Enlarge image

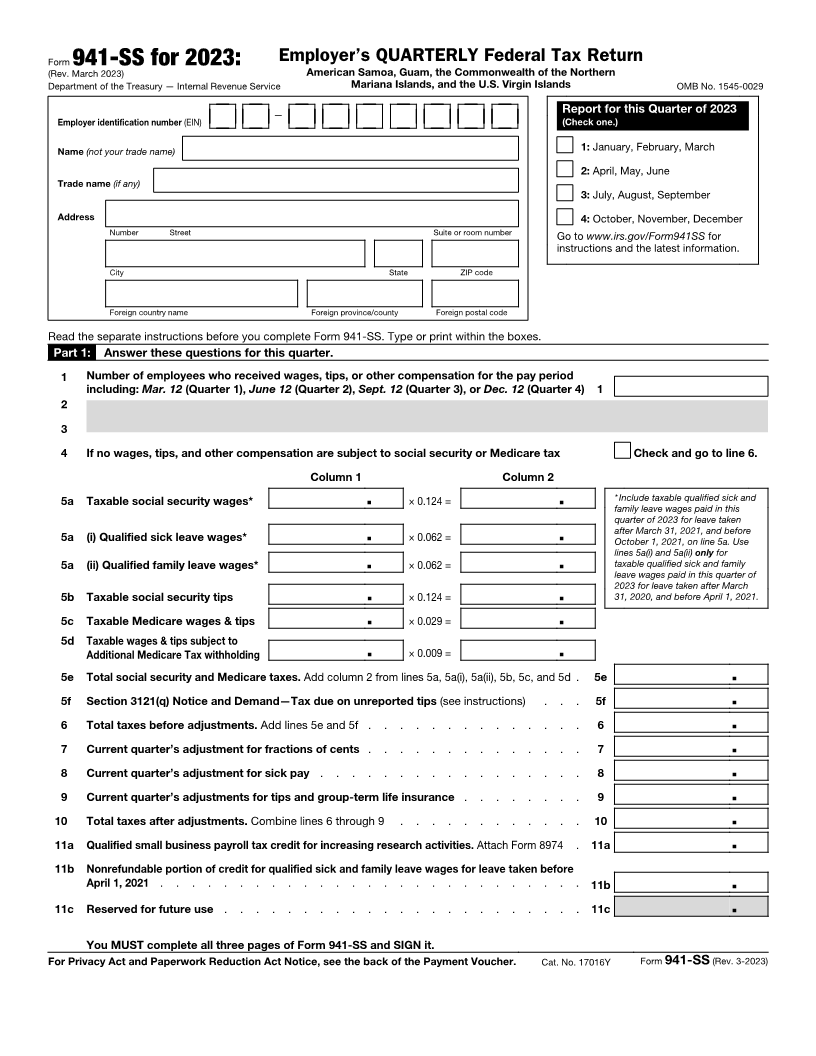

Form 941-SS for 2023: Employer’s QUARTERLY Federal Tax Return

(Rev. March 2023) American Samoa, Guam, the Commonwealth of the Northern

Department of the Treasury — Internal Revenue Service Mariana Islands, and the U.S. Virgin Islands OMB No. 1545-0029

— Report for this Quarter of 2023

Employer identification number (EIN) (Check one.)

Name (not your trade name) 1: January, February, March

2: April, May, June

Trade name (if any)

3: July, August, September

Address 4: October, November, December

Number Street Suite or room number Go to www.irs.gov/Form941SS for

instructions and the latest information.

City State ZIP code

Foreign country name Foreign province/county Foreign postal code

Read the separate instructions before you complete Form 941-SS. Type or print within the boxes.

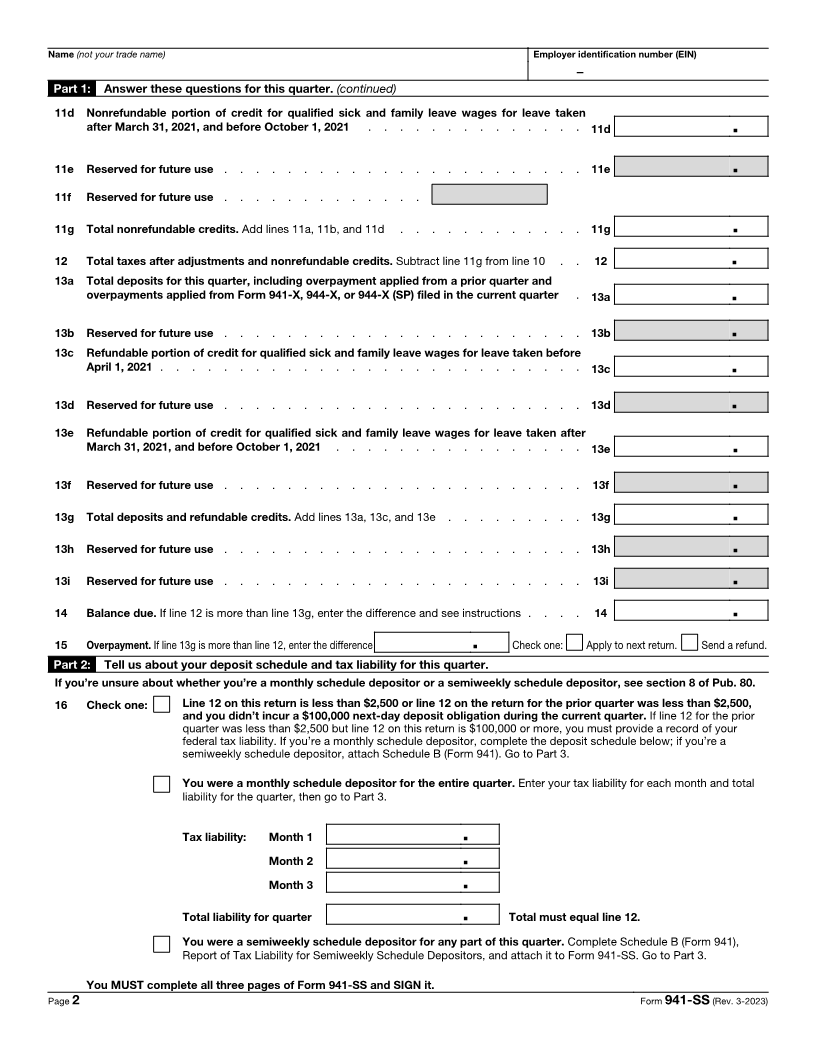

Part 1: Answer these questions for this quarter.

1 Number of employees who received wages, tips, or other compensation for the pay period

including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 1

2

3

4 If no wages, tips, and other compensation are subject to social security or Medicare tax Check and go to line 6.

Column 1 Column 2

5a Taxable social security wages* . × 0.124 = . *Include taxable qualified sick and

family leave wages paid in this

quarter of 2023 for leave taken

after March 31, 2021, and before

5a (i) Qualified sick leave wages* . × 0.062 = . October 1, 2021, on line 5a. Use

lines 5a(i) and 5a(ii) only for

5a (ii) Qualified family leave wages* . × 0.062 = . taxable qualified sick and family

leave wages paid in this quarter of

2023 for leave taken after March

5b Taxable social security tips . × 0.124 = . 31, 2020, and before April 1, 2021.

5c Taxable Medicare wages & tips . × 0.029 = .

5 d Taxable wages & tips subject to

Additional Medicare Tax withholding . × 0.009 = .

5e Total social security and Medicare taxes. Add column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d . 5e .

5f Section 3121(q) Notice and Demand—Tax due on unreported tips (see instructions) . . . 5f .

6 Total taxes before adjustments. Add lines 5e and 5f . . . . . . . . . . . . . . 6 .

7 Current quarter’s adjustment for fractions of cents . . . . . . . . . . . . . . 7 .

8 Current quarter’s adjustment for sick pay . . . . . . . . . . . . . . . . . 8 .

9 Current quarter’s adjustments for tips and group-term life insurance . . . . . . . . 9 .

10 Total taxes after adjustments. Combine lines 6 through 9 . . . . . . . . . . . . 10 .

11a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 . 11a .

11 b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before

April 1, 2021 . . . . . . . . . . . . . . . . . . . . . . . . . . . 11b .

11c Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 11c .

You MUST complete all three pages of Form 941-SS and SIGN it.

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 17016Y Form 941-SS (Rev. 3-2023)