Enlarge image

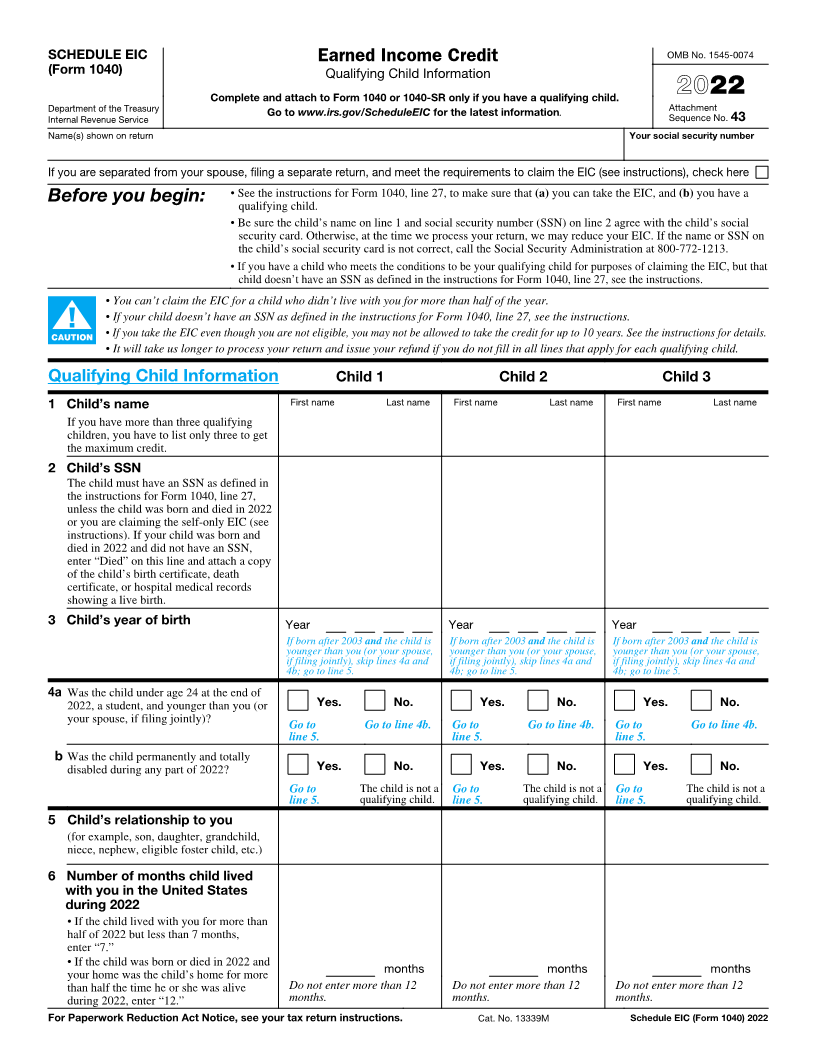

SCHEDULE EIC Earned Income Credit OMB No. 1545-0074

(Form 1040) Qualifying Child Information

Complete and attach to Form 1040 or 1040-SR only if you have a qualifying child. 2022

Department of the Treasury Go to www.irs.gov/ScheduleEIC for the latest information. Attachment

Internal Revenue Service Sequence No. 43

Name(s) shown on return Your social security number

If you are separated from your spouse, filing a separate return, and meet the requirements to claim the EIC (see instructions), check here

Before you begin: • See the instructions for Form 1040, line 27, to make sure that (a) you can take the EIC, and (b) you have a

qualifying child.

• Be sure the child’s name on line 1 and social security number (SSN) on line 2 agree with the child’s social

security card. Otherwise, at the time we process your return, we may reduce your EIC. If the name or SSN on

the child’s social security card is not correct, call the Social Security Administration at 800-772-1213.

• If you have a child who meets the conditions to be your qualifying child for purposes of claiming the EIC, but that

child doesn’t have an SSN as defined in the instructions for Form 1040, line 27, see the instructions.

• You can’t claim the EIC for a child who didn’t live with you for more than half of the year.

• If your child doesn’t have an SSN as defined in the instructions for Form 1040, line 27, see the instructions.

▲! • If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See the instructions for details.

CAUTION

• It will take us longer to process your return and issue your refund if you do not fill in all lines that apply for each qualifying child.

Qualifying Child Information Child 1 Child 2 Child 3

1 Child’s name First name Last name First name Last name First name Last name

If you have more than three qualifying

children, you have to list only three to get

the maximum credit.

2 Child’s SSN

The child must have an SSN as defined in

the instructions for Form 1040, line 27,

unless the child was born and died in 2022

or you are claiming the self-only EIC (see

instructions). If your child was born and

died in 2022 and did not have an SSN,

enter “Died” on this line and attach a copy

of the child’s birth certificate, death

certificate, or hospital medical records

showing a live birth.

3 Child’s year of birth Year Year Year

If born after 2003 and the child is If born after 2003 and the child is If born after 2003 and the child is

younger than you (or your spouse, younger than you (or your spouse, younger than you (or your spouse,

if filing jointly), skip lines 4a and if filing jointly), skip lines 4a and if filing jointly), skip lines 4a and

4b; go to line 5. 4b; go to line 5. 4b; go to line 5.

4a Was the child under age 24 at the end of

2022, a student, and younger than you (or Yes. No. Yes. No. Yes. No.

your spouse, if filing jointly)? Go to Go to line 4b. Go to Go to line 4b. Go to Go to line 4b.

line 5. line 5. line 5.

b Was the child permanently and totally

disabled during any part of 2022? Yes. No. Yes. No. Yes. No.

Go to The child is not a Go to The child is not a Go to The child is not a

line 5. qualifying child. line 5. qualifying child. line 5. qualifying child.

5 Child’s relationship to you

(for example, son, daughter, grandchild,

niece, nephew, eligible foster child, etc.)

6 Number of months child lived

with you in the United States

during 2022

• If the child lived with you for more than

half of 2022 but less than 7 months,

enter “7.”

• If the child was born or died in 2022 and

your home was the child’s home for more months months months

than half the time he or she was alive Do not enter more than 12 Do not enter more than 12 Do not enter more than 12

during 2022, enter “12.” months. months. months.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13339M Schedule EIC (Form 1040) 2022