Enlarge image

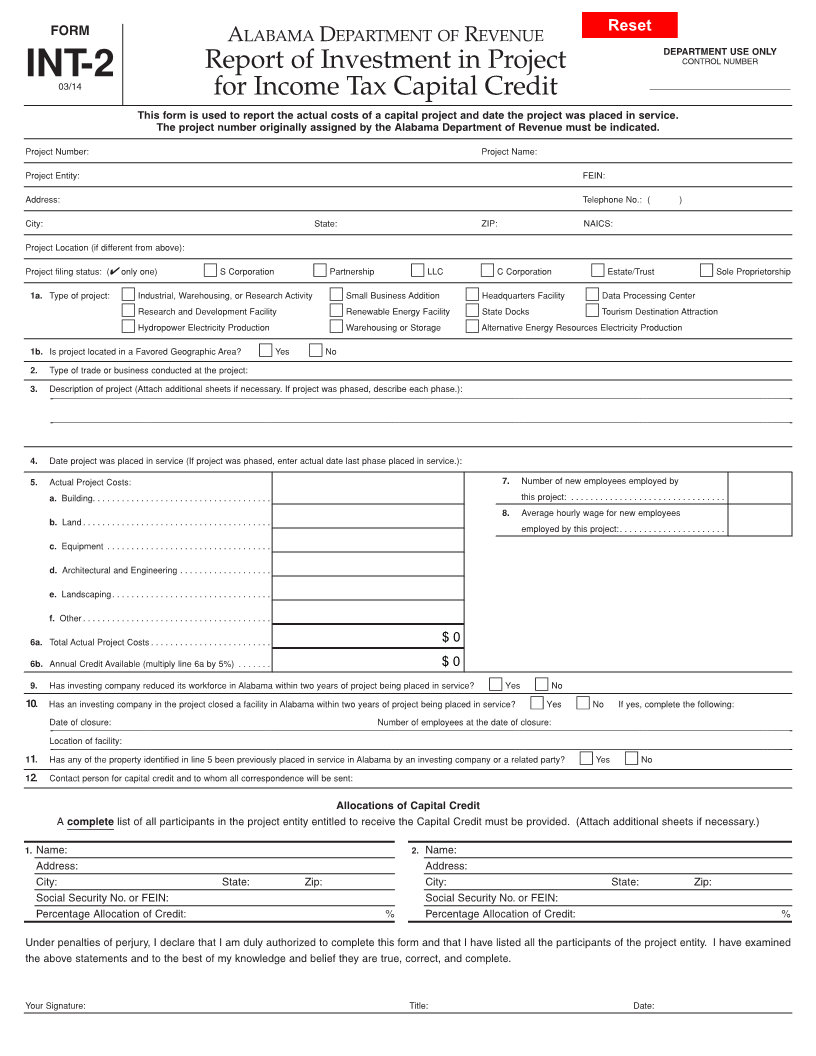

Project Number: Project Name: Project Entity: FEIN: Address: Telephone No.: ( ) City: State: ZIP: NAICS: Project Location (if different from above): Project filing status: (

