Enlarge image

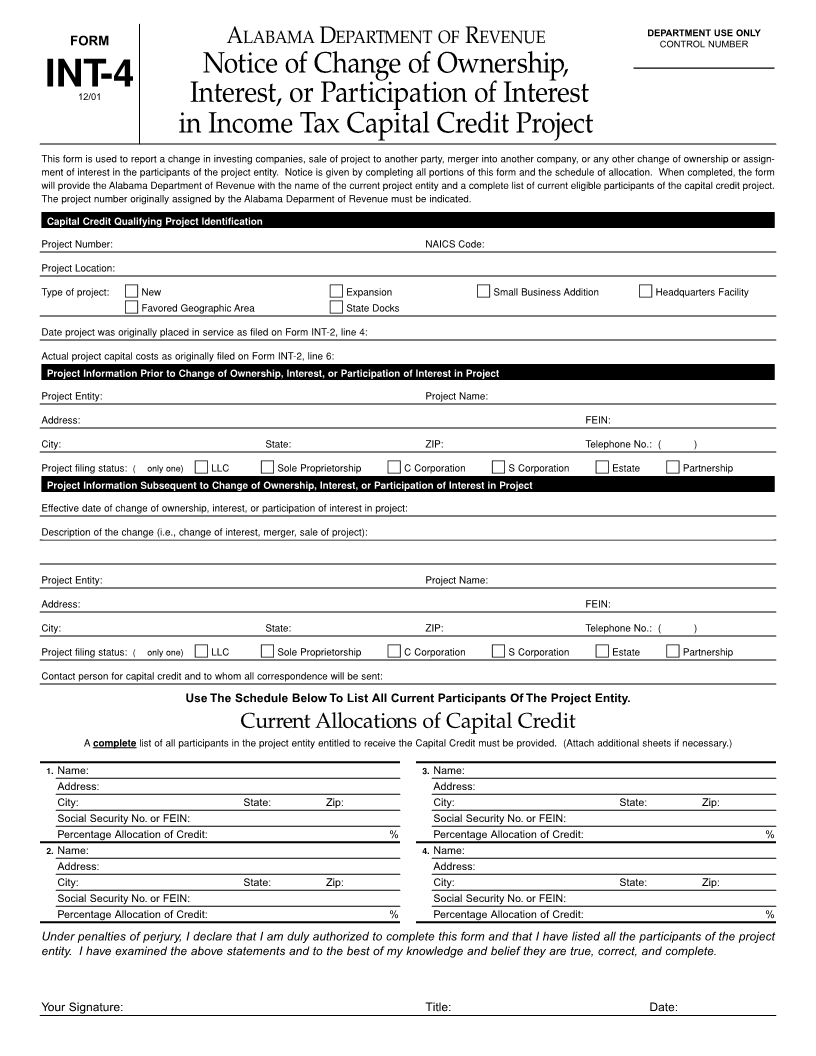

DEPARTMENT USE ONLY

FORM ALABAMA DEPARTMENT OF REVENUE CONTROL NUMBER

___________________

Notice of Change of Ownership,

INT-412/01

Interest, or Participation of Interest

in Income Tax Capital Credit Project

This form is used to report a change in investing companies, sale of project to another party, merger into another company, or any other change of ownership or assign-

ment of interest in the participants of the project entity. Notice is given by completing all portions of this form and the schedule of allocation. When completed, the form

will provide the Alabama Department of Revenue with the name of the current project entity and a complete list of current eligible participants of the capital credit project.

The project number originally assigned by the Alabama Deparment of Revenue must be indicated.

Capital Credit Qualifying Project Identification

Project Number: NAICS Code:

Project Location:

Type of project: New Expansion Small Business Addition Headquarters Facility

Favored Geographic Area State Docks

Date project was originally placed in service as filed on Form INT-2, line 4:

Actual project capital costs as originally filed on Form INT-2, line 6:

Project Information Prior to Change of Ownership, Interest, or Participation of Interest in Project

Project Entity: Project Name:

Address: FEIN:

City: State: ZIP: Telephone No.: ( )

Project filing status: (✔ only one) LLC Sole Proprietorship C Corporation S Corporation Estate Partnership

Project Information Subsequent to Change of Ownership, Interest, or Participation of Interest in Project

Effective date of change of ownership, interest, or participation of interest in project:

Description of the change (i.e., change of interest, merger, sale of project):

Project Entity: Project Name:

Address: FEIN:

City: State: ZIP: Telephone No.: ( )

Project filing status: (✔ only one) LLC Sole Proprietorship C Corporation S Corporation Estate Partnership

Contact person for capital credit and to whom all correspondence will be sent:

Use The Schedule Below To List All Current Participants Of The Project Entity.

Current Allocations of Capital Credit

A complete list of all participants in the project entity entitled to receive the Capital Credit must be provided. (Attach additional sheets if necessary.)

1. Name: 3. Name:

Address: Address:

City: State: Zip: City: State: Zip:

Social Security No. or FEIN: Social Security No. or FEIN:

Percentage Allocation of Credit: % Percentage Allocation of Credit: %

2. Name: 4. Name:

Address: Address:

City: State: Zip: City: State: Zip:

Social Security No. or FEIN: Social Security No. or FEIN:

Percentage Allocation of Credit: % Percentage Allocation of Credit: %

Under penalties of perjury, I declare that I am duly authorized to complete this form and that I have listed all the participants of the project

entity. I have examined the above statements and to the best of my knowledge and belief they are true, correct, and complete.

Your Signature: Title: Date: