Enlarge image

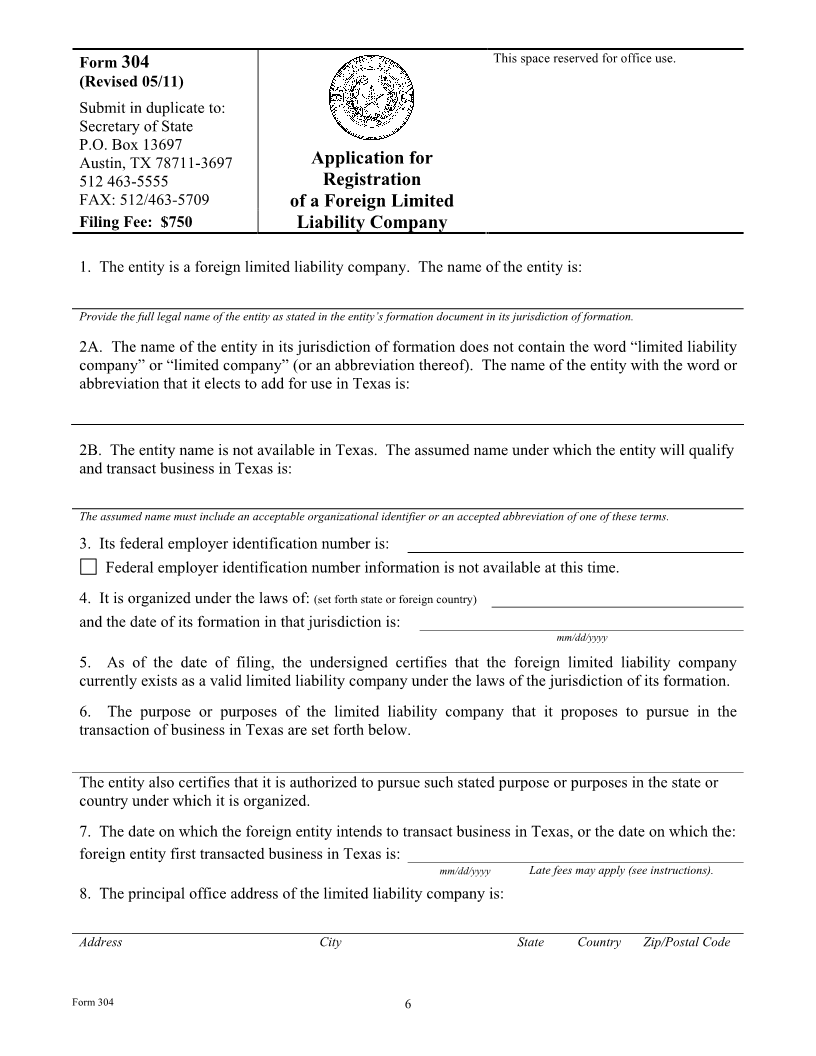

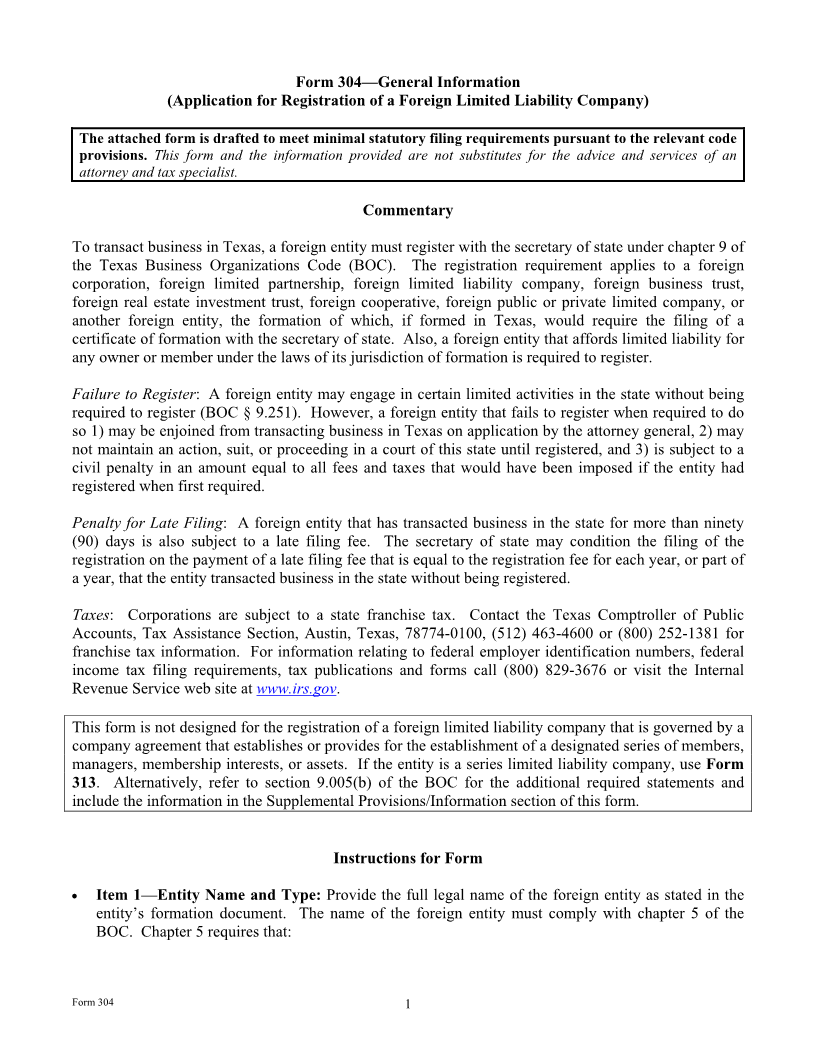

Form 304—General Information

(Application for Registration of a Foreign Limited Liability Company)

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist.

Commentary

To transact business in Texas, a foreign entity must register with the secretary of state under chapter 9 of

the Texas Business Organizations Code (BOC). The registration requirement applies to a foreign

corporation, foreign limited partnership, foreign limited liability company, foreign business trust,

foreign real estate investment trust, foreign cooperative, foreign public or private limited company, or

another foreign entity, the formation of which, if formed in Texas, would require the filing of a

certificate of formation with the secretary of state. Also, a foreign entity that affords limited liability for

any owner or member under the laws of its jurisdiction of formation is required to register.

Failure to Register: A foreign entity may engage in certain limited activities in the state without being

required to register (BOC § 9.251). However, a foreign entity that fails to register when required to do

so 1) may be enjoined from transacting business in Texas on application by the attorney general, 2) may

not maintain an action, suit, or proceeding in a court of this state until registered, and 3) is subject to a

civil penalty in an amount equal to all fees and taxes that would have been imposed if the entity had

registered when first required.

