- 10 -

Enlarge image

|

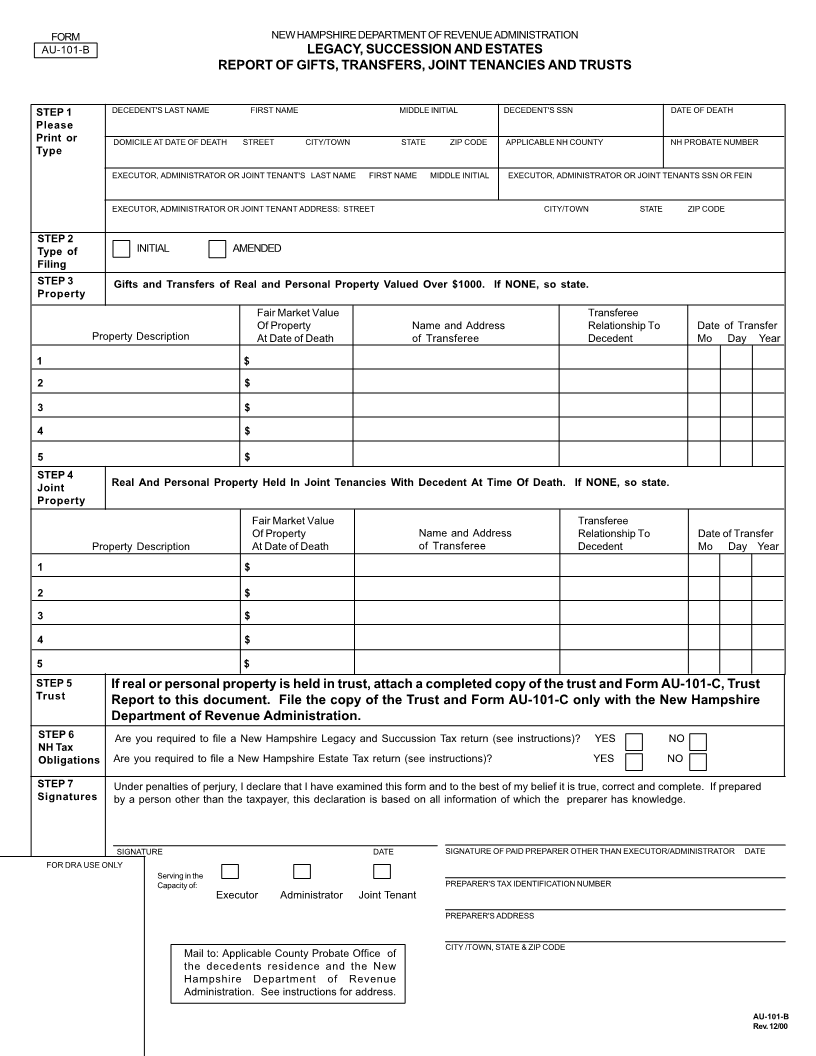

FORM NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

AU-101-B LEGACY, SUCCESSION AND ESTATES

Instructions REPORT OF GIFTS, TRANSFERS, JOINT TENANCIES AND TRUSTS

INSTRUCTIONS

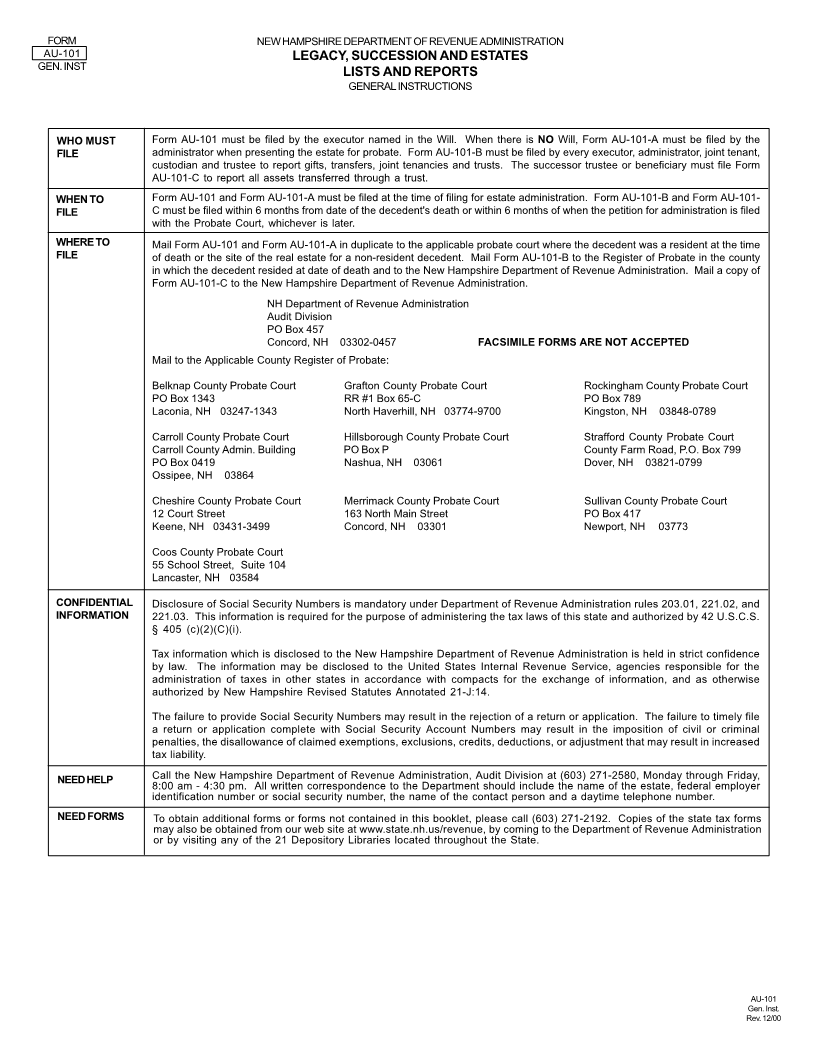

WHO MUST Every executor, administrator, joint tenant or custodian and trustee must file a report of gifts, transfers, joint tenancies and trust report.

FILE

WHEN TO Form AU-101-B must be filed within 6 months from date of the decedent's death or within 6 months of when the petition for administration is

FILE filed with the Probate Court, whichever is later. If the DOD is after July 1, 1995, the form must also be filed with the Department of Revenue

Administration.

WHERE TO Mail Form AU-101-B to the Register of Probate in the county in which the decedent resided at date of death and to the Department of Revenue

FILE Administration, Audit Division, PO Box 457, Concord, NH 03302-0457.

Belknap County Probate Court Grafton County Probate Court Rockingham County Probate Court

PO Box 1343 RR #1 Box 65-C PO Box 789

Laconia, NH 03247-1343 North Haverhill, NH 03774-9700 Kingston, NH 03848-0789

Carroll County Probate Court Hillsborough County Probate Court Strafford County Probate Court

PO Box 0419 PO Box P County Farm Road, PO Box 799

Ossipee, NH 03864 Nashua, NH 03061 Dover, NH 03821-0799

Cheshire County Probate Court Merrimack County Probate Court Sullivan County Probate Court

12 Court Street 163 North Main Street PO Box 417

Keene, NH 03431-3499 Concord, NH 03301 Newport, NH 03773

Coos County Probate Court

55 School Street, Suite 104 FASCIMILE FORMS ARE NOT ACCEPTED

Lancaster, NH 03584

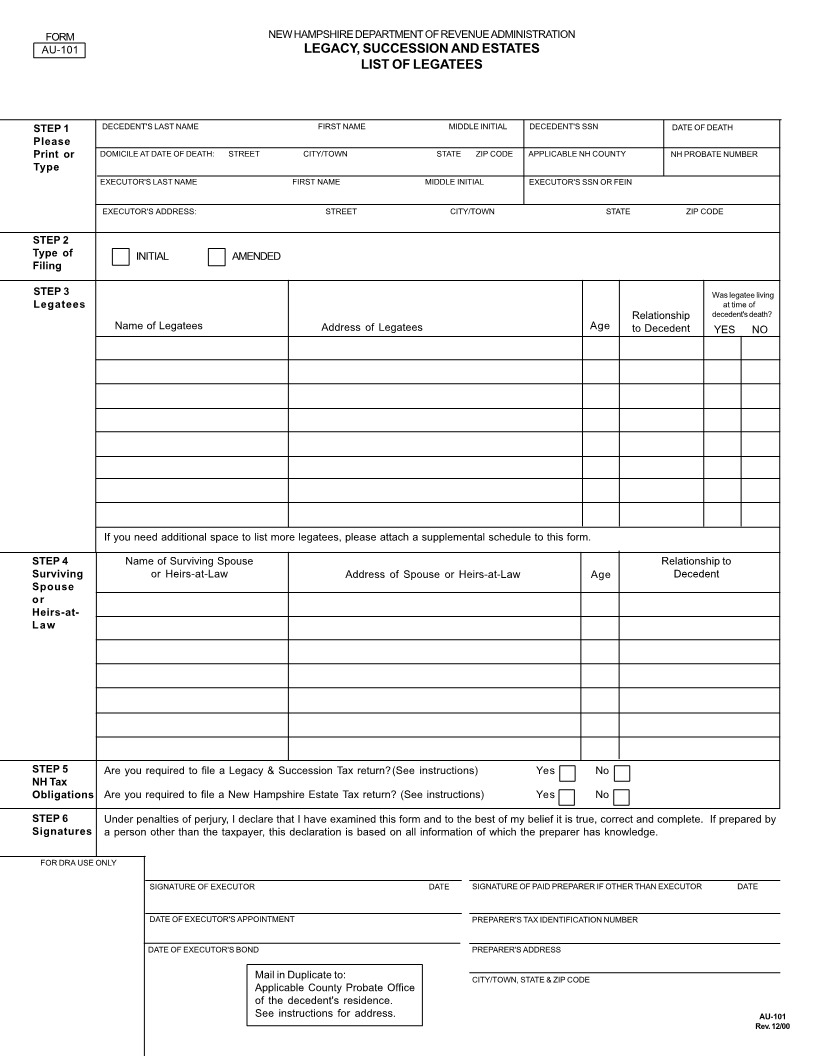

STEP 1 Type or print the name of the decedent, the decedent's social security number, the date of death, the domicile of the decedent at date of death,

the applicable NH county and the NH probate number. Type or Print Executor, Administrator or Joint Tenant name, social security number or

Federal ID number and address.

STEP 2 Check the appropriate box to indicate whether this is an initial or amended filing.

STEP 3 List all property having a value over $1000 which transferred upon the death of the decedent or which the decedent gifted or transferred

within 2 years of death. If NONE, so state.

STEP 4 List all real and personal property held jointly with the decedent at time of death. If NONE, so state.

STEP 5 Real and personal property held in trust at the time of death must be reported to the Department of Revenue Administration on a separate

schedule, Form AU-101-C, Trust Report.

STEP 6 Indicate if you are required to file either or both a New Hampshire Legacy & Succession Tax return or Estate Tax return by marking yes or no

in the proper box. See both "who must file" sections below.

STEP 7 This form must be signed in ink and dated. Indicate whether the signature is of the executor, administrator or joint tenant. If completed by a

paid preparer, the preparer must also sign in ink and date the form.

