Enlarge image

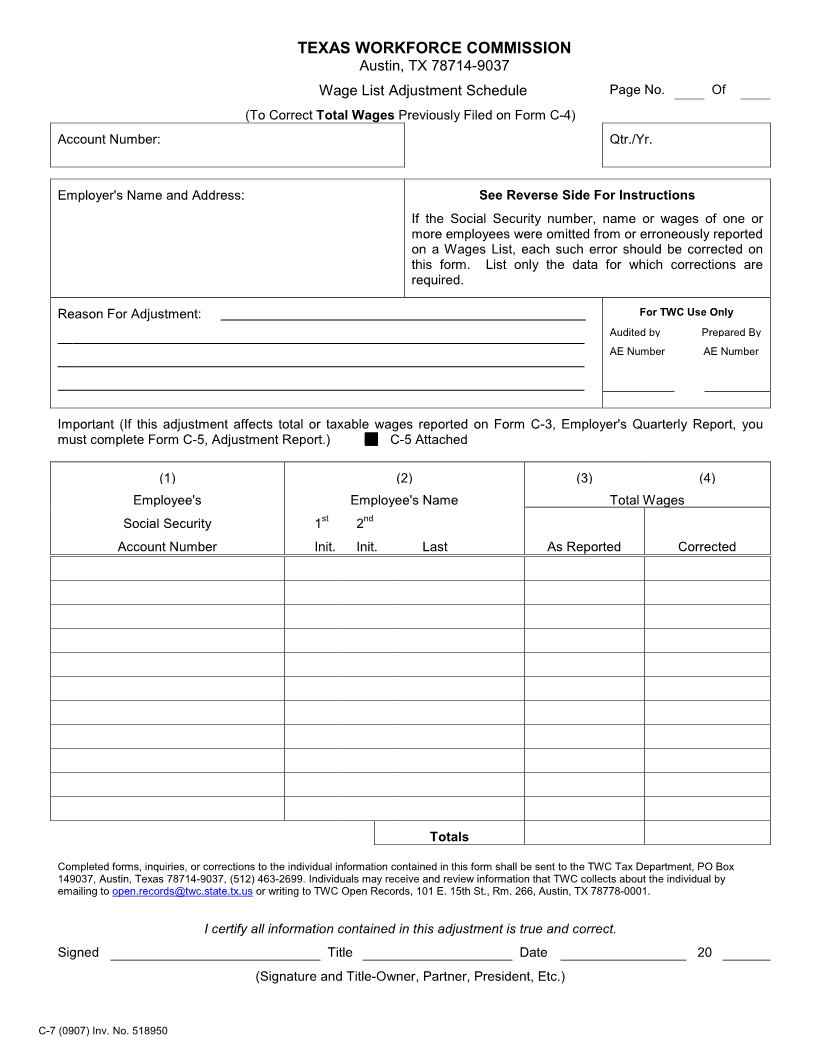

TEXAS WORKFORCE COMMISSION

Austin, TX 78714-9037

Wage List Adjustment Schedule Page No. Of

(To Correct Total Wages Previously Filed on Form C-4)

Account Number: Qtr./Yr.

Employer's Name and Address: See Reverse Side For Instructions

If the Social Security number, name or wages of one or

more employees were omitted from or erroneously reported

on a Wages List, each such error should be corrected on

this form. List only the data for which corrections are

required.

Reason For Adjustment: For TWC Use Only

Audited by Prepared By

AE Number AE Number

Important (If this adjustment affects total or taxable wages reported on Form C-3, Employer's Quarterly Report, you

must complete Form C-5, Adjustment Report.) C-5 Attached

(1) (2) (3) (4)

Employee's Employee's Name Total Wages

st nd

Social S ecurity 1 2

Account Number Init. Init. Last As Reported Corrected

Totals

Completed forms, inquiries, or corrections to the individual information contained in this form shall be sent to the TWC Tax Department, PO Box

149037, Austin, Texas 78714-9037, (512) 463-2699. Individuals may receive and review information that TWC collects about the individual by

emailing to open.records@twc.state.tx.us or writing to TWC Open Records, 101 E. 15th St., Rm. 266, Austin, TX 78778-0001.

I certify all information contained in this adjustment is true and correct.

Signed Title Date 20

(Signature and Title-Owner, Partner, President, Etc.)

C-7 (0907) Inv. No. 518950