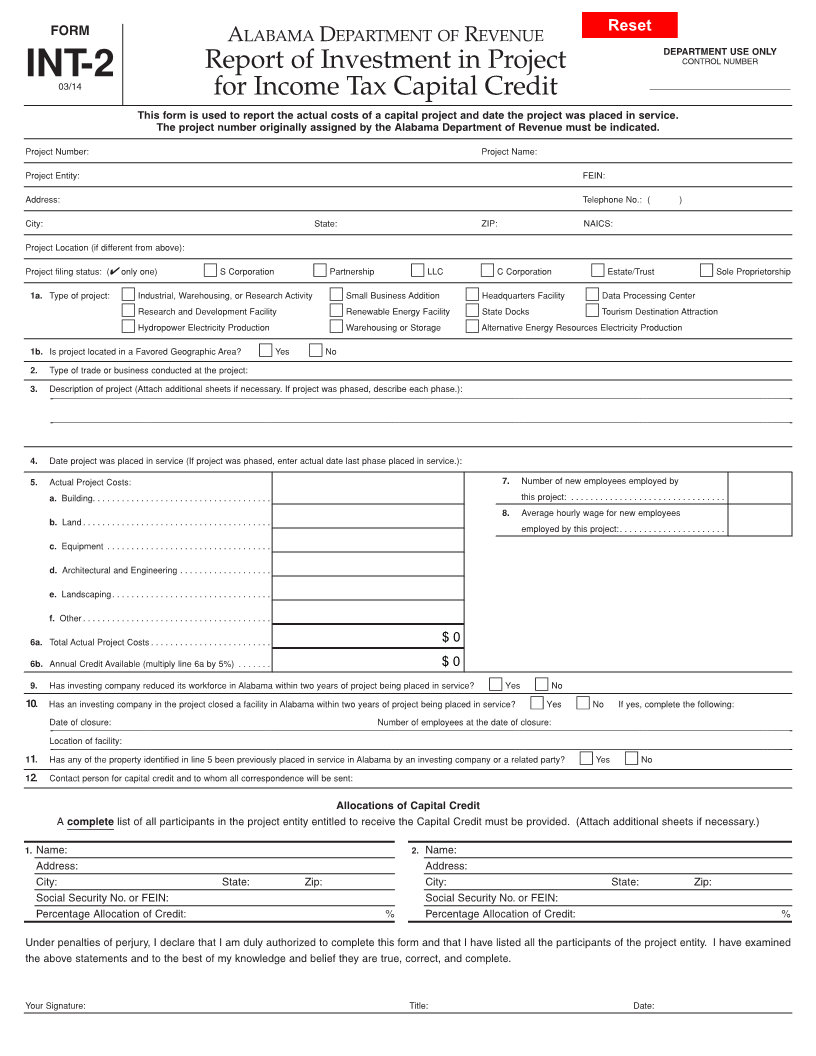

Enlarge image | Project Number: Project Name: Project Entity: FEIN: Address: Telephone No.: ( ) City: State: ZIP: NAICS: Project Location (if different from above): Project filing status: ( |

Enlarge image |

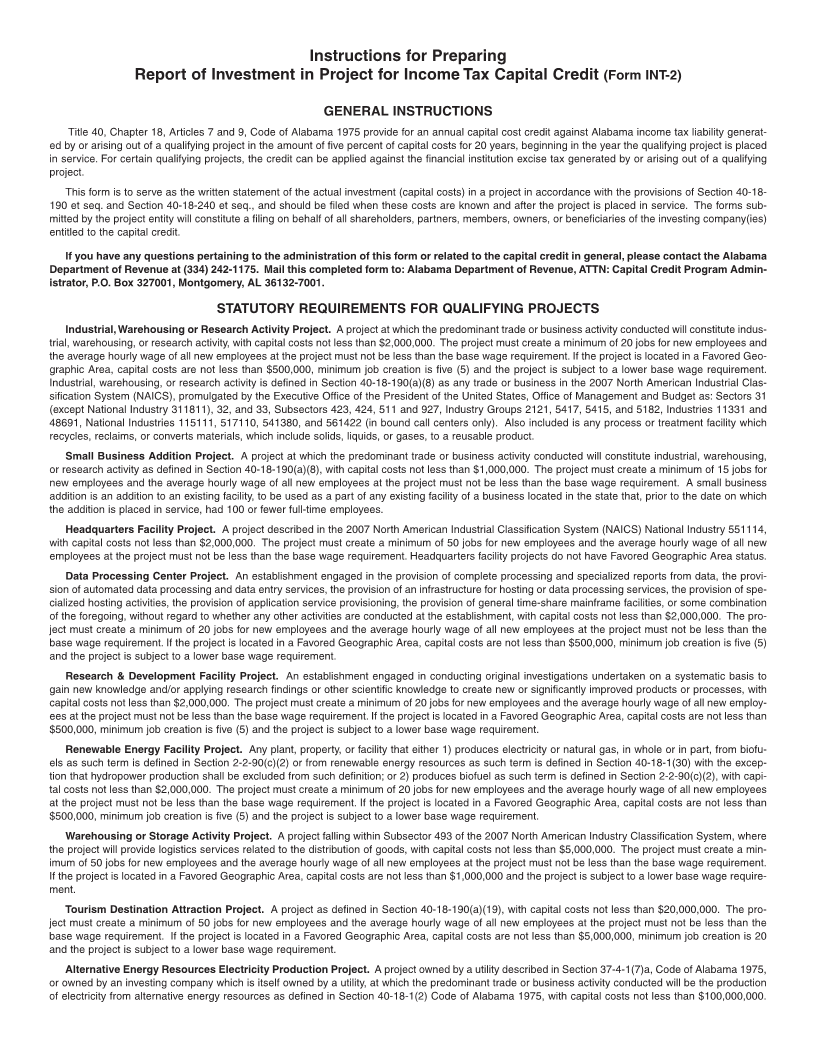

Instructions for Preparing

Report of Investment in Project for Income Tax Capital Credit (Form INT-2)

GENERAL INSTRUCTIONS

Title 40, Chapter 18, Articles 7 and 9, Code of Alabama 1975 provide for an annual capital cost credit against Alabama income tax liability generat-

ed by or arising out of a qualifying project in the amount of five percent of capital costs for 20 years, beginning in the year the qualifying project is placed

in service. For certain qualifying projects, the credit can be applied against the financial institution excise tax generated by or arising out of a qualifying

project.

This form is to serve as the written statement of the actual investment (capital costs) in a project in accordance with the provisions of Section 40-18-

190 et seq. and Section 40-18-240 et seq., and should be filed when these costs are known and after the project is placed in service. The forms sub-

mitted by the project entity will constitute a filing on behalf of all shareholders, partners, members, owners, or beneficiaries of the investing company(ies)

entitled to the capital credit.

If you have any questions pertaining to the administration of this form or related to the capital credit in general, please contact the Alabama

Department of Revenue at (334) 242-1175. Mail this completed form to: Alabama Department of Revenue, ATTN: Capital Credit Program Admin-

istrator, P.O. Box 327001, Montgomery, AL 36132-7001.

STATUTORY REQUIREMENTS FOR QUALIFYING PROJECTS

Industrial, Warehousing or Research Activity Project. A project at which the predominant trade or business activity conducted will constitute indus-

trial, warehousing, or research activity, with capital costs not less than $2,000,000. The project must create a minimum of 20 jobs for new employees and

the average hourly wage of all new employees at the project must not be less than the base wage requirement. If the project is located in a Favored Geo-

graphic Area, capital costs are not less than $500,000, minimum job creation is five (5) and the project is subject to a lower base wage requirement.

Industrial, warehousing, or research activity is defined in Section 40-18-190(a)(8) as any trade or business in the 2007 North American Industrial Clas-

sification System (NAICS), promulgated by the Executive Office of the President of the United States, Office of Management and Budget as: Sectors 31

(except National Industry 311811), 32, and 33, Subsectors 423, 424, 511 and 927, Industry Groups 2121, 5417, 5415, and 5182, Industries 11331 and

48691, National Industries 115111, 517110, 541380, and 561422 (in bound call centers only). Also included is any process or treatment facility which

recycles, reclaims, or converts materials, which include solids, liquids, or gases, to a reusable product.

Small Business Addition Project. A project at which the predominant trade or business activity conducted will constitute industrial, warehousing,

or research activity as defined in Section 40-18-190(a)(8), with capital costs not less than $1,000,000. The project must create a minimum of 15 jobs for

new employees and the average hourly wage of all new employees at the project must not be less than the base wage requirement. A small business

addition is an addition to an existing facility, to be used as a part of any existing facility of a business located in the state that, prior to the date on which

the addition is placed in service, had 100 or fewer full-time employees.

Headquarters Facility Project. A project described in the 2007 North American Industrial Classification System (NAICS) National Industry 551114,

with capital costs not less than $2,000,000. The project must create a minimum of 50 jobs for new employees and the average hourly wage of all new

employees at the project must not be less than the base wage requirement. Headquarters facility projects do not have Favored Geographic Area status.

Data Processing Center Project. An establishment engaged in the provision of complete processing and specialized reports from data, the provi-

sion of automated data processing and data entry services, the provision of an infrastructure for hosting or data processing services, the provision of spe-

cialized hosting activities, the provision of application service provisioning, the provision of general time-share mainframe facilities, or some combination

of the foregoing, without regard to whether any other activities are conducted at the establishment, with capital costs not less than $2,000,000. The pro-

ject must create a minimum of 20 jobs for new employees and the average hourly wage of all new employees at the project must not be less than the

base wage requirement. If the project is located in a Favored Geographic Area, capital costs are not less than $500,000, minimum job creation is five (5)

and the project is subject to a lower base wage requirement.

Research & Development Facility Project. An establishment engaged in conducting original investigations undertaken on a systematic basis to

gain new knowledge and/or applying research findings or other scientific knowledge to create new or significantly improved products or processes, with

capital costs not less than $2,000,000. The project must create a minimum of 20 jobs for new employees and the average hourly wage of all new employ-

ees at the project must not be less than the base wage requirement. If the project is located in a Favored Geographic Area, capital costs are not less than

$500,000, minimum job creation is five (5) and the project is subject to a lower base wage requirement.

Renewable Energy Facility Project. Any plant, property, or facility that either 1) produces electricity or natural gas, in whole or in part, from biofu-

els as such term is defined in Section 2-2-90(c)(2) or from renewable energy resources as such term is defined in Section 40-18-1(30) with the excep-

tion that hydropower production shall be excluded from such definition; or 2) produces biofuel as such term is defined in Section 2-2-90(c)(2), with capi-

tal costs not less than $2,000,000. The project must create a minimum of 20 jobs for new employees and the average hourly wage of all new employees

at the project must not be less than the base wage requirement. If the project is located in a Favored Geographic Area, capital costs are not less than

$500,000, minimum job creation is five (5) and the project is subject to a lower base wage requirement.

Warehousing or Storage Activity Project. A project falling within Subsector 493 of the 2007 North American Industry Classification System, where

the project will provide logistics services related to the distribution of goods, with capital costs not less than $5,000,000. The project must create a min-

imum of 50 jobs for new employees and the average hourly wage of all new employees at the project must not be less than the base wage requirement.

If the project is located in a Favored Geographic Area, capital costs are not less than $1,000,000 and the project is subject to a lower base wage require-

ment.

Tourism Destination Attraction Project. A project as defined in Section 40-18-190(a)(19), with capital costs not less than $20,000,000. The pro-

ject must create a minimum of 50 jobs for new employees and the average hourly wage of all new employees at the project must not be less than the

base wage requirement. If the project is located in a Favored Geographic Area, capital costs are not less than $5,000,000, minimum job creation is 20

and the project is subject to a lower base wage requirement.

Alternative Energy Resources Electricity Production Project. A project owned by a utility described in Section 37-4-1(7)a, Code of Alabama 1975,

or owned by an investing company which is itself owned by a utility, at which the predominant trade or business activity conducted will be the production

of electricity from alternative energy resources as defined in Section 40-18-1(2) Code of Alabama 1975, with capital costs not less than $100,000,000.

|

Enlarge image |

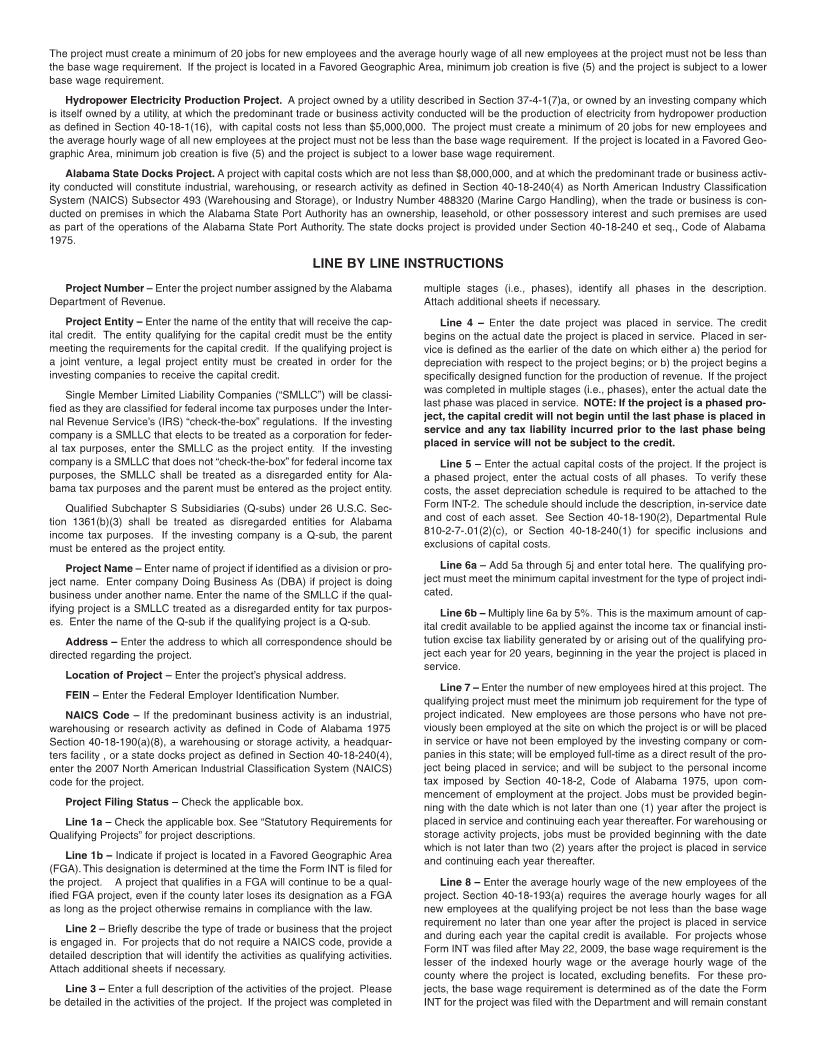

The project must create a minimum of 20 jobs for new employees and the average hourly wage of all new employees at the project must not be less than

the base wage requirement. If the project is located in a Favored Geographic Area, minimum job creation is five (5) and the project is subject to a lower

base wage requirement.

Hydropower Electricity Production Project. A project owned by a utility described in Section 37-4-1(7)a, or owned by an investing company which

is itself owned by a utility, at which the predominant trade or business activity conducted will be the production of electricity from hydropower production

as defined in Section 40-18-1(16), with capital costs not less than $5,000,000. The project must create a minimum of 20 jobs for new employees and

the average hourly wage of all new employees at the project must not be less than the base wage requirement. If the project is located in a Favored Geo-

graphic Area, minimum job creation is five (5) and the project is subject to a lower base wage requirement.

Alabama State Docks Project. A project with capital costs which are not less than $8,000,000, and at which the predominant trade or business activ-

ity conducted will constitute industrial, warehousing, or research activity as defined in Section 40-18-240(4) as North American Industry Classification

System (NAICS) Subsector 493 (Warehousing and Storage), or Industry Number 488320 (Marine Cargo Handling), when the trade or business is con-

ducted on premises in which the Alabama State Port Authority has an ownership, leasehold, or other possessory interest and such premises are used

as part of the operations of the Alabama State Port Authority. The state docks project is provided under Section 40-18-240 et seq., Code of Alabama

1975.

LINE BY LINE INSTRUCTIONS

Project Number – Enter the project number assigned by the Alabama multiple stages (i.e., phases), identify all phases in the description.

Department of Revenue. Attach additional sheets if necessary.

Project Entity – Enter the name of the entity that will receive the cap- Line 4 – Enter the date project was placed in service. The credit

ital credit. The entity qualifying for the capital credit must be the entity begins on the actual date the project is placed in service. Placed in ser-

meeting the requirements for the capital credit. If the qualifying project is vice is defined as the earlier of the date on which either a) the period for

a joint venture, a legal project entity must be created in order for the depreciation with respect to the project begins; or b) the project begins a

investing companies to receive the capital credit. specifically designed function for the production of revenue. If the project

Single Member Limited Liability Companies (“SMLLC”) will be classi- was completed in multiple stages (i.e., phases), enter the actual date the

fied as they are classified for federal income tax purposes under the Inter- last phase was placed in service. NOTE: If the project is a phased pro-

nal Revenue Service’s (IRS) “check-the-box” regulations. If the investing ject, the capital credit will not begin until the last phase is placed in

company is a SMLLC that elects to be treated as a corporation for feder- service and any tax liability incurred prior to the last phase being

al tax purposes, enter the SMLLC as the project entity. If the investing placed in service will not be subject to the credit.

company is a SMLLC that does not “check-the-box” for federal income tax Line 5 – Enter the actual capital costs of the project. If the project is

purposes, the SMLLC shall be treated as a disregarded entity for Ala- a phased project, enter the actual costs of all phases. To verify these

bama tax purposes and the parent must be entered as the project entity. costs, the asset depreciation schedule is required to be attached to the

Qualified Subchapter S Subsidiaries (Q-subs) under 26 U.S.C. Sec- Form INT-2. The schedule should include the description, in-service date

tion 1361(b)(3) shall be treated as disregarded entities for Alabama and cost of each asset. See Section 40-18-190(2), Departmental Rule

income tax purposes. If the investing company is a Q-sub, the parent 810-2-7-.01(2)(c), or Section 40-18-240(1) for specific inclusions and

must be entered as the project entity. exclusions of capital costs.

Project Name – Enter name of project if identified as a division or pro- Line 6a – Add 5a through 5j and enter total here. The qualifying pro-

ject name. Enter company Doing Business As (DBA) if project is doing ject must meet the minimum capital investment for the type of project indi-

business under another name. Enter the name of the SMLLC if the qual- cated.

ifying project is a SMLLC treated as a disregarded entity for tax purpos- Line 6b – Multiply line 6a by 5%. This is the maximum amount of cap-

es. Enter the name of the Q-sub if the qualifying project is a Q-sub. ital credit available to be applied against the income tax or financial insti-

Address – Enter the address to which all correspondence should be tution excise tax liability generated by or arising out of the qualifying pro-

directed regarding the project. ject each year for 20 years, beginning in the year the project is placed in

service.

Location of Project – Enter the project’s physical address.

Line 7 – Enter the number of new employees hired at this project. The

FEIN – Enter the Federal Employer Identification Number. qualifying project must meet the minimum job requirement for the type of

NAICS Code – If the predominant business activity is an industrial, project indicated. New employees are those persons who have not pre-

warehousing or research activity as defined in Code of Alabama 1975 viously been employed at the site on which the project is or will be placed

Section 40-18-190(a)(8), a warehousing or storage activity, a headquar- in service or have not been employed by the investing company or com-

ters facility , or a state docks project as defined in Section 40-18-240(4), panies in this state; will be employed full-time as a direct result of the pro-

enter the 2007 North American Industrial Classification System (NAICS) ject being placed in service; and will be subject to the personal income

code for the project. tax imposed by Section 40-18-2, Code of Alabama 1975, upon com-

mencement of employment at the project. Jobs must be provided begin-

Project Filing Status – Check the applicable box. ning with the date which is not later than one (1) year after the project is

Line 1a – Check the applicable box. See “Statutory Requirements for placed in service and continuing each year thereafter. For warehousing or

Qualifying Projects” for project descriptions. storage activity projects, jobs must be provided beginning with the date

which is not later than two (2) years after the project is placed in service

Line 1b – Indicate if project is located in a Favored Geographic Area and continuing each year thereafter.

(FGA). This designation is determined at the time the Form INT is filed for

the project. A project that qualifies in a FGA will continue to be a qual- Line 8 – Enter the average hourly wage of the new employees of the

ified FGA project, even if the county later loses its designation as a FGA project. Section 40-18-193(a) requires the average hourly wages for all

as long as the project otherwise remains in compliance with the law. new employees at the qualifying project be not less than the base wage

Line 2 – Briefly describe the type of trade or business that the project requirement no later than one year after the project is placed in service

is engaged in. For projects that do not require a NAICS code, provide a and during each year the capital credit is available. For projects whose

detailed description that will identify the activities as qualifying activities. Form INT was filed after May 22, 2009, the base wage requirement is the

Attach additional sheets if necessary. lesser of the indexed hourly wage or the average hourly wage of the

county where the project is located, excluding benefits. For these pro-

Line 3 – Enter a full description of the activities of the project. Please jects, the base wage requirement is determined as of the date the Form

be detailed in the activities of the project. If the project was completed in INT for the project was filed with the Department and will remain constant

|

Enlarge image |

throughout the life of the credit. To verify the wage and new employee require- mencement of the project.

ments, a list of all employees working at the project should be attached to

Form INT-2. The list should include employee name, social security number, Line 9b – Check applicable box. If the investing company closed a facility

date of hire, date of termination (if applicable) and average hourly wage. in Alabama within two years of the project being placed in service, list the date

of the closure for the facility, the number of employees at the facility on the date

Projects whose Form INT was filed on or before May 22, 2009, the base of closure, and the location of the facility. If an investing company places a

wage requirement is either an average hourly wage of not less than eight dol- qualifying project in service within two years following a facility closure, only

lars ($8) per hour or an average total compensation of not less than ten dol- the number of employees in excess of the number of employees who worked

lars (10) per hour, including benefits. at the existing facility at the time of the closure shall be treated as new employ-

The above wage requirements do not include employees of direct proces- ees for purposes of meeting the employee requirements.

sors of agriculture food products. These employees’ wages shall be deter- Line 10 – Check applicable box. Property previously owned or leased

mined by the local labor market or a source established by the Department of before the commencement of the qualifying project by the investing company

Revenue if reliable local labor market statistics is not available. or a related party shall not be included as a part of the project’s capital cost

Line 9a – Check the applicable box. The qualifying project must create new unless such property was located outside of Alabama at least one year prior

jobs and those jobs must be a net increase in employment for the investing to the date the project is placed in service.

company. If the investing company reduced its workforce within two years of Line 12 – Enter the name of the person to which all correspondence should

the qualifying project being placed in service, only the number of employees in be directed regarding the project. Include a telephone number if different from

excess of the Alabama employee level prior to the reduction shall be treated the number indicated on the top of this form.

as new employees for purposes of meeting the employee requirements. A two

year look back period from the placed in service date may be required to deter- Allocations of Capital Credit – List all participants of the project entity

mine if the existing employee base decreased prior to or during the com- entitled to receive the capital credit. Attach additional sheets if necessary.

|