Enlarge image

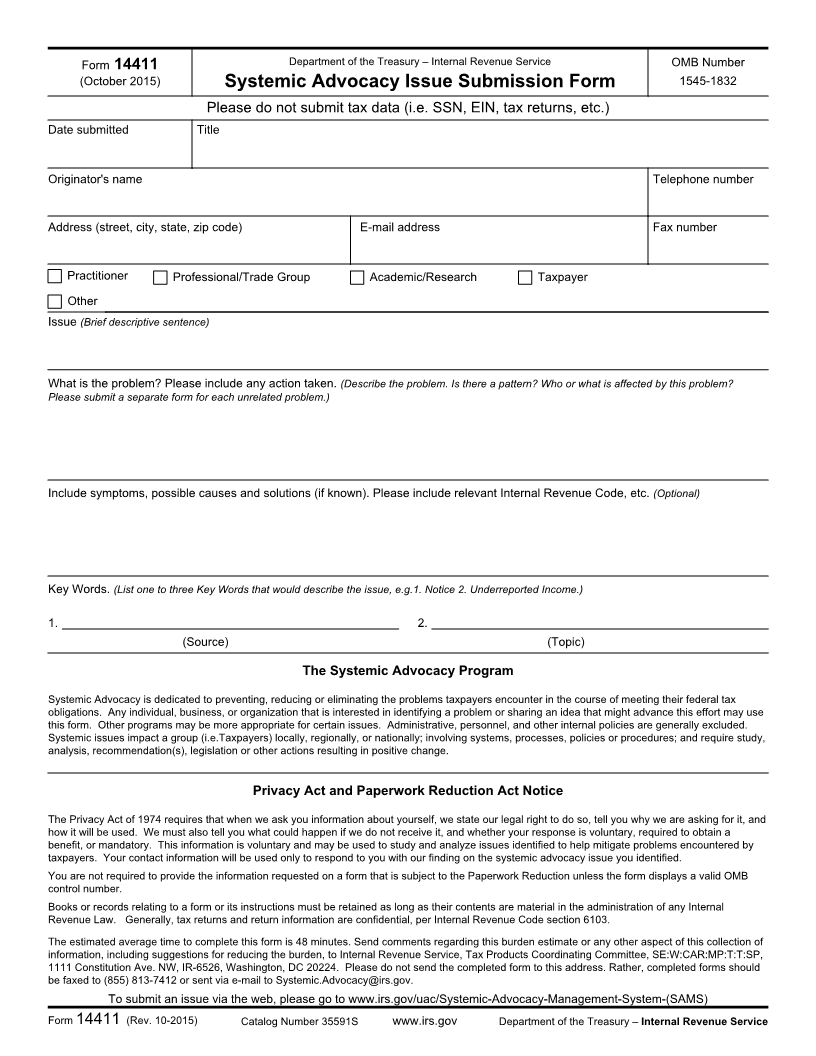

Form 14411 Department of the Treasury – Internal Revenue Service OMB Number

(October 2015) Systemic Advocacy Issue Submission Form 1545-1832

Please do not submit tax data (i.e. SSN, EIN, tax returns, etc.)

Date submitted Title

Originator's name Telephone number

Address (street, city, state, zip code) E-mail address Fax number

Practitioner Professional/Trade Group Academic/Research Taxpayer

Other

Issue (Brief descriptive sentence)

What is the problem? Please include any action taken. (Describe the problem. Is there a pattern? Who or what is affected by this problem?

Please submit a separate form for each unrelated problem.)

Include symptoms, possible causes and solutions (if known). Please include relevant Internal Revenue Code, etc. (Optional)

Key Words. (List one to three Key Words that would describe the issue, e.g.1. Notice 2. Underreported Income.)

1. 2.

(Source) (Topic)

The Systemic Advocacy Program

Systemic Advocacy is dedicated to preventing, reducing or eliminating the problems taxpayers encounter in the course of meeting their federal tax

obligations. Any individual, business, or organization that is interested in identifying a problem or sharing an idea that might advance this effort may use

this form. Other programs may be more appropriate for certain issues. Administrative, personnel, and other internal policies are generally excluded.

Systemic issues impact a group (i.e.Taxpayers) locally, regionally, or nationally; involving systems, processes, policies or procedures; and require study,

analysis, recommendation(s), legislation or other actions resulting in positive change.

Privacy Act and Paperwork Reduction Act Notice

The Privacy Act of 1974 requires that when we ask you information about yourself, we state our legal right to do so, tell you why we are asking for it, and

how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a

benefit, or mandatory. This information is voluntary and may be used to study and analyze issues identified to help mitigate problems encountered by

taxpayers. Your contact information will be used only to respond to you with our finding on the systemic advocacy issue you identified.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction unless the form displays a valid OMB

control number.

Books or records relating to a form or its instructions must be retained as long as their contents are material in the administration of any Internal

Revenue Law. Generally, tax returns and return information are confidential, per Internal Revenue Code section 6103.

The estimated average time to complete this form is 48 minutes. Send comments regarding this burden estimate or any other aspect of this collection of

information, including suggestions for reducing the burden, to Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP,

1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Please do not send the completed form to this address. Rather, completed forms should

be faxed to (855) 813-7412 or sent via e-mail to Systemic.Advocacy@irs.gov.

To submit an issue via the web, please go to www.irs.gov/uac/Systemic-Advocacy-Management-System-(SAMS)

Form 14411 (Rev. 10-2015) Catalog Number 35591S www.irs.gov Department of the Treasury – Internal Revenue Service