Enlarge image

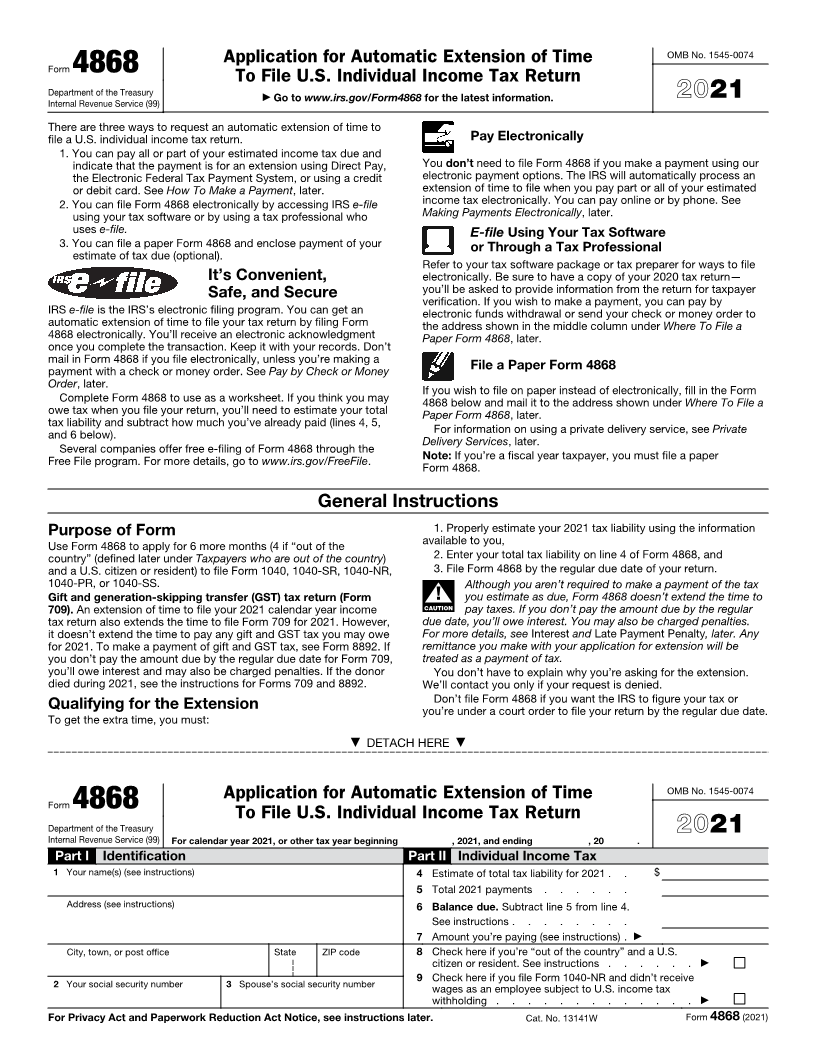

OMB No. 1545-0074

Application for Automatic Extension of Time

Form 4868 To File U.S. Individual Income Tax Return

Department of the Treasury ▶ Go to www.irs.gov/Form4868 for the latest information. 2021

Internal Revenue Service (99)

