- 3 -

Enlarge image

|

Form 706-CE (Rev. 10-2013) Page 3

Future developments. For the latest information about If you or any other person receives a refund of any of the

developments related to Form 706-CE and instructions, such as foreign death tax for which you are claiming this credit, you or

legislation enacted after they were published, go to the person receiving the refund must notify the Internal Revenue

www.irs.gov/form706ce. Service Center listed in the Where to file section of these

instructions within 30 days of receiving any refund. Section

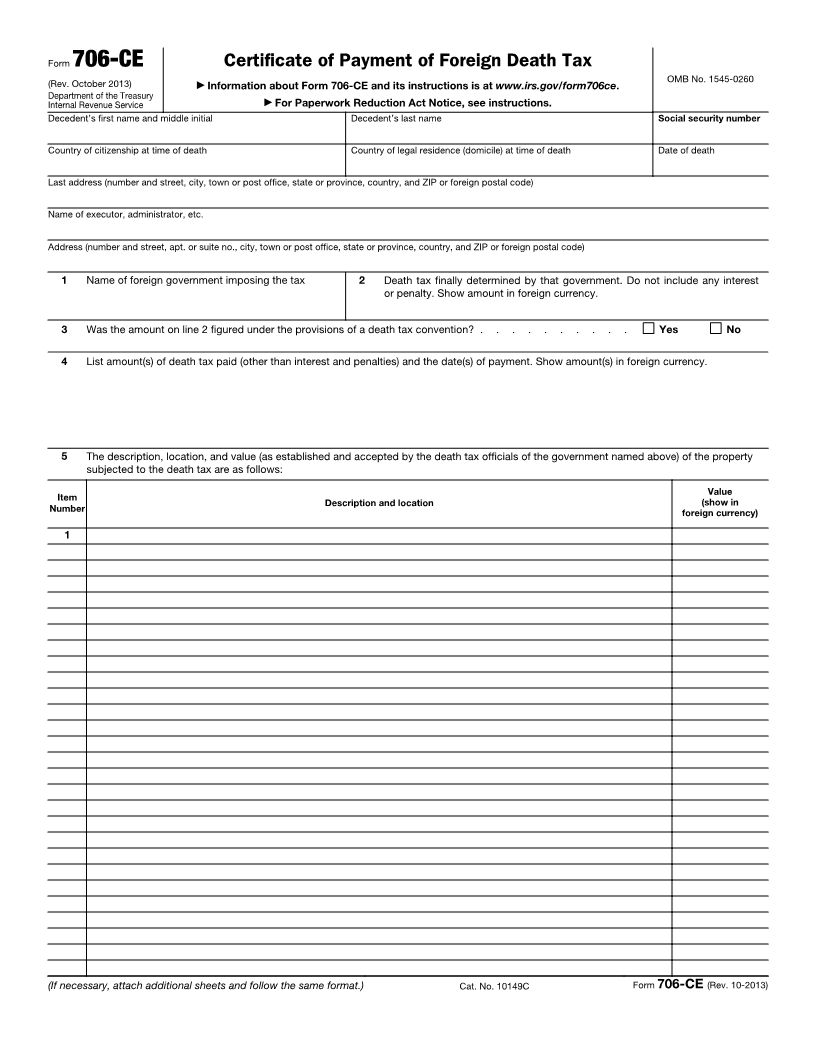

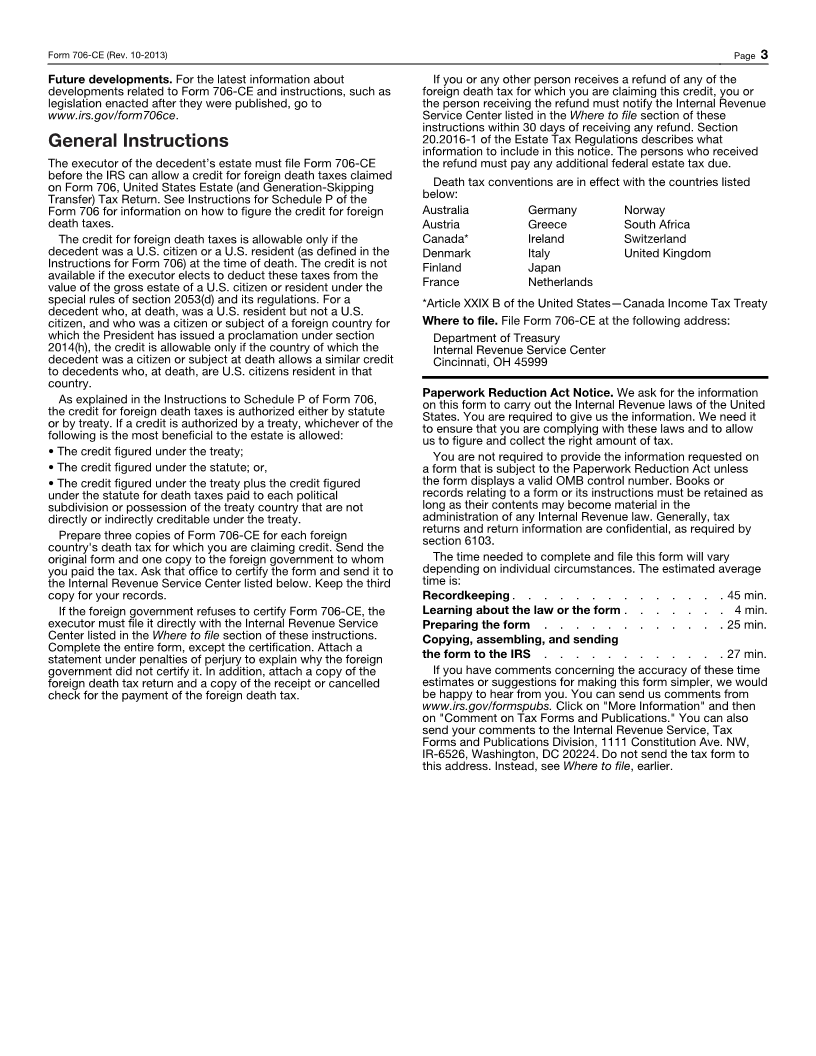

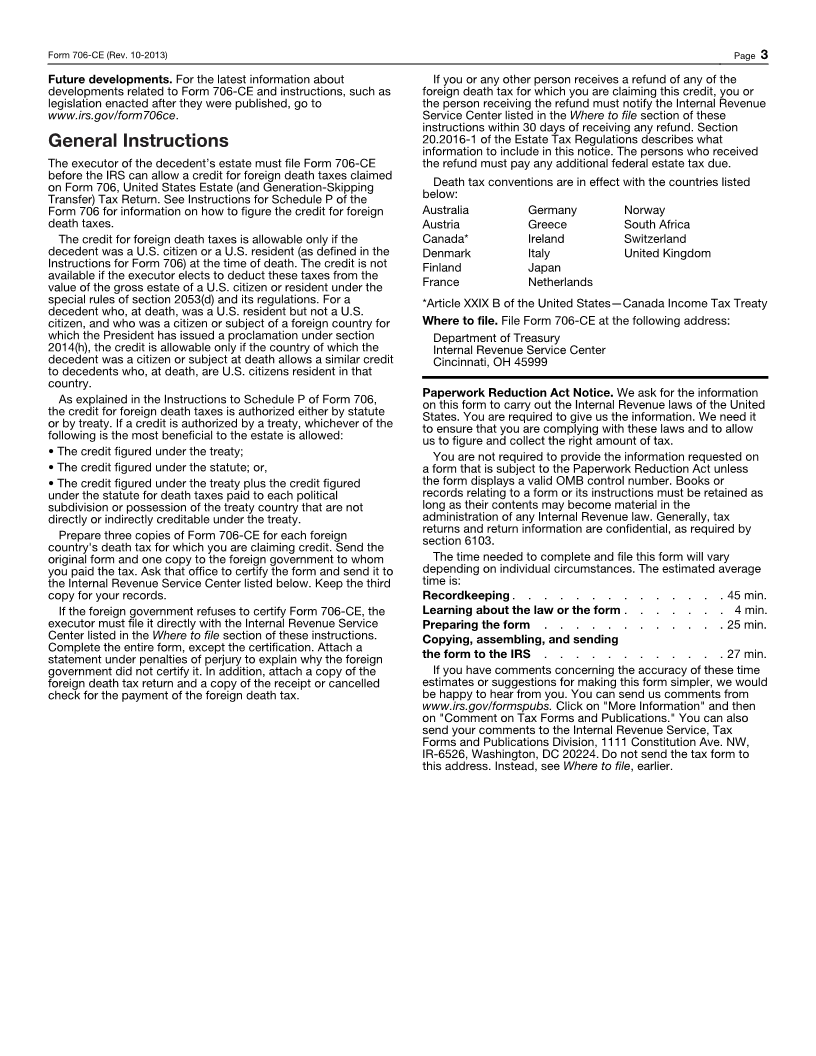

General Instructions 20.2016-1 of the Estate Tax Regulations describes what

information to include in this notice. The persons who received

The executor of the decedent’s estate must file Form 706-CE the refund must pay any additional federal estate tax due.

