Enlarge image

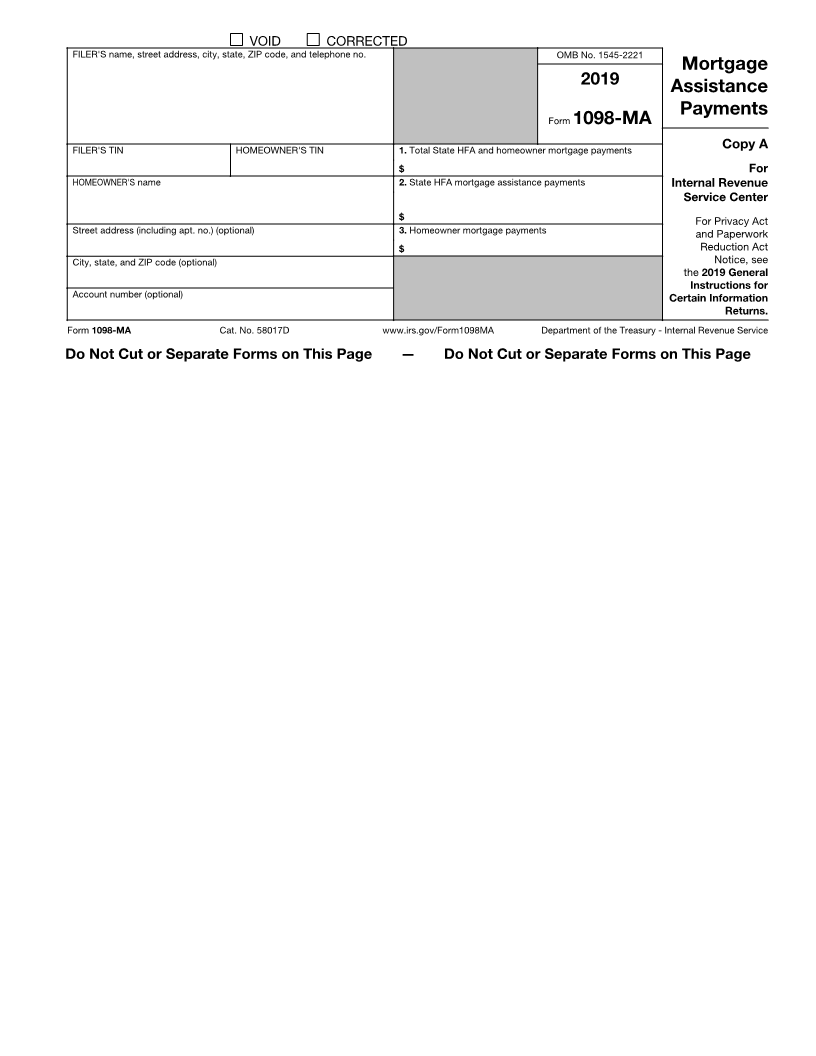

VOID CORRECTED

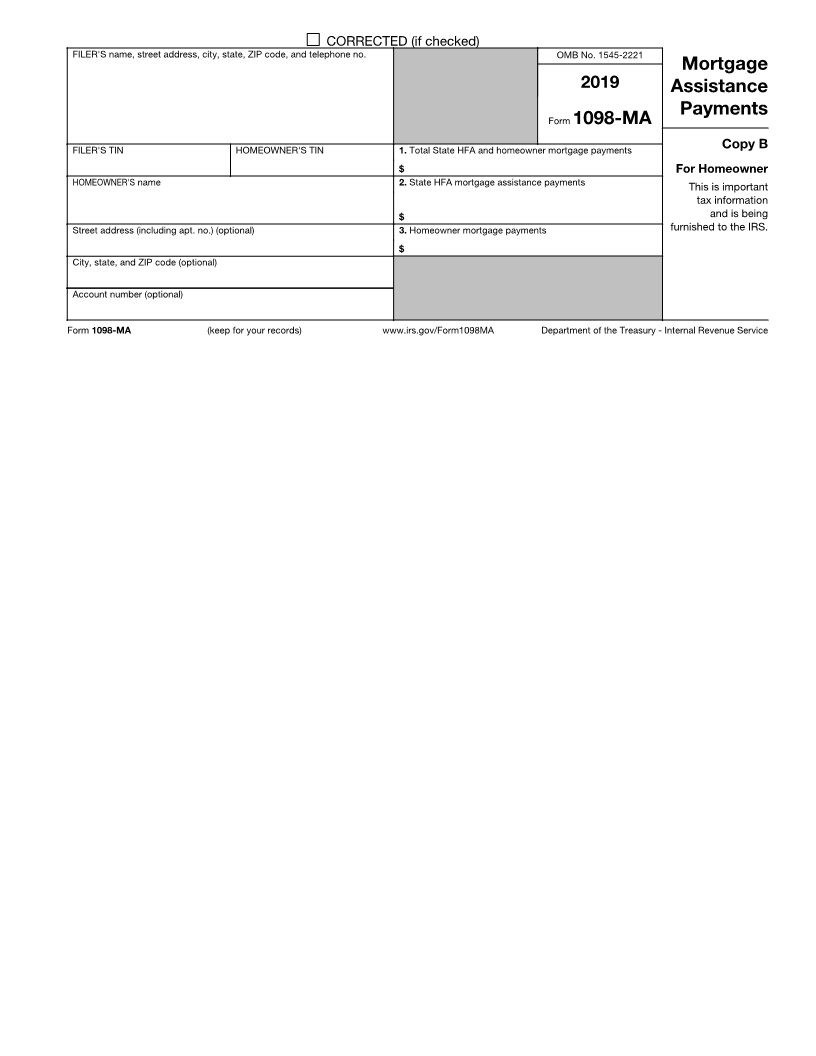

FILER'S name, street address, city, state, ZIP code, and telephone no. OMB No. 1545-2221

Mortgage

2019

Assistance

Payments

Form 1098-MA

FILER'S TIN HOMEOWNER'S TIN 1. Total State HFA and homeowner mortgage payments Copy A

$ For

HOMEOWNER'S name 2. State HFA mortgage assistance payments Internal Revenue

Service Center

$ For Privacy Act

Street address (including apt. no.) (optional) 3. Homeowner mortgage payments and Paperwork

$ Reduction Act

City, state, and ZIP code (optional) Notice, see

the 2019 General

Instructions for

Account number (optional) Certain Information

Returns.

Form 1098-MA Cat. No. 58017D www.irs.gov/Form1098MA Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page