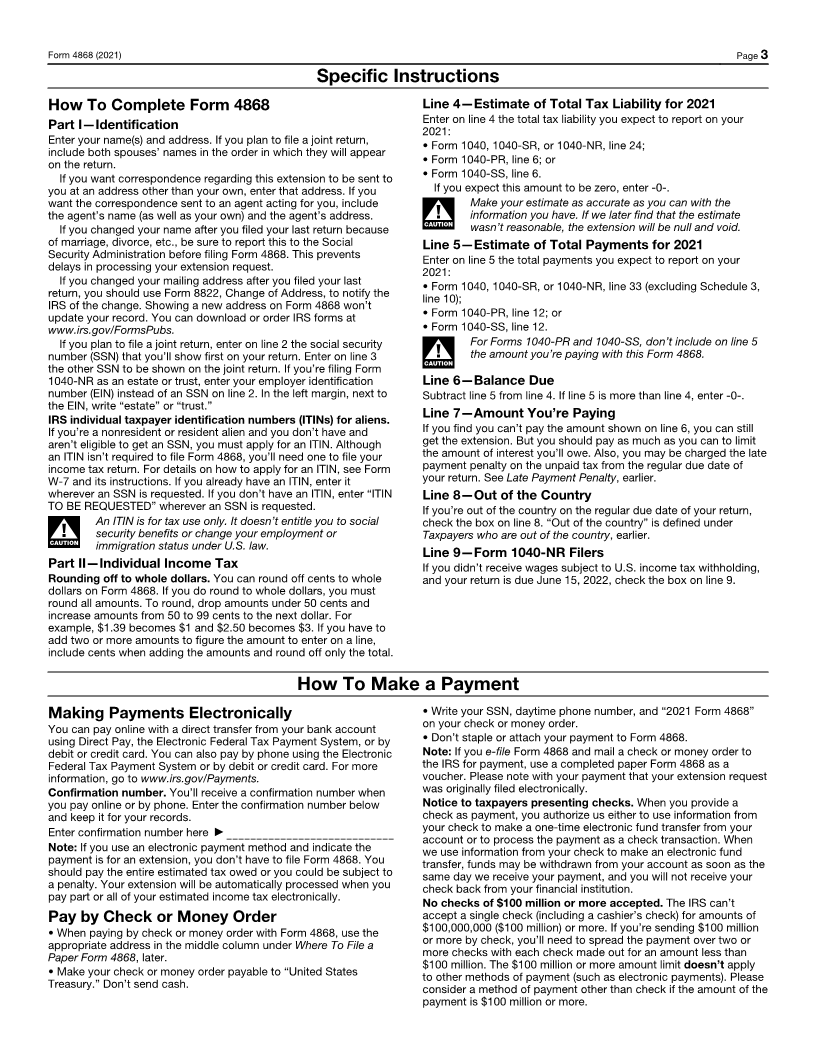

There are three ways to request an automatic extension of time to

file a U.S. individual income tax return. Pay Electronically

1. You can pay all or part of your estimated income tax due and

indicate that the payment is for an extension using Direct Pay, You don’t need to file Form 4868 if you make a payment using our

the Electronic Federal Tax Payment System, or using a credit electronic payment options. The IRS will automatically process an

or debit card. See How To Make a Payment, later. extension of time to file when you pay part or all of your estimated

2. You can file Form 4868 electronically by accessing IRS e-file income tax electronically. You can pay online or by phone. See

using your tax software or by using a tax professional who Making Payments Electronically, later.

uses e-file. E-file Using Your Tax Software

3. You can file a paper Form 4868 and enclose payment of your or Through a Tax Professional

estimate of tax due (optional).

Refer to your tax software package or tax preparer for ways to file

It’s Convenient, electronically. Be sure to have a copy of your 2020 tax return—

Safe, and Secure you’ll be asked to provide information from the return for taxpayer

verification. If you wish to make a payment, you can pay by

IRS e-file is the IRS’s electronic filing program. You can get an electronic funds withdrawal or send your check or money order to

automatic extension of time to file your tax return by filing Form the address shown in the middle column underWhere To File a

4868 electronically. You’ll receive an electronic acknowledgment Paper Form 4868, later.

once you complete the transaction. Keep it with your records. Don’t

mail in Form 4868 if you file electronically, unless you’re making a

payment with a check or money order. See Pay by Check or Money File a Paper Form 4868

Order, later.

If you wish to file on paper instead of electronically, fill in the Form

Complete Form 4868 to use as a worksheet. If you think you may 4868 below and mail it to the address shown under Where To File a

owe tax when you file your return, you’ll need to estimate your total Paper Form 4868 , later.

tax liability and subtract how much you’ve already paid (lines 4, 5,

and 6 below). For information on using a private delivery service, see Private

Delivery Services, later.

Several companies offer free e-filing of Form 4868 through the

Free File program. For more details, go to www.irs.gov/FreeFile. Note: If you’re a fiscal year taxpayer, you must file a paper

Form 4868.

General Instructions

Purpose of Form 1. Properly estimate your 2021 tax liability using the information

Use Form 4868 to apply for 6 more months (4 if “out of the available to you,

country” (defined later under Taxpayers who are out of the country) 2. Enter your total tax liability on line 4 of Form 4868, and

and a U.S. citizen or resident) to file Form 1040, 1040-SR, 1040-NR, 3. File Form 4868 by the regular due date of your return.

1040-PR, or 1040-SS. Although you aren’t required to make a payment of the tax

Gift and generation-skipping transfer (GST) tax return (Form ▲! you estimate as due, Form 4868 doesn’t extend the time to

709). An extension of time to file your 2021 calendar year income CAUTION pay taxes. If you don’t pay the amount due by the regular

tax return also extends the time to file Form 709 for 2021. However, due date, you’ll owe interest. You may also be charged penalties.

it doesn’t extend the time to pay any gift and GST tax you may owe For more details, seeInterest and Late Payment Penalty, later. Any

for 2021. To make a payment of gift and GST tax, see Form 8892. If remittance you make with your application for extension will be

you don’t pay the amount due by the regular due date for Form 709, treated as a payment of tax.

you’ll owe interest and may also be charged penalties. If the donor You don’t have to explain why you’re asking for the extension.

died during 2021, see the instructions for Forms 709 and 8892. We’ll contact you only if your request is denied.

