Enlarge image

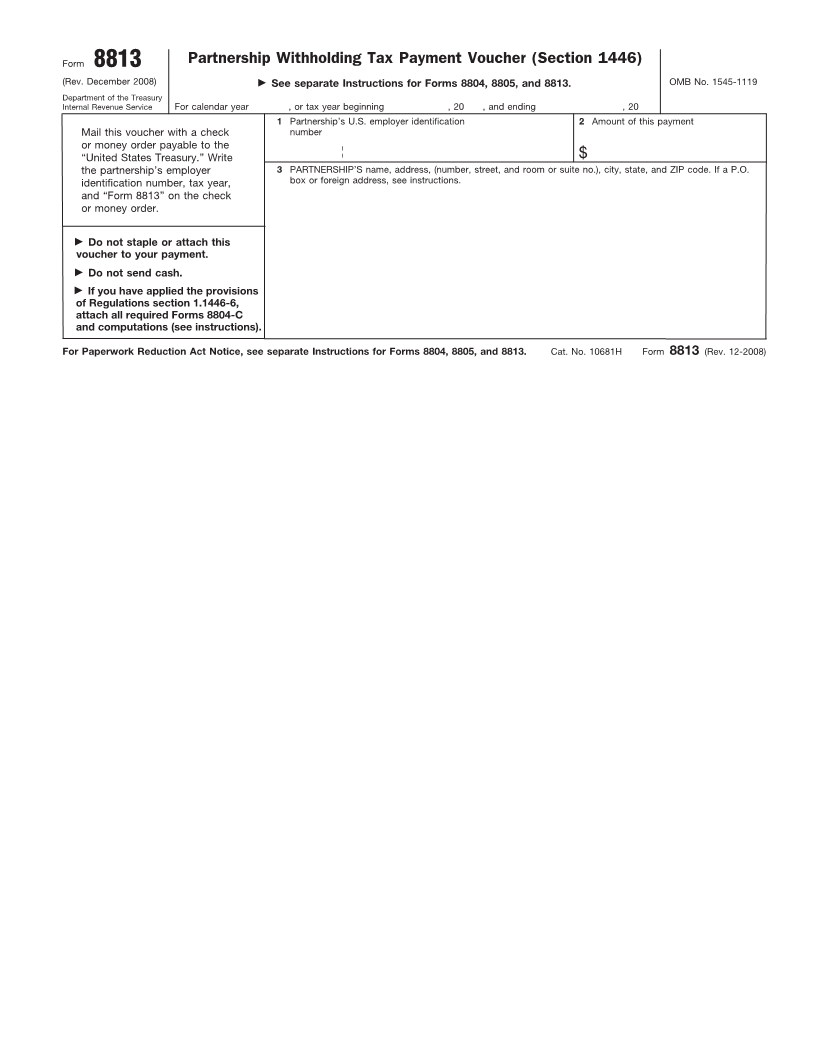

Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)

(Rev. December 2008) © See separate Instructions for Forms 8804, 8805, and 8813. OMB No. 1545-1119

Department of the Treasury

Internal Revenue Service For calendar year , or tax year beginning , 20 , and ending , 20

1 Partnership’s U.S. employer identification 2 Amount of this payment

Mail this voucher with a check number

or money order payable to the

“United States Treasury.” Write $

the partnership’s employer 3 PARTNERSHIP’S name, address, (number, street, and room or suite no.), city, state, and ZIP code. If a P.O.

identification number, tax year, box or foreign address, see instructions.

and “Form 8813” on the check

or money order.

© Do not staple or attach this

voucher to your payment.

© Do not send cash.

© If you have applied the provisions

of Regulations section 1.1446-6,

attach all required Forms 8804-C

and computations (see instructions).

For Paperwork Reduction Act Notice, see separate Instructions for Forms 8804, 8805, and 8813. Cat. No. 10681H Form 8813 (Rev. 12-2008)