before the IRS can allow a credit for foreign death taxes claimed Death tax conventions are in effect with the countries listed

on Form 706, United States Estate (and Generation-Skipping below:

Transfer) Tax Return. See Instructions for Schedule P of the

Form 706 for information on how to figure the credit for foreign Australia Germany Norway

death taxes. Austria Greece South Africa

The credit for foreign death taxes is allowable only if the Canada* Ireland Switzerland

decedent was a U.S. citizen or a U.S. resident (as defined in the Denmark Italy United Kingdom

Instructions for Form 706) at the time of death. The credit is not Finland Japan

available if the executor elects to deduct these taxes from the France Netherlands

value of the gross estate of a U.S. citizen or resident under the

special rules of section 2053(d) and its regulations. For a *Article XXIX B of the United States—Canada Income Tax Treaty

decedent who, at death, was a U.S. resident but not a U.S.

citizen, and who was a citizen or subject of a foreign country for Where to file. File Form 706-CE at the following address:

which the President has issued a proclamation under section Department of Treasury

2014(h), the credit is allowable only if the country of which the Internal Revenue Service Center

decedent was a citizen or subject at death allows a similar credit Cincinnati, OH 45999

to decedents who, at death, are U.S. citizens resident in that

country.

As explained in the Instructions to Schedule P of Form 706, Paperwork Reduction Act Notice. We ask for the information

on this form to carry out the Internal Revenue laws of the United

the credit for foreign death taxes is authorized either by statute States. You are required to give us the information. We need it

or by treaty. If a credit is authorized by a treaty, whichever of the to ensure that you are complying with these laws and to allow

following is the most beneficial to the estate is allowed: us to figure and collect the right amount of tax.

• The credit figured under the treaty; You are not required to provide the information requested on

• The credit figured under the statute; or, a form that is subject to the Paperwork Reduction Act unless

• The credit figured under the treaty plus the credit figured the form displays a valid OMB control number. Books or

under the statute for death taxes paid to each political records relating to a form or its instructions must be retained as

subdivision or possession of the treaty country that are not long as their contents may become material in the

directly or indirectly creditable under the treaty. administration of any Internal Revenue law. Generally, tax

Prepare three copies of Form 706-CE for each foreign returns and return information are confidential, as required by

country's death tax for which you are claiming credit. Send the section 6103.

original form and one copy to the foreign government to whom The time needed to complete and file this form will vary

you paid the tax. Ask that office to certify the form and send it to depending on individual circumstances. The estimated average

the Internal Revenue Service Center listed below. Keep the third time is:

copy for your records. Recordkeeping. . . . . . . . . . . . . . 45 min.

If the foreign government refuses to certify Form 706-CE, the Learning about the law or the form . . . . . . . 4 min.

executor must file it directly with the Internal Revenue Service Preparing the form . . . . . . . . . . . . 25 min.

Center listed in the Where to file section of these instructions. Copying, assembling, and sending

statement under penalties of perjury to explain why the foreign the form to the IRS

Complete the entire form, except the certification. Attach a . . . . . . . . . . . . 27 min.

government did not certify it. In addition, attach a copy of the If you have comments concerning the accuracy of these time

foreign death tax return and a copy of the receipt or cancelled estimates or suggestions for making this form simpler, we would

check for the payment of the foreign death tax. be happy to hear from you. You can send us comments from

www.irs.gov/formspubs. Click on "More Information" and then

on "Comment on Tax Forms and Publications." You can also

send your comments to the Internal Revenue Service, Tax

Forms and Publications Division, 1111 Constitution Ave. NW,

IR-6526, Washington, DC 20224. Do not send the tax form to

this address. Instead, see Where to file, earlier.

|