Penalty for Late Filing: A foreign entity that has transacted business in the state for more than ninety

(90) days is also subject to a late filing fee. The secretary of state may condition the filing of the

registration on the payment of a late filing fee that is equal to the registration fee for each year, or part of

a year, that the entity transacted business in the state without being registered.

Taxes: Corporations are subject to a state franchise tax. Contact the Texas Comptroller of Public

Accounts, Tax Assistance Section, Austin, Texas, 78774-0100, (512) 463-4600 or (800) 252-1381 for

franchise tax information. For information relating to federal employer identification numbers, federal

income tax filing requirements, tax publications and forms call (800) 829-3676 or visit the Internal

Revenue Service web site at www.irs.gov.

This form is not designed for the registration of a foreign limited liability company that is governed by a

company agreement that establishes or provides for the establishment of a designated series of members,

managers, membership interests, or assets. If the entity is a series limited liability company, use Form

313. Alternatively, refer to section 9.005(b) of the BOC for the additional required statements and

include the information in the Supplemental Provisions/Information section of this form.

Instructions for Form

Item 1—Entity Name and Type: Provide the full legal name of the foreign entity as stated in the

entity’s formation document. The name of the foreign entity must comply with chapter 5 of the

BOC. Chapter 5 requires that:

Form 304 1