Enlarge image

Mail completed form to:

NH Attorney General’s Office

Attn: Charitable Trusts Unit

One Granite Place South

Concord, NH 03301

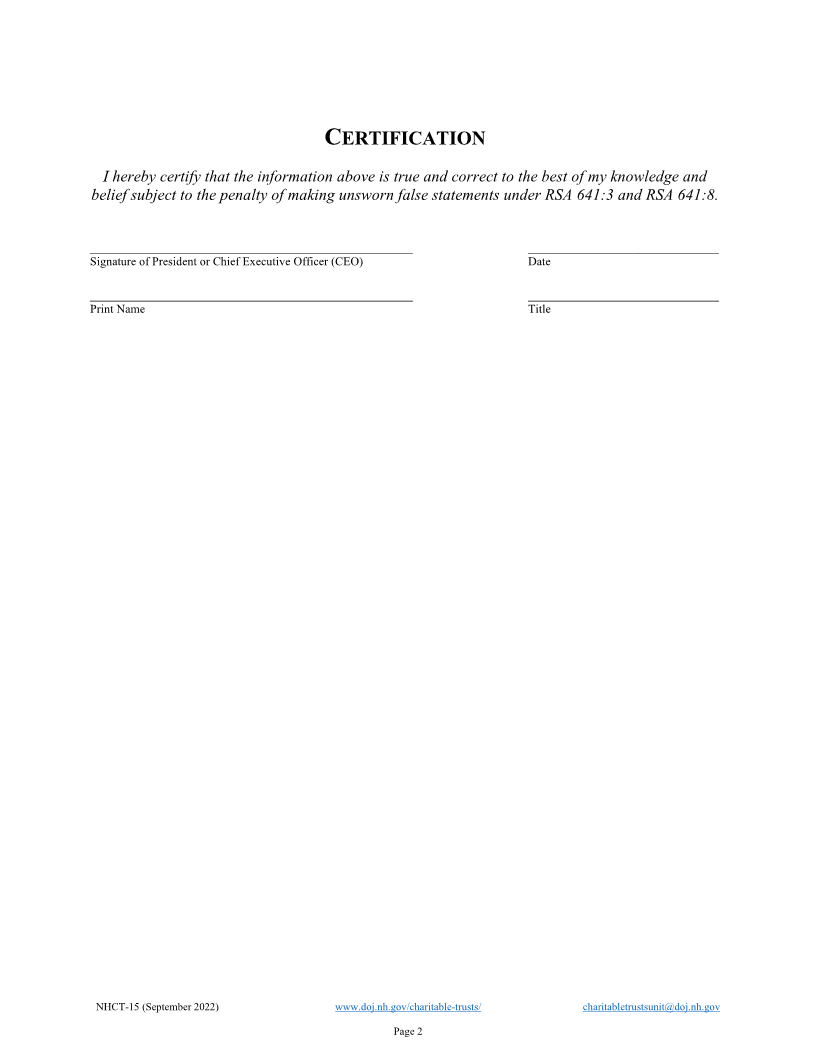

FORM NHCT-15

CHARITABLE GIFT NNUITY A ERTIFICATIONC

ENTITY INFORMATION

Legal Name

NH Charitable Trusts Unit Registration Number (if applicable)

Mailing Address check here if this is a new address

□

City State Zip

Website Address

CONTACT INFORMATION

Contact Name Title

Telephone Number Email Address

NHCT-15 Certification/Recertification for Charitable Gift Annuities

1. The person signing the NHCT-15 on behalf of this entity certifies that the entity has entered into one or more

charitable gift annuity agreements in New Hampshire and that each such agreement is and shall be a qualified

charitable gift annuity, as defined in NH RSA 403-E:1, V, in that on the date of the annuity agreement, it (check

each of the following to certify):

□ Has a minimum of $300,000 in unrestricted cash, cash equivalents, or publicly-traded securities, exclusive of the

assets funding the annuity agreement;

□ Has been in continuous operation for at least 3 years or is a successor or affiliate of a charitable organization that

has been in continuous operation for at least 3 years;

□ Issues charitable gift annuities with payout ratios no greater than recommended by American Council on Gift

Annuities at the time of issuance;

□ Retains 100 percent of the contribution made in exchange for each charitable gift annuity, increased by earnings

on the contribution and decreased by annuity payments and expenses properly allocated to the annuity, until the

annuity is terminated; and

□ Invests contributions made in exchange for charitable gift annuities solely in conformance with article 9 of RSA

564-B, general standards of prudent investment.

2. Check the applicable box:

□ Initial notification

□ Annual recertification

NHCT-15 (September 2022) www.doj.nh.gov/charitable-trusts/ charitabletrustsunit@doj.nh.gov

Page 1