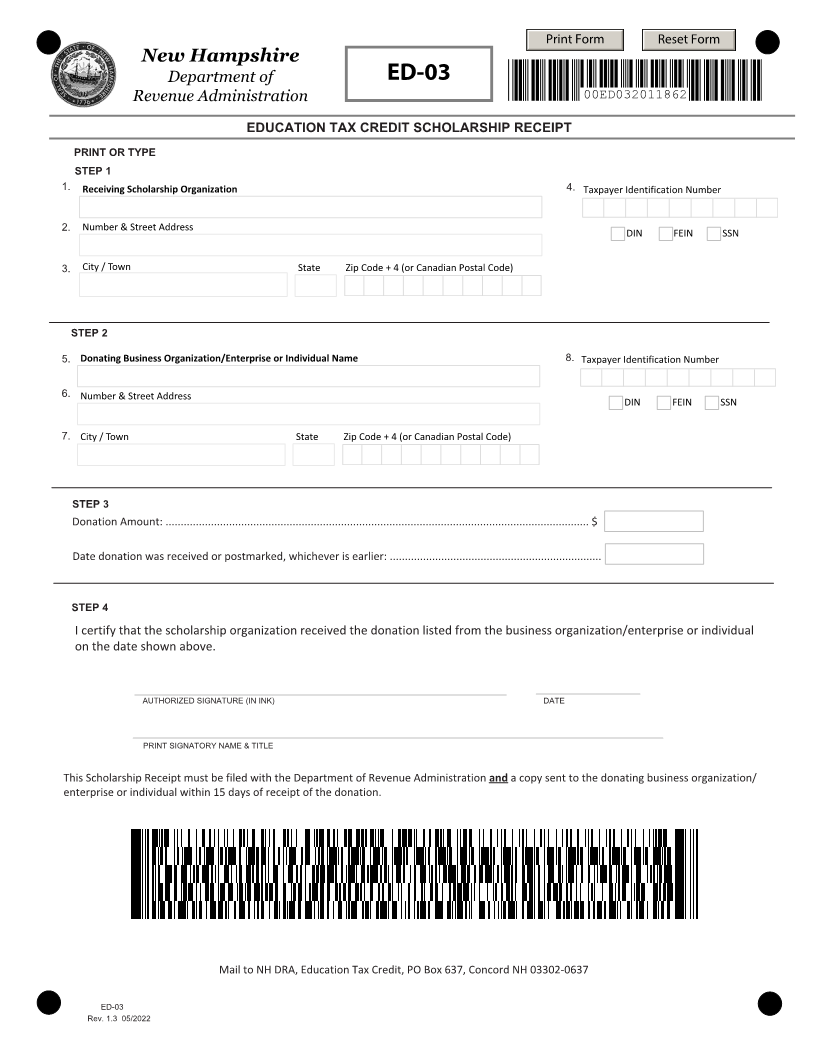

EDUCATION TAX CREDIT SCHOLARSHIP RECEIPT

PRINT OR TYPE

STEP 1

1. Receiving Scholarship Organization 4. Taxpayer Identification Number

2. Number & Street Address DIN FEIN SSN

3. City / Town State Zip Code + 4 (or Canadian Postal Code)

STEP 2

5. Donating Business Organization/Enterprise or Individual Name 8. Taxpayer Identification Number

6.

Number & Street Address DIN FEIN SSN

7. City / Town State Zip Code + 4 (or Canadian Postal Code)

STEP 3

Donation Amount: ............................................................................................................................................ $

Date donation was received or postmarked, whichever is earlier: ......................................................................

STEP 4

I certify that the scholarship organization received the donation listed from the business organization/enterprise or individual

on the date shown above.

AUTHORIZED SIGNATURE (IN INK) DATE

PRINT SIGNATORY NAME & TITLE

This Scholarship Receipt must be filed with the Department of Revenue Administration and a copy sent to the donating business organization/

enterprise or individual within 15 days of receipt of the donation.

Mail to NH DRA, Education Tax Credit, PO Box 637, Concord NH 03302-0637

ED-03

Rev. 1.3 05/2022