Don’t file Form 4868 if you want the IRS to figure your tax or

Qualifying for the Extension you’re under a court order to file your return by the regular due date.

To get the extra time, you must:

▼ DETACH HERE ▼

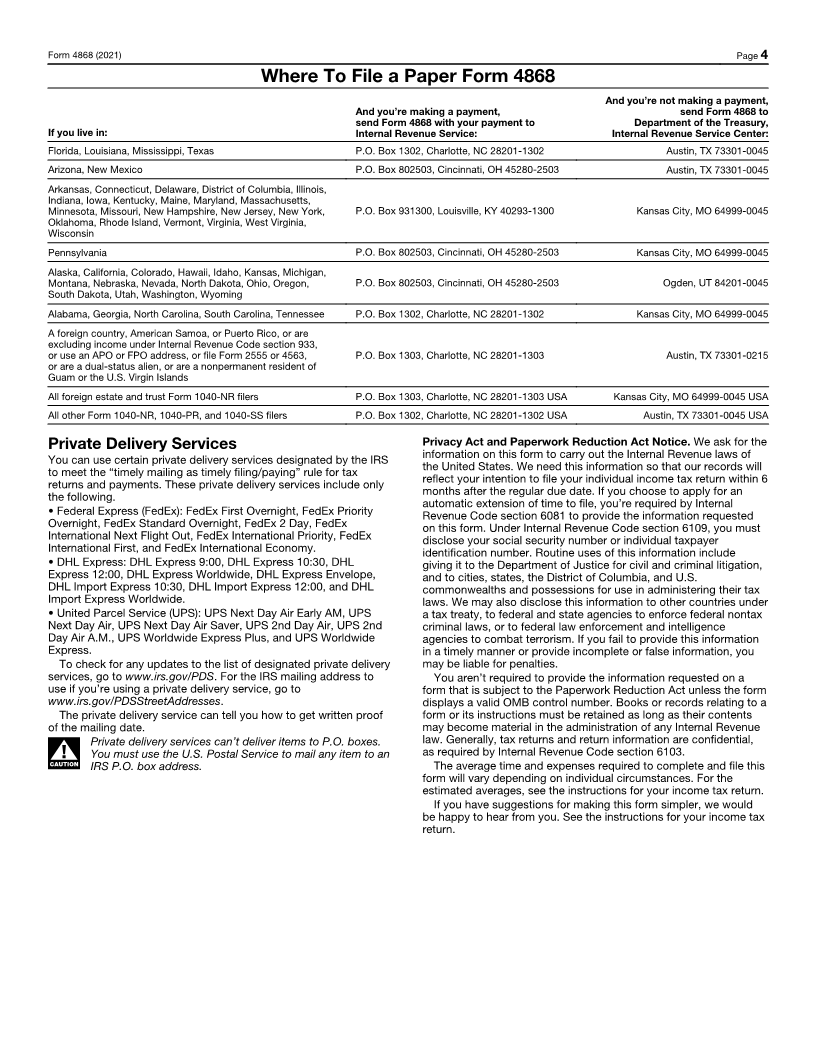

OMB No. 1545-0074

Application for Automatic Extension of Time

Form 4868

To File U.S. Individual Income Tax Return

Department of the Treasury 2021

Internal Revenue Service (99) For calendar year 2021, or other tax year beginning , 2021, and ending , 20 .

Part I Identification Part II Individual Income Tax

1 Your name(s) (see instructions) 4 Estimate of total tax liability for 2021 . . $

5 Total 2021 payments . . . . . .

Address (see instructions) 6 Balance due. Subtract line 5 from line 4.

See instructions . . . . . . . .

7 Amount you’re paying (see instructions) . ▶

City, town, or post office State ZIP code 8 Check here if you’re “out of the country” and a U.S.

citizen or resident. See instructions . . . . . . ▶

2 Your social security number 3 Spouse’s social security number 9 Check here if you file Form 1040-NR and didn’t receive

wages as an employee subject to U.S. income tax

withholding . . . . . . . . . . . . . ▶

For Privacy Act and Paperwork Reduction Act Notice, see instructions later. Cat. No. 13141W Form 4868 (2021)