- 2 -

Enlarge image

|

Form 8905 (1-2012) Page 2

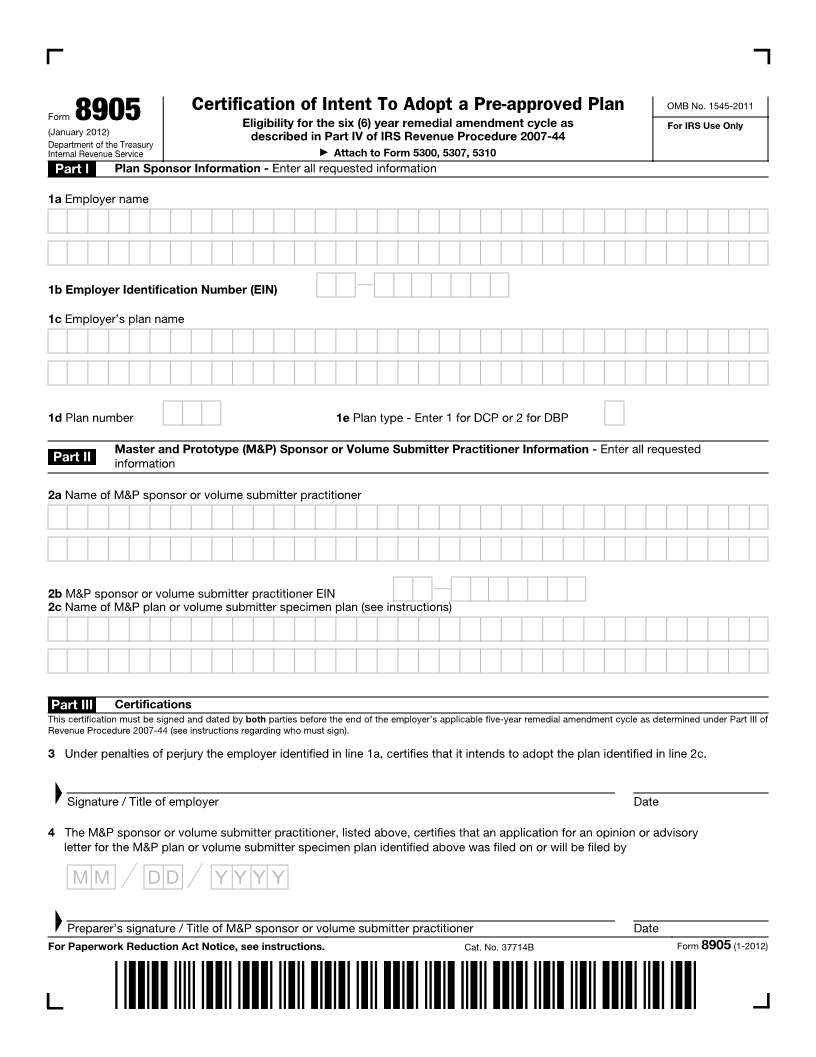

General Instructions Line 1b – Employer Identification Line 4. Enter the date by which the

Number (EIN). Enter the 9-digit EIN opinion or advisory letter application for

Purpose of Form assigned to the plan sponsor/employer. the M&P plan or volume submitter

Use Form 8905 to treat an employer as Do not use a social security specimen plan being adopted by the

employer was or must be submitted as

eligible for the 6-year remedial number or the EIN of the trust. determined under Part IV of Rev. Proc.

amendment cycle under Part IV of Rev. ▲! 2007-44.

CAUTION

Proc. 2007-44, 2007-28 I.R.B. 54.

Line 1c – Employer’s plan name. Enter

Who May File the name of the employer’s plan which Paperwork Reduction Act Notice. We

will be amended or restated by the ask for the information on this form to

An adopter of an individually designed adoption of a pre-approved plan. carry out the Internal Revenue laws of

plan or pre-approved plan (not otherwise

entitled to the 6-year remedial Line 1e – Plan Type. the United States. You are required to

give us the information. We need it to

amendment cycle) files this form when • Enter “1” for a defined contribution ensure that you are complying with these

necessary to request that their 5-year plan (DCP). laws and to allow us to figure and collect

remedial amendment cycle be converted

to the 6-year remedial amendment cycle • Enter “2” for a defined benefit plan the right amount of tax.

(as described under Parts III and IV of (DBP). You are not required to provide the

Rev. Proc. 2007-44). information requested on a form that is

Part II – M&P Sponsor or subject to the Paperwork Reduction Act

When To Complete Volume Submitter unless the form displays a valid OMB

Complete Form 8905 before the end of Practitioner control number. Books or records

relating to a form or its instructions must

the employer’s 5-year remedial Line 2a – Name of M&P sponsor or be retained as long as their contents

amendment cycle as determined under volume submitter practitioner. Enter may become material in the

Part III of Rev. Proc. 2007-44. the name of the M&P sponsor or volume administration of any Internal Revenue

submitter practitioner whose plan you law. Generally, tax returns and return

How To File will be adopting. information are confidential, as required

File the completed Form 8905 by Line 2b – M&P sponsor or volume by Internal Revenue Code section 6103.

attaching it to one of the following submitter practitioner EIN. Enter the 9- The time needed to complete and file

applications. digit EIN assigned to the M&P sponsor this form will vary depending on

• Form 5300, Application for or volume submitter practitioner. individual circumstances. The estimated

Determination for Employee Benefit Plan Line 2c – Name of the M&P plan or average time is:

• Form 5307, Application for volume submitter specimen plan. Recordkeeping . . . 3 hr., 21 mins.

Determination for Adopters of Master or Enter the name of the M&P plan or

Prototype or Volume Submitter Plans volume submitter specimen plan the Learning about the law

• Form 5310, Application for employer intends to adopt. or the form . . . . . . 12 mins.

Determination for Terminating Plan Example. Volume Submitter Profit Preparing, copying,

Sharing Plan. assembling, and sending

If no Form 5300, 5307, or 5310 the form to the IRS . . . 15 mins.

filing is made, the employer Part III – Certifications If you have comments concerning the

▲! should keep the original accuracy of these time estimates or

CAUTION certification in their records The employer and the M&P sponsor or

and should not file Form 8905 with the volume submitter practitioner must sign suggestions for making this form

IRS. and date this certification before the end simpler, we would be happy to hear from

of the employer’s applicable 5-year you. You can write to the Internal

Filing a Complete remedial amendment cycle as Revenue Service, Tax Products

determined under Part III, of Rev. Proc. Coordinating Committee,

Certification 2007-44. The employer must manually SE:W:CAR:MP:M:T:S, 1111 Constitution

Certifications are screened for sign the form. Scanned or stamped Ave., NW, IR-6526, Washington, DC

completeness. The certification must be signatures will not be accepted. The 20224. Do not send Form 8905 to this

signed and dated by the employer and M&P sponsor and the volume submitter address; instead, see the instructions for

the pre-approved plan sponsor or practitioner may use a stamped, the application with which this form is

practitioner. scanned, or electronic signature. filed.

You must retain a complete

certification until it is filed with

▲! the appropriate application.

CAUTION

Specific Instructions

Part I – Plan Sponsor

Information

Line 1a – Employer name. Enter the

company (employer’s) complete name.

|