Enlarge image

New Hampshire

Department of ED-01

Revenue Administration FOR DRA USE ONLY

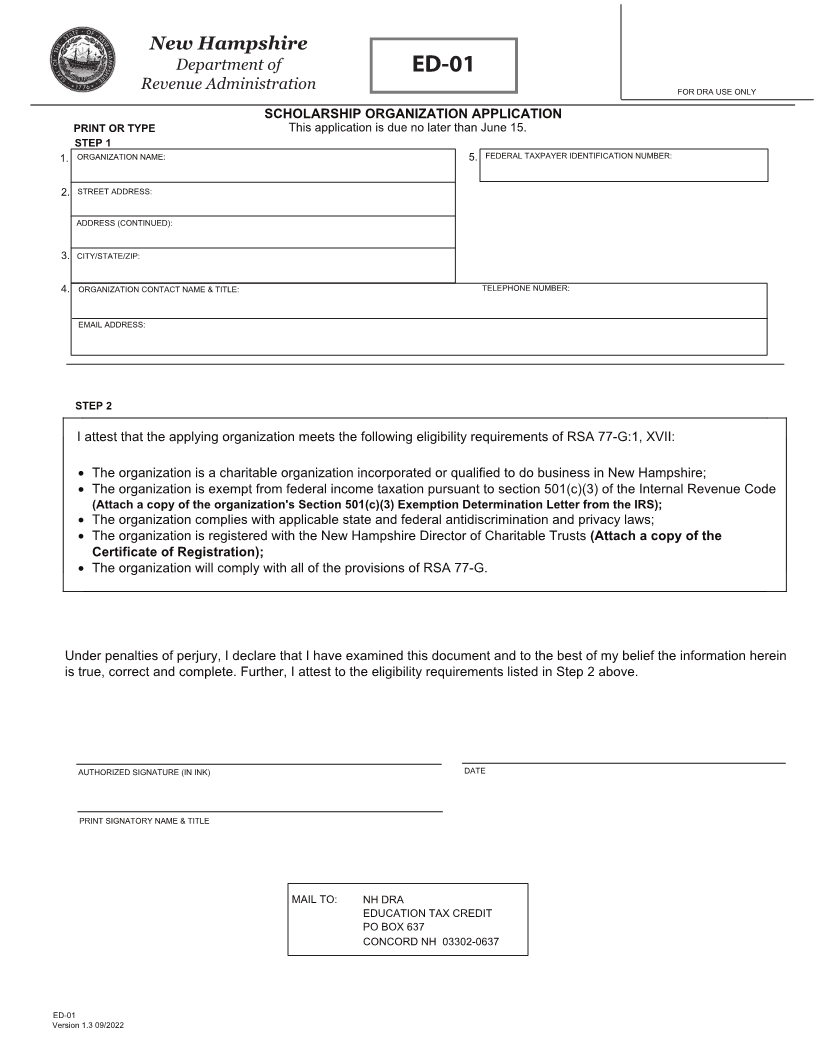

SCHOLARSHIP ORGANIZATION APPLICATION

PRINT OR TYPE This application is due no later than June 15.

STEP 1

1. ORGANIZATION NAME: 5. FEDERAL TAXPAYER IDENTIFICATION NUMBER:

2. STREET ADDRESS:

ADDRESS (CONTINUED):

3. CITY/STATE/ZIP:

4. ORGANIZATION CONTACT NAME & TITLE: TELEPHONE NUMBER:

EMAIL ADDRESS:

STEP 2

I attest that the applying organization meets the following eligibility requirements of RSA 77-G:1, XVII:

• The organization is a charitable organization incorporated or qualified to do business in New Hampshire;

• The organization is exempt from federal income taxation pursuant to section 501(c)(3) of the Internal Revenue Code

(Attach a copy of the organization's Section 501(c)(3) Exemption Determination Letter from the IRS);

• The organization complies with applicable state and federal antidiscrimination and privacy laws;

• The organization is registered with the New Hampshire Director of Charitable Trusts (Attach a copy of the

Certificate of Registration);

• The organization will comply with all of the provisions of RSA 77-G.

Under penalties of perjury, I declare that I have examined this document and to the best of my belief the information herein

is true, correct and complete. Further, I attest to the eligibility requirements listed in Step 2 above.

AUTHORIZED SIGNATURE (IN INK) DATE

PRINT SIGNATORY NAME & TITLE

MAIL TO: NH DRA

EDUCATION TAX CREDIT

PO BOX 637

CONCORD NH 03302-0637

ED-01

Version 1.3 09/2022