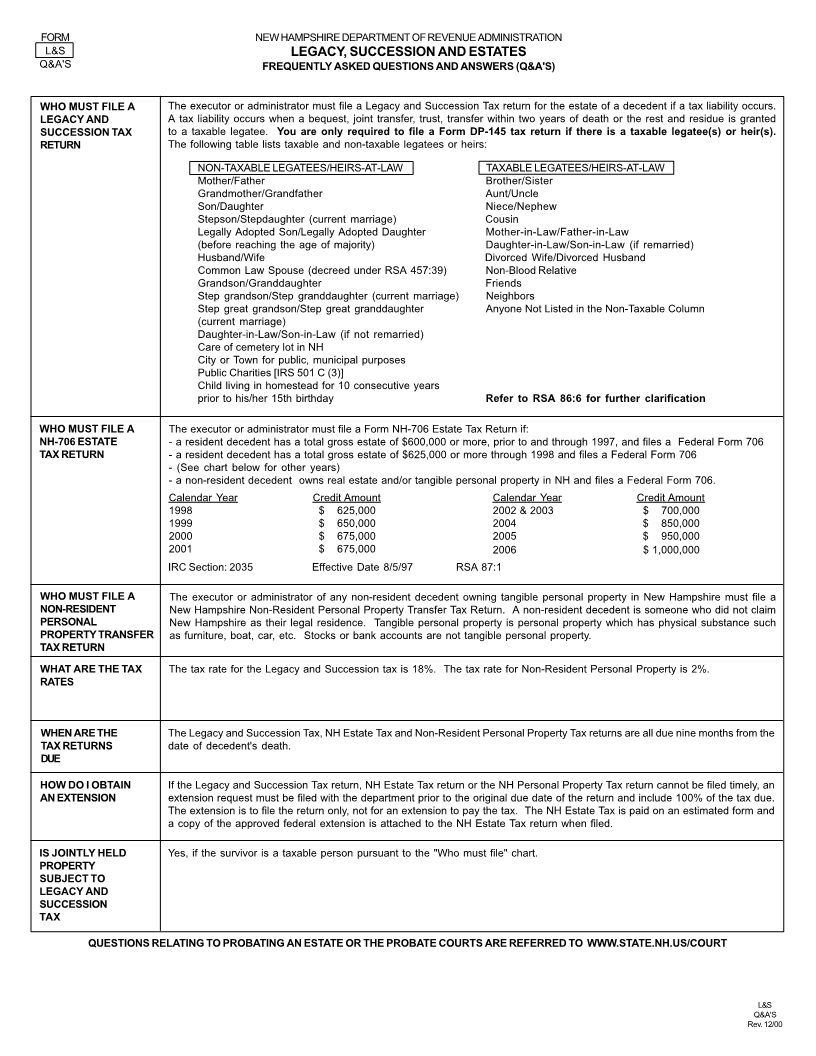

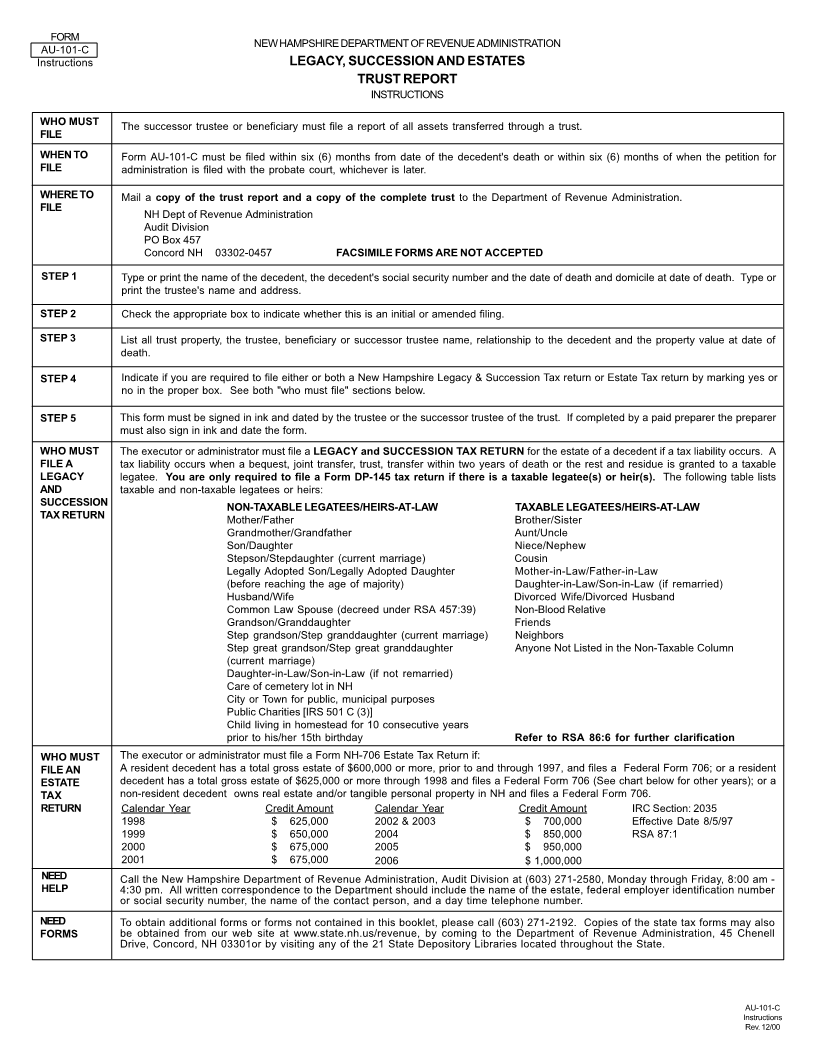

WHO MUST The executor or administrator must file a LEGACY and SUCCESSION TAX RETURN for the estate of a decedent if a tax liability occurs. A

FILE A tax liability occurs when a bequest, joint transfer, trust, transfer within two years of death or the rest and residue is granted to a taxable

LEGACY legatee. You are only required to file a Form DP-145 tax return if there is a taxable legatee(s) or heir(s). The following table lists

AND taxable and non-taxable legatees or heirs:

SUCCESSION NON-TAXABLE LEGATEES/HEIRS-AT-LAW TAXABLE LEGATEES/HEIRS-AT-LAW

Mother/Father Brother/Sister

TAX RETURN Grandmother/Grandfather Aunt/Uncle

Son/Daughter Niece/Nephew

Stepson/Stepdaughter (current marriage) Cousin

Legally Adopted Son/Legally Adopted Daughter Mother-in-Law/Father-in-Law

(before reaching the age of majority) Daughter-in-Law/Son-in-Law (if remarried)

Husband/Wife Divorced Wife/Divorced Husband

Common Law Spouse (decreed under RSA 457:39) Non-Blood Relative

Grandson/Granddaughter Friends

Step grandson/Step granddaughter (current marriage) Neighbors

Step great grandson/Step great granddaughter Anyone Not Listed in the Non-Taxable Column

(current marriage)

Daughter-in-Law/Son-in-Law (if not remarried)

Care of cemetery lot in NH

City or Town for public, municipal purposes

Public Charities [IRS 501 C (3)]

Child living in homestead for 10 consecutive years

prior to his/her 15th birthday Refer to RSA 86:6 for further clarification

