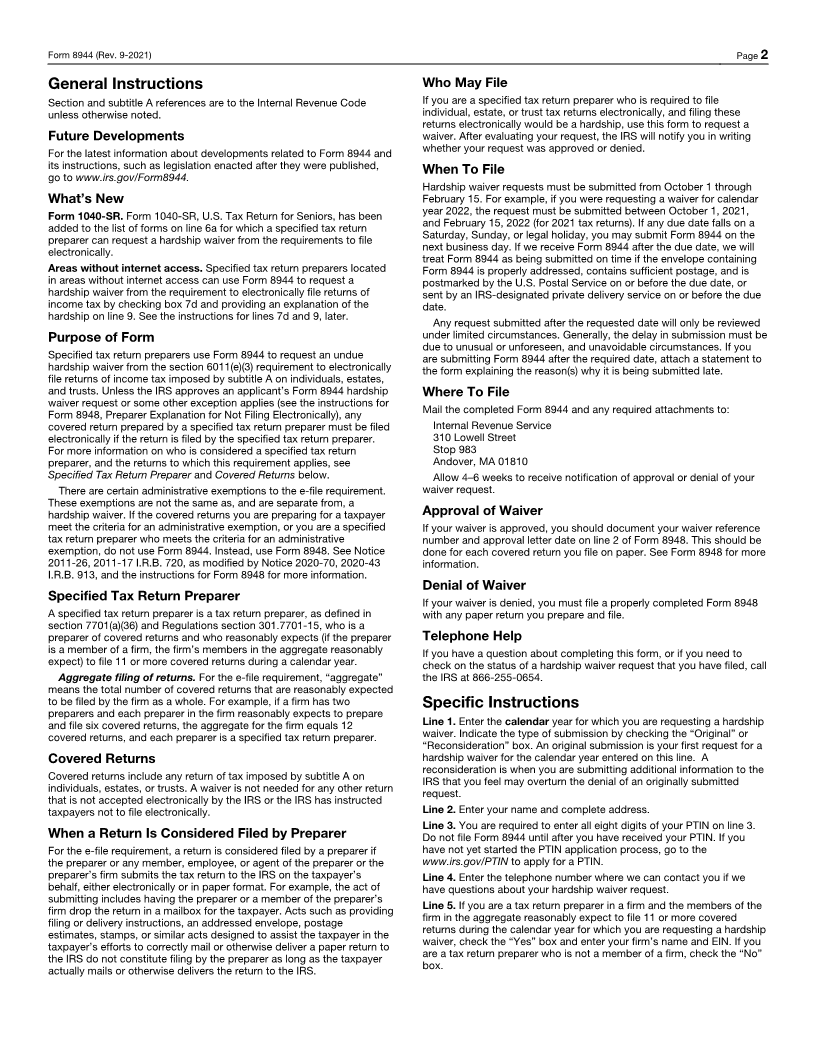

Enlarge image

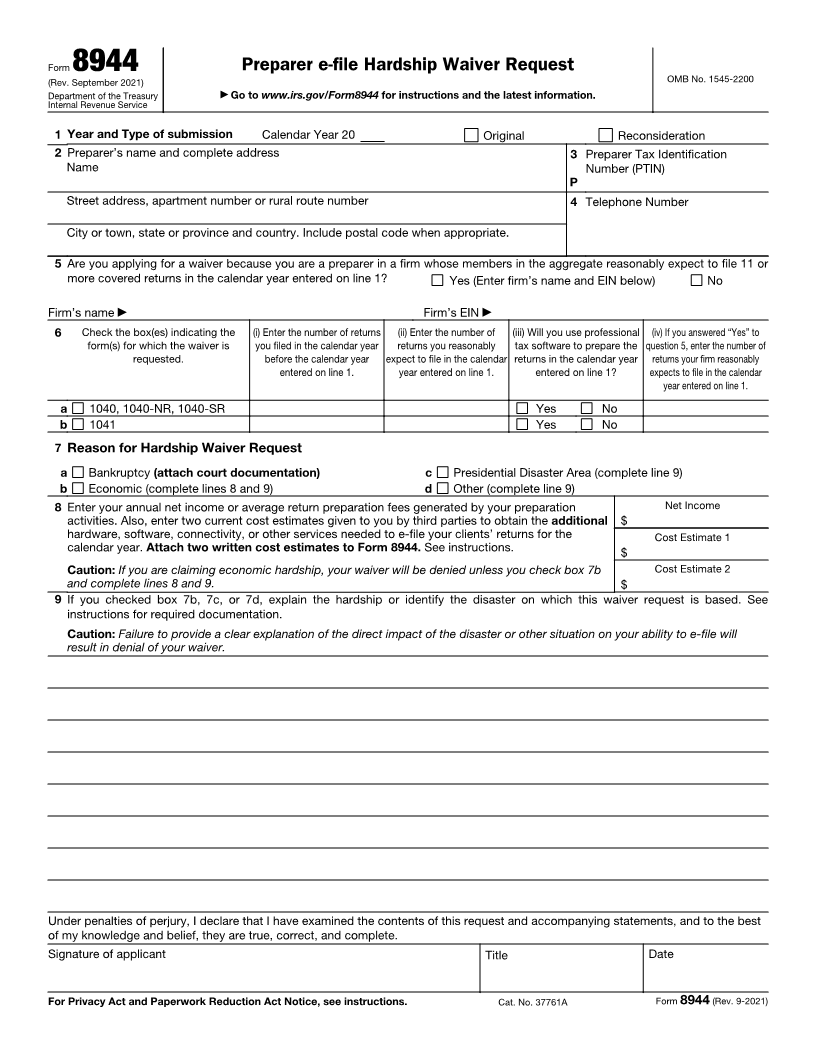

Form 8944 Preparer e-file Hardship Waiver Request

(Rev. September 2021) OMB No. 1545-2200

Department of the Treasury ▶ Go to www.irs.gov/Form8944 for instructions and the latest information.

Internal Revenue Service

1 Year and Type of submission Calendar Year 20 Original Reconsideration

2 Preparer’s name and complete address 3 Preparer Tax Identification

Name Number (PTIN)

P

Street address, apartment number or rural route number 4 Telephone Number

City or town, state or province and country. Include postal code when appropriate.

5 Are you applying for a waiver because you are a preparer in a firm whose members in the aggregate reasonably expect to file 11 or

more covered returns in the calendar year entered on line 1? Yes (Enter firm’s name and EIN below) No

Firm’s name ▶ Firm’s EIN ▶

6 Check the box(es) indicating the (i) Enter the number of returns (ii) Enter the number of (iii) Will you use professional (iv) If you answered “Yes” to

form(s) for which the waiver is you filed in the calendar year returns you reasonably tax software to prepare the question 5, enter the number of

requested. before the calendar year expect to file in the calendar returns in the calendar year returns your firm reasonably

entered on line 1. year entered on line 1. entered on line 1? expects to file in the calendar

year entered on line 1.

a 1040, 1040-NR, 1040-SR Yes No

b 1041 Yes No

7 Reason for Hardship Waiver Request

a Bankruptcy (attach court documentation) c Presidential Disaster Area (complete line 9)

b Economic (complete lines 8 and 9) d Other (complete line 9)

8 Enter your annual net income or average return preparation fees generated by your preparation Net Income

activities. Also, enter two current cost estimates given to you by third parties to obtain the additional $

hardware, software, connectivity, or other services needed to e-file your clients’ returns for the Cost Estimate 1

calendar year. Attach two written cost estimates to Form 8944. See instructions. $

Caution: If you are claiming economic hardship, your waiver will be denied unless you check box 7b Cost Estimate 2

and complete lines 8 and 9. $

9 If you checked box 7b, 7c, or 7d, explain the hardship or identify the disaster on which this waiver request is based. See

instructions for required documentation.

Caution: Failure to provide a clear explanation of the direct impact of the disaster or other situation on your ability to e-file will

result in denial of your waiver.

Under penalties of perjury, I declare that I have examined the contents of this request and accompanying statements, and to the best

of my knowledge and belief, they are true, correct, and complete.

Signature of applicant Title Date

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 37761A Form 8944 (Rev. 9-2021)