Enlarge image

OFFICE OF THE NEW HAMPSHIRE ATTORNEY GENERAL

CHARITABLE TRUSTS UNIT

One Granite Place South

Concord, NH 03301

ANNUAL REPORT

INSTRUCTIONS

1

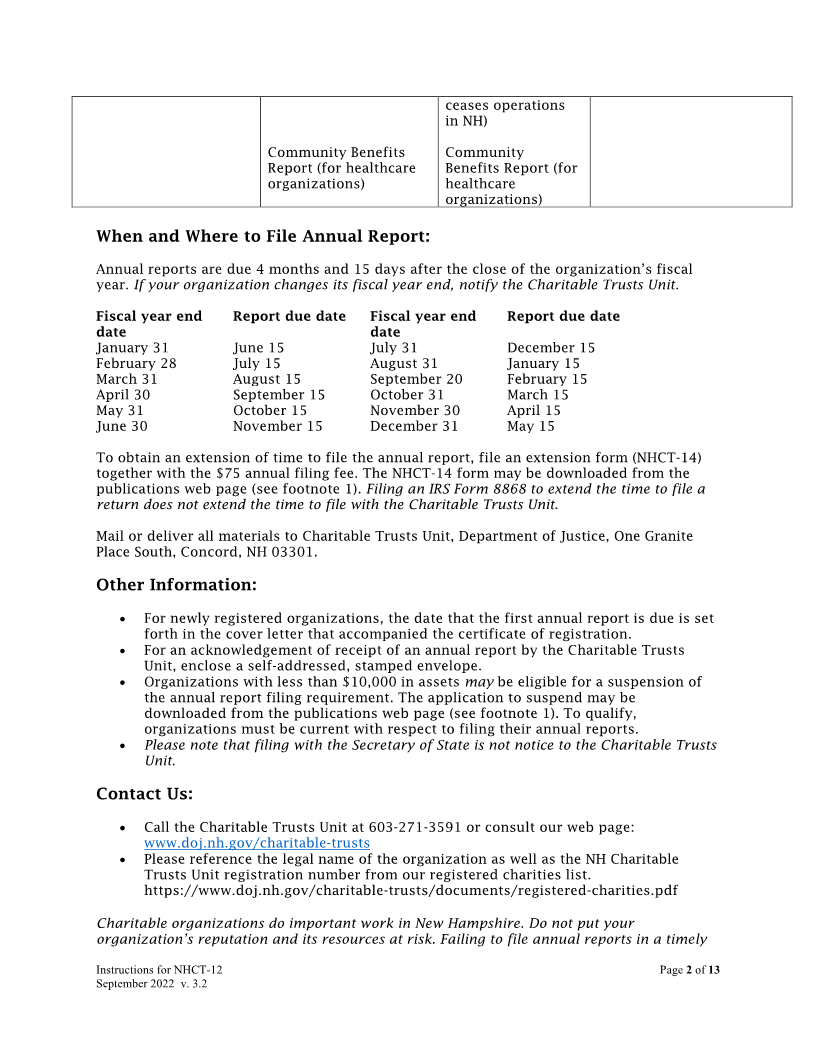

General Requirements:

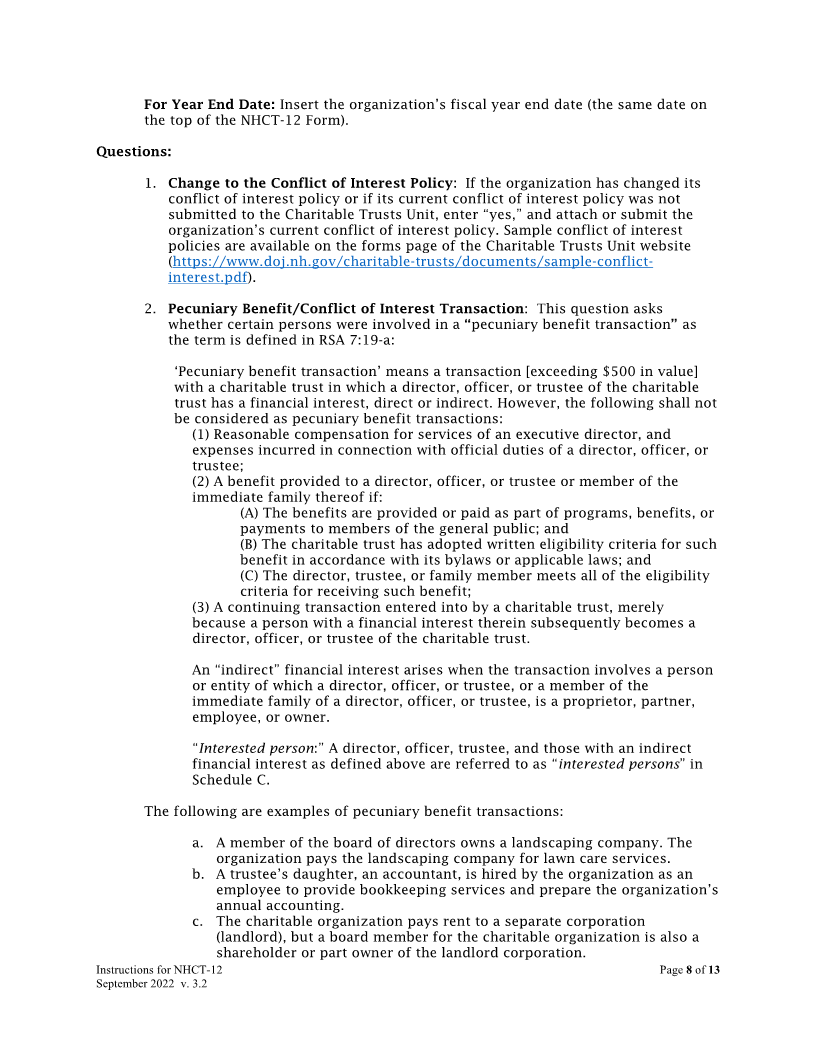

Filing New Hampshire- Out of State Express

Requirements Based Charitable Charitable Trusts/Private

Corporations or Corporations or Foundations

Associations Associations

Filing Fee $75 check payable to $75 check payable $75 check payable to State

State of New Hampshire to State of New of New Hampshire

Hampshire

Annual Report Form NHCT-12 signed under NHCT-12 signed NHCT-12 signed under

oath by president or under oath by oath by president,

treasurer president or treasurer, or trustee

treasurer

Financial Report Schedule A or Form 990 Schedule A or Form Form 990-PF

or 990-EZ (990-N is not 990 or 990-EZ (990-

acceptable) N is not acceptable)

Governing Board List Schedule B or a Schedule B or list of Schedule B or list of

document with Board members in trustees on Form 990-PF

equivalent information Form 990 or 990-EZ

Conflict of Schedule C N/A N/A

Interest/Governance

Report

Financial GAAP financial N/A Copy of accounting filed

Statements/Accountings statements if revenue is with probate court (if filing

between $500,000 and with probate court is

$2 ,000,000 required)

Audited GAAP financial

statements if revenue

exceeds $2,000,000

Additional Reports (if Schedule D (Charitable Schedule D Schedule E (Withdrawal due

applicable) Gift Annuity) (Charitable Gift to dissolution, merger,

Annuity) ceases operations in NH)

Schedule E (Withdrawal

due to dissolution, Schedule E

merger, ceases (Withdrawal due to

operations in NH) dissolution, merger,

1 Form NHCT-12 and Schedules A, B, C, D, and E may be downloaded from the All Forms web page:

https://www.doj.nh.gov/charitable-trusts/forms.htm.

Instructions for NHCT-12 Page 1of 13

September 2022 v. 3.2