Enlarge image

Mail To:

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX 78714-9037 Account Number

512.463.2731

www.texasworkforce.org

Employer

APPLICATION FOR TERMINATION OF COVERAGE

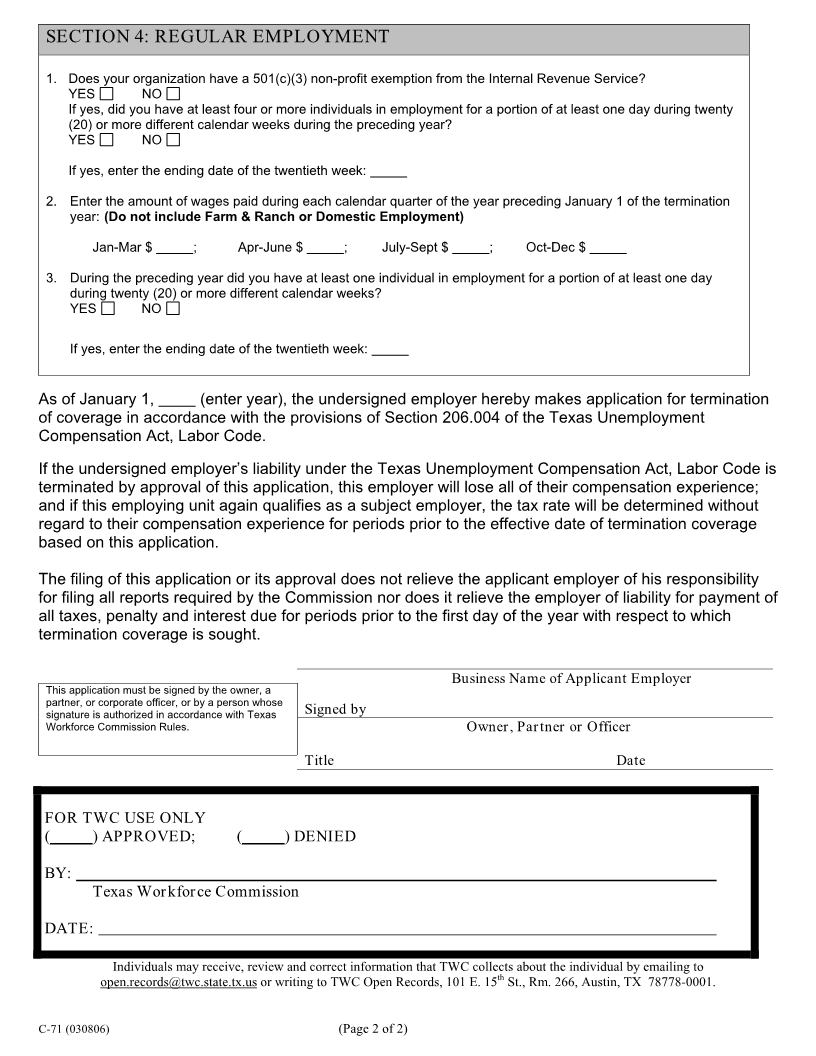

SECTION 1: GENERAL INFORMATION

1. NOTICE: Termination of an employer’s coverage voids all previous compensation experience for the purpose of

determining experience tax rates.

2. SECTION 206.004 of the TEXAS UNEMPLOYMENT COMPENSATION ACT

a. An employing unit may cease to be an employer only on January 1 of a year and only if the Commission

finds that:

1) the employing unit was not an employer during the preceding year; or

2) the employing unit has not had any individuals in employment during the preceding three calendar years.

b. The Commission may not make a finding under Section (a)(1) unless the employing unit files an application for

termination of coverage with the Commission on or after January 1 but before April 1 of the year

for which termination is requested. The Commission may make a finding under Subsection (a)(2)

without an application having been filed.

3. SECTION 206.005 of the TEXAS UNEMPLOYMENT COMPENSATION ACT

When an employing unit that ceased to be an employer subsequently becomes an employer, the employing

unit is considered to be a new employer without regard to the rights that employing unit acquired when previously

an employer.

SECTION 2: DOMESTIC EMPLOYMENT

1. Enter the amount of cash wages paid for DOMESTIC employment during each calendar quarter of the year

preceding January 1 of the termination year.

Jan-Mar$ ; Apr-June $ ; July-Sept $ ; Oct-Dec $

SECTION 3: FARM AND RANCH EMPLOYMENT

1. Enter the amount of wages paid for FARM AND RANCH employment during each calendar quarter of the year

preceding January 1 of the termination year:

Jan-Mar$ ; Apr-June $ ; July-Sept $ ; Oct-Dec $

2 During the preceding year, did you employ at least three persons in Texas performing farm or ranch labor during

twenty (20) or more calendar weeks? YES NO

If yes, enter the ending date of the twentieth week:

3. During the preceding calendar year, did you:

a. Employ seasonal workers in Texas on a truck farm, orchard or vineyard? YES NO

b. Employ migrant workers in Texas? YES NO

c. Employ seasonal workers in Texas working with migrant workers, at the same place and time during the same

week? YES NO

C-71 (030806) (Page 1 of 2)