Enlarge image

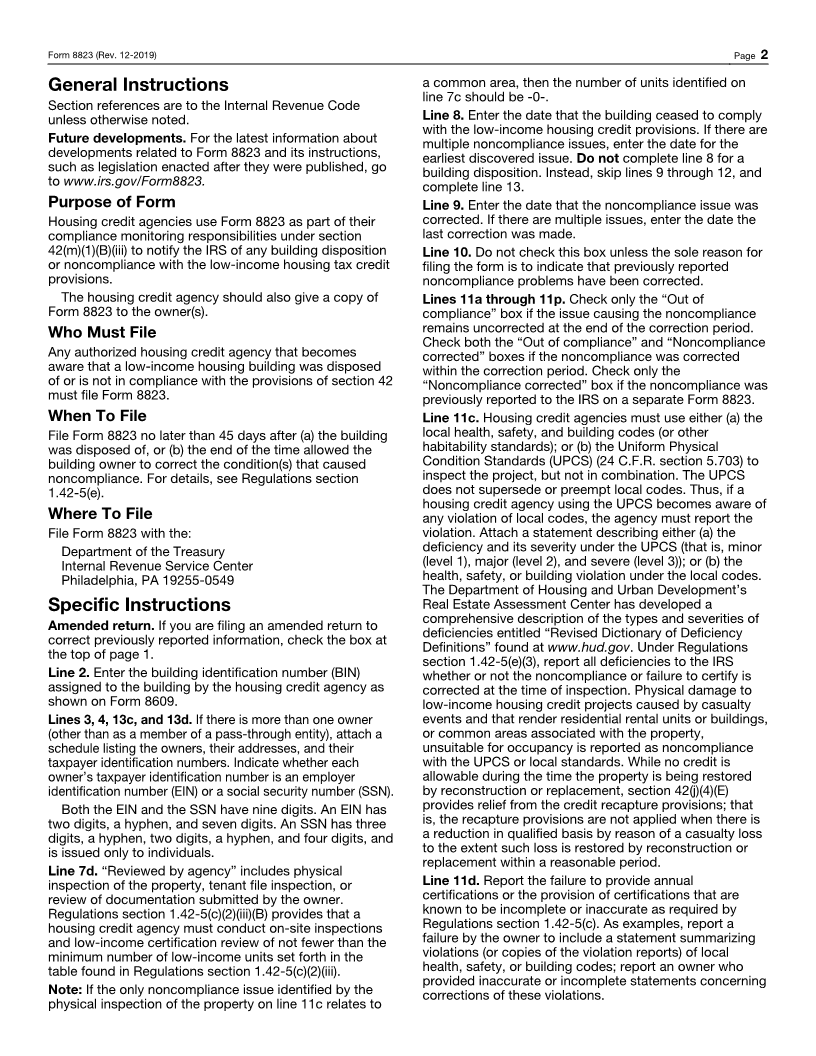

OMB No. 1545-1204

Low-Income Housing Credit Agencies

(Rev. December 2019)

Form 8823 Report of Noncompliance or Building Disposition Check here if this is an

Department of the Treasury ▶ File a separate Form 8823 for each building that is disposed of or goes out of compliance. amended return ▶

Internal Revenue Service ▶ Go to www.irs.gov/Form8823 for the latest information.

1 Building name (if any). Check if line 1 differs from Form 8609 ▶ IRS Use Only

Street address

City or town, state, and ZIP code

2 Building identification number (BIN)

3 Owner’s name. Check if line 3 differs from Form 8609 . . ▶

Street address

City or town, state, and ZIP code

4 Owner’s taxpayer identification number

EIN SSN

5 Total credit allocated to this BIN . . . . . . . . . . . . . . . . . . . . . . . . ▶ $

6 If this building is part of a multiple building project, enter the number of buildings in the project . . . . . . . . . ▶

7 a Total number of residential units in this building . . . . . . . . . . . . . . . . . . . . . . . ▶

b Total number of low-income units in this building . . . . . . . . . . . . . . . . . . . . . . ▶

c Total number of residential units in this building determined to have noncompliance issues (see instructions) . . . . . ▶

d Total number of units reviewed by agency (see instructions) . . . . . . . . . . . . . . . . . . . ▶

8 Date building ceased to comply with the low-income housing credit provisions (see instructions) (MMDDYYYY) . .

9 Date noncompliance corrected (if applicable) (see instructions) (MMDDYYYY) . . . . . . . . . . . .

10 Check this box if you are filing only to show correction of a previously reported noncompliance problem . