Enlarge image

Form 433-B

(Rev. December 2012) Collection Information Statement for Businesses

Department of the Treasury

Internal Revenue Service

Note: Complete all entry spaces with the current data available or "N/A" (not applicable). Failure to complete all entry spaces may result in rejection of

your request or significant delay in account resolution. Include attachments if additional space is needed to respond completely to any question.

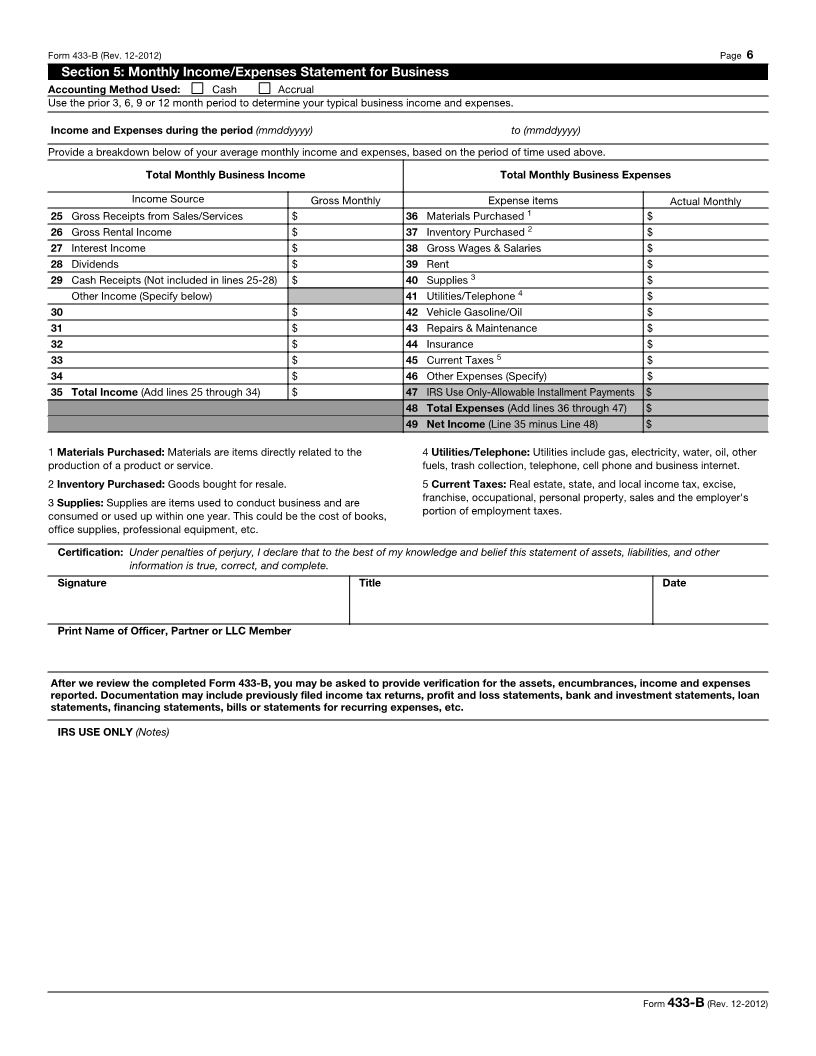

Section 1: Business Information

1a Business Name 2a Employer Identification No. (EIN)

2b Type of entity (Check appropriate box below)

1b Business Street Address Partnership Corporation Other

Limited Liability Company (LLC) classified as a corporation

Mailing Address Other LLC - Include number of members

City State ZIP 2c Date Incorporated/Established

1c County mmddyyyy

1d Business Telephone ( ) 3a Number of Employees

1e Type of Business 3b Monthly Gross Payroll

3c Frequency of Tax Deposits

1f Business Website (web address) 3d Is the business enrolled in Electronic

Federal Tax Payment System (EFTPS) Yes No

4 Does the business engage in e-Commerce (Internet sales) If yes, complete 5a and 5b. Yes No

PAYMENT PROCESSOR (e.g., PayPal, Authorize.net, Google Checkout, etc.) Name and Address (Street, City, State, ZIP code) Payment Processor Account Number

5a

5b

CREDIT CARDS ACCEPTED BY THE BUSINESS

Type of Credit Card Merchant Account Number Issuing Bank Name and Address (Street, City, State, ZIP code)

(e.g., Visa, Mastercard, etc.)

6a Phone

6b Phone

6c Phone

Section 2: Business Personnel and Contacts

PARTNERS, OFFICERS, LLC MEMBERS, MAJOR SHAREHOLDERS, ETC.

7a Full Name Social Security Number

Title Home Telephone ( )

Home Address Work/Cell Phone ( )

City State ZIP Ownership Percentage & Shares or Interest

Responsible for Depositing Payroll Taxes Yes No Annual Salary/Draw

7b Full Name Social Security Number

Title Home Telephone ( )

Home Address Work/Cell Phone ( )

City State ZIP Ownership Percentage & Shares or Interest

Responsible for Depositing Payroll Taxes Yes No Annual Salary/Draw

7c Full Name Social Security Number

Title Home Telephone ( )

Home Address Work/Cell Phone ( )

City State ZIP Ownership Percentage & Shares or Interest

Responsible for Depositing Payroll Taxes Yes No Annual Salary/Draw

7d Full Name Social Security Number

Title Home Telephone ( )

Home Address Work/Cell Phone ( )

City State ZIP Ownership Percentage & Shares or Interest

Responsible for Depositing Payroll Taxes Yes No Annual Salary/Draw

www.irs.gov Cat. No. 16649P Form 433-B (Rev. 12-2012)