Enlarge image

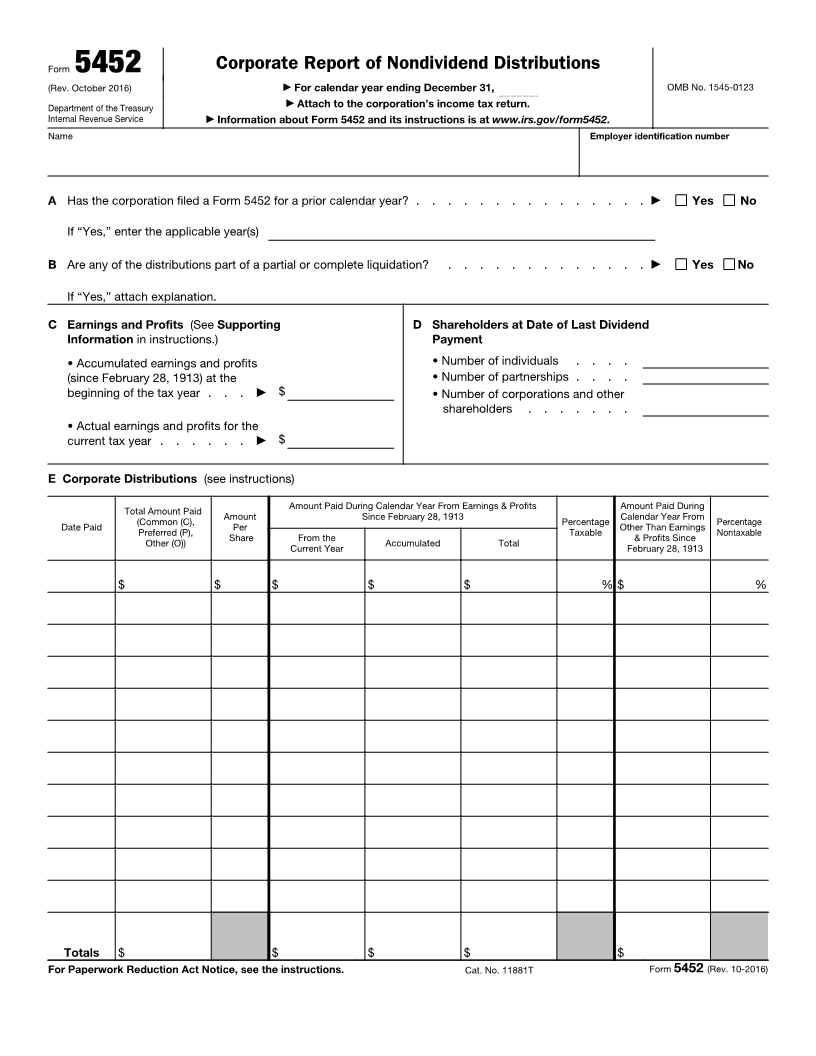

Form 5452 Corporate Report of Nondividend Distributions

(Rev. October 2016) ▶ For calendar year ending December 31, OMB No. 1545-0123

Department of the Treasury ▶ Attach to the corporation’s income tax return.

Internal Revenue Service ▶ Information about Form 5452 and its instructions is at www.irs.gov/form5452.

Name Employer identification number

A Has the corporation filed a Form 5452 for a prior calendar year? . . . . . . . . . . . . . . . ▶ Yes No

If “Yes,” enter the applicable year(s)

B Are any of the distributions part of a partial or complete liquidation? . . . . . . . . . . . . . ▶ Yes No

If “Yes,” attach explanation.

C Earnings and Profits (See Supporting D Shareholders at Date of Last Dividend

Information in instructions.) Payment

• Accumulated earnings and profits • Number of individuals . . . .

(since February 28, 1913) at the • Number of partnerships . . . .

beginning of the tax year . . . ▶ $ • Number of corporations and other

shareholders . . . . . . .

• Actual earnings and profits for the

current tax year . . . . . . ▶ $

E Corporate Distributions (see instructions)

Total Amount Paid Amount Paid During Calendar Year From Earnings & Profits Amount Paid During

Date Paid (Common (C), Amount Since February 28, 1913 Percentage Calendar Year From Percentage

Other (O)) Share & Profits Since

Preferred (P), Per From the Accumulated Total Taxable Other Than Earnings Nontaxable

Current Year February 28, 1913

$ $ $ $ $ % $ %

Totals $ $ $ $ $

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 11881T Form 5452 (Rev. 10-2016)