- 4 -

Enlarge image

|

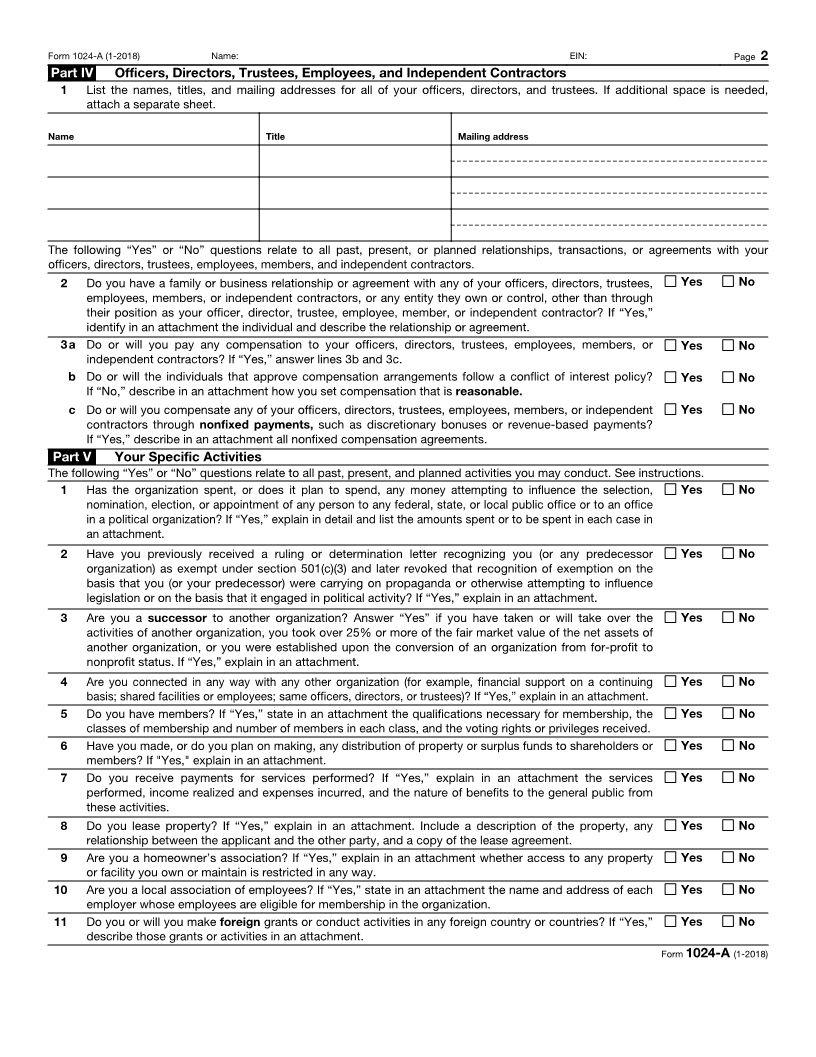

Form 1024-A (1-2018) Name: EIN: Page 2

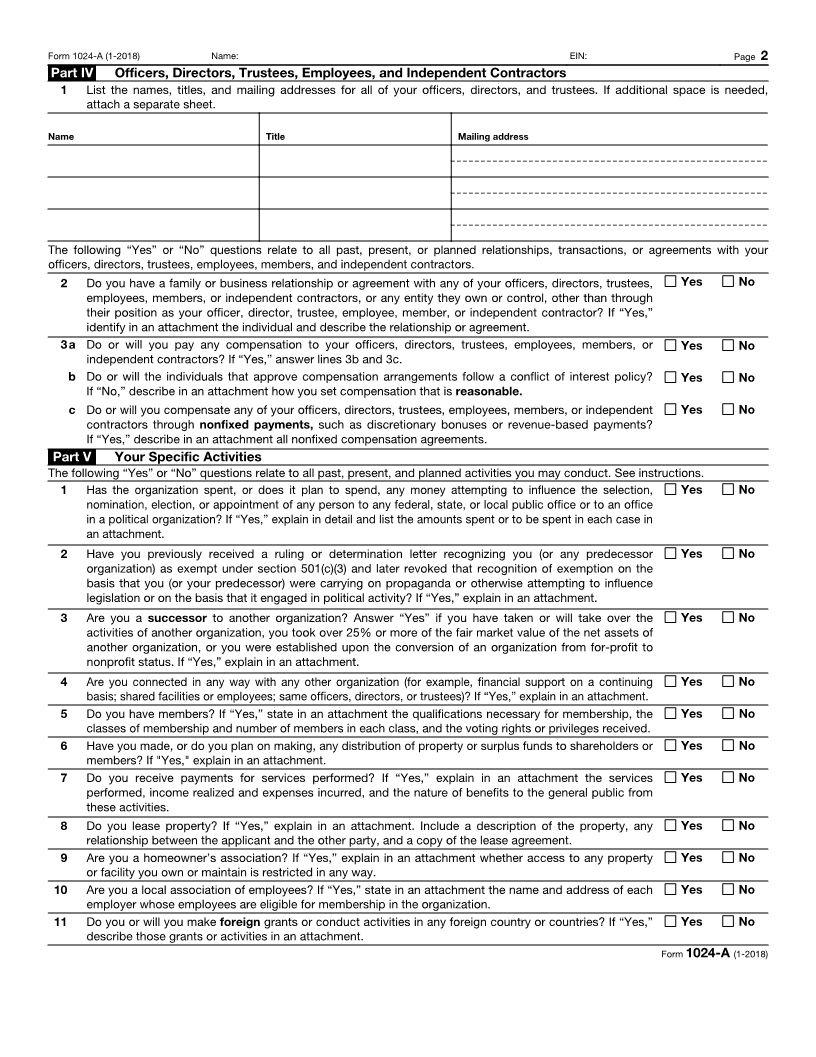

Part IV Officers, Directors, Trustees, Employees, and Independent Contractors

1 List the names, titles, and mailing addresses for all of your officers, directors, and trustees. If additional space is needed,

attach a separate sheet.

Name Title Mailing address

The following “Yes” or “No” questions relate to all past, present, or planned relationships, transactions, or agreements with your

officers, directors, trustees, employees, members, and independent contractors.

2 Do you have a family or business relationship or agreement with any of your officers, directors, trustees, Yes No

employees, members, or independent contractors, or any entity they own or control, other than through

their position as your officer, director, trustee, employee, member, or independent contractor? If “Yes,”

identify in an attachment the individual and describe the relationship or agreement.

3 a Do or will you pay any compensation to your officers, directors, trustees, employees, members, or Yes No

independent contractors? If “Yes,” answer lines 3b and 3c.

b Do or will the individuals that approve compensation arrangements follow a conflict of interest policy? Yes No

If “No,” describe in an attachment how you set compensation that is reasonable.

c Do or will you compensate any of your officers, directors, trustees, employees, members, or independent Yes No

contractors through nonfixed payments, such as discretionary bonuses or revenue-based payments?

If “Yes,” describe in an attachment all nonfixed compensation agreements.

Part V Your Specific Activities

The following “Yes” or “No” questions relate to all past, present, and planned activities you may conduct. See instructions.

1 Has the organization spent, or does it plan to spend, any money attempting to influence the selection, Yes No

nomination, election, or appointment of any person to any federal, state, or local public office or to an office

in a political organization? If “Yes,” explain in detail and list the amounts spent or to be spent in each case in

an attachment.

2 Have you previously received a ruling or determination letter recognizing you (or any predecessor Yes No

organization) as exempt under section 501(c)(3) and later revoked that recognition of exemption on the

basis that you (or your predecessor) were carrying on propaganda or otherwise attempting to influence

legislation or on the basis that it engaged in political activity? If “Yes,” explain in an attachment.

3 Are you a successor to another organization? Answer “Yes” if you have taken or will take over the Yes No

activities of another organization, you took over 25% or more of the fair market value of the net assets of

another organization, or you were established upon the conversion of an organization from for-profit to

nonprofit status. If “Yes,” explain in an attachment.

4 Are you connected in any way with any other organization (for example, financial support on a continuing Yes No

basis; shared facilities or employees; same officers, directors, or trustees)? If “Yes,” explain in an attachment.

5 Do you have members? If “Yes,” state in an attachment the qualifications necessary for membership, the Yes No

classes of membership and number of members in each class, and the voting rights or privileges received.

6 Have you made, or do you plan on making, any distribution of property or surplus funds to shareholders or Yes No

members? If "Yes," explain in an attachment.

7 Do you receive payments for services performed? If “Yes,” explain in an attachment the services Yes No

performed, income realized and expenses incurred, and the nature of benefits to the general public from

these activities.

8 Do you lease property? If “Yes,” explain in an attachment. Include a description of the property, any Yes No

relationship between the applicant and the other party, and a copy of the lease agreement.

9 Are you a homeowner’s association? If “Yes,” explain in an attachment whether access to any property Yes No

or facility you own or maintain is restricted in any way.

10 Are you a local association of employees? If “Yes,” state in an attachment the name and address of each Yes No

employer whose employees are eligible for membership in the organization.

11 Do you or will you make foreign grants or conduct activities in any foreign country or countries? If “Yes,” Yes No

describe those grants or activities in an attachment.

Form 1024-A (1-2018)

|