Enlarge image

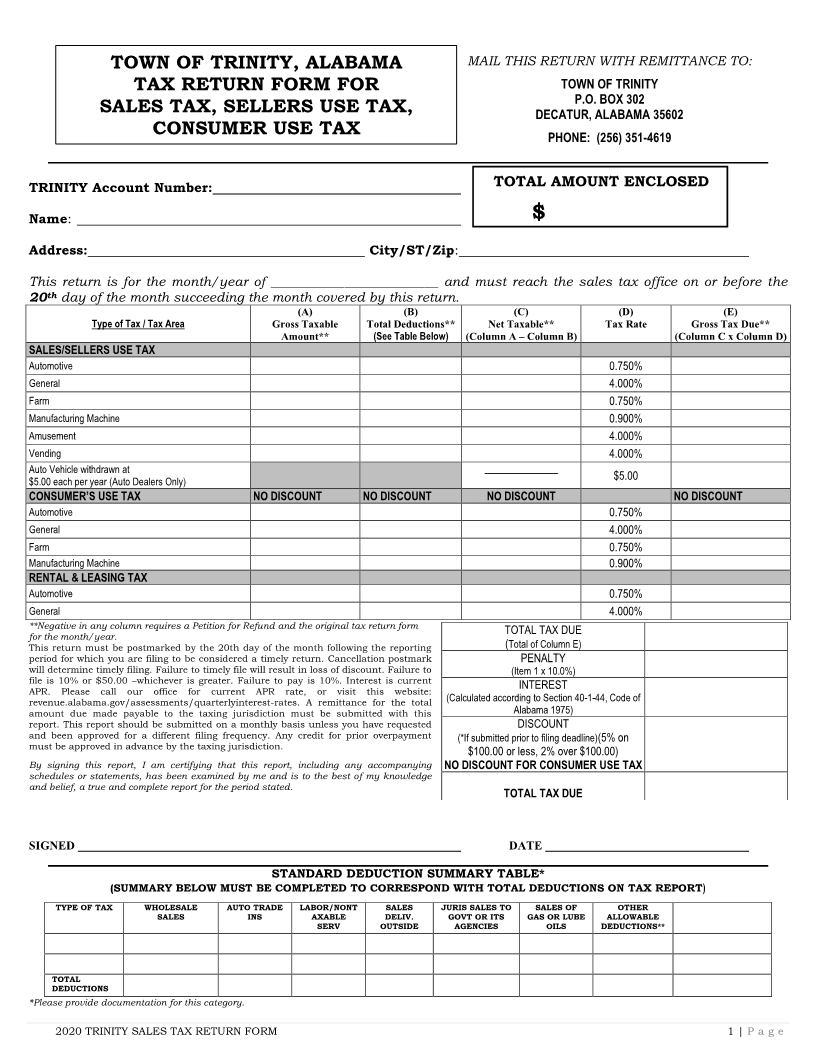

TOWN OF TRINITY, ALABAMA MAIL THIS RETURN WITH REMITTANCE TO:

TAX RETURN FORM FOR TOWN OF TRINITY

P.O. BOX 302

SALES TAX, SELLERS USE TAX, DECATUR, ALABAMA 35602

CONSUMER USE TAX PHONE: (256) 351-4619

TRINITY Account Number: TOTAL AMOUNT ENCLOSED

Name: $

Address: City/ST/Zip:

This return is for the month/year of _________________________ and must reach the sales tax office on or before the

20th day of the month succeeding the month covered by this return.

(A) (B) (C) (D) (E)

Type of Tax / Tax Area Gross Taxable Total Deductions** Net Taxable** Tax Rate Gross Tax Due**

Amount** (See Table Below) (Column A – Column B) (Column C x Column D)

SALES/SELLERS USE TAX

Automotive 0.750%

General 4.000%

Farm 0.750%

Manufacturing Machine 0.900%

Amusement 4.000%

Vending 4.000%

Auto Vehicle withdrawn at _______________

$5.00 each per year (Auto Dealers Only) $5.00

CONSUMER’S USE TAX NO DISCOUNT NO DISCOUNT NO DISCOUNT NO DISCOUNT

Automotive 0.750%

General 4.000%

Farm 0.750%

Manufacturing Machine 0.900%

RENTAL & LEASING TAX

Automotive 0.750%

General 4.000%

**Negative in any column requires a Petition for Refund and the original tax return form TOTAL TAX DUE

for the month/year.

This return must be postmarked by the 20th day of the month following the reporting (Total of Column E)

period for which you are filing to be considered a timely return. Cancellation postmark PENALTY

will determine timely filing. Failure to timely file will result in loss of discount. Failure to (Item 1 x 10.0%)

file is 10% or $50.00 whichever– is greater. Failure to pay is 10%. Interest is current INTEREST

APR. Please call our office for current APR rate, or visit this website:

revenue.alabama.gov/assessments/quarterlyinterest-rates. A remittance for the total (Calculated according to Section 40-1-44, Code of

amount due made payable to the taxing jurisdiction must be submitted with this Alabama 1975)

report. This report should be submitted on a monthly basis unless you have requested DISCOUNT

and been approved for a different filing frequency. Any credit for prior overpayment (*If submitted prior to filing deadline)(5% on

must be approved in advance by the taxing jurisdiction. $100.00 or less, 2% over $100.00)

By signing this report, I am certifying that this report, including any accompanying NO DISCOUNT FOR CONSUMER USE TAX

schedules or statements, has been examined by me and is to the best of my knowledge

and belief, a true and complete report for the period stated.

TOTAL TAX DUE

SIGNED DATE

STANDARD DEDUCTION SUMMARY TABLE*

(SUMMARY BELOW MUST BE COMPLETED TO CORRESPOND WITH TOTAL DEDUCTIONS ON TAX REPORT)

TYPE OF TAX WHOLESALE AUTO TRADE LABOR/NONT SALES JURIS SALES TO SALES OF OTHER

SALES INS AXABLE DELIV. GOVT OR ITS GAS OR LUBE ALLOWABLE

SERV OUTSIDE AGENCIES OILS DEDUCTIONS**

TOTAL

DEDUCTIONS

*Please provide documentation for this category.

2020 TRINITY SALES TAX RETURN FORM 1 | P a g e