WHO MUST The executor or administrator must file a Form NH-706 Estate Tax Return if:

FILE AN A resident decedent has a total gross estate of $600,000 or more, prior to and through 1997, and files a Federal Form 706; or a resident

ESTATE decedent has a total gross estate of $625,000 or more through 1998 and files a Federal Form 706 (See chart below for other years); or a

TAX non-resident decedent owns real estate and/or tangible personal property in NH and files a Federal Form 706.

RETURN Calendar Year Credit Amount Calendar Year Credit Amount IRC Section: 2035

1998 $ 625,000 2002 & 2003 $ 700,000 Effective Date 8/5/97

1999 $ 650,000 2004 $ 850,000 RSA 87:1

2000 $ 675,000 2005 $ 950,000

2001 $ 675,000 2006 $ 1,000,000

NEED Call the New Hampshire Department of Revenue Administration, Audit Division at (603) 271-2580, Monday through Friday, 8:00 am - 4:30

HELP or pm. All written correspondence to the Department should include the name of the estate, federal employer identification number or

FORMS social security number, the name of the contact person, and a day time telephone number. To obtain additional forms or forms not

contained in this booklet, please call (603) 271-2192. Copies of the state tax forms may also be obtained from our web site at

www.state.nh.us/revenue, by coming to the Department of Revenue Administration or by visiting any of the 21 Depository Libraries

located throughout the State.

AU-101-B

Instructions

Rev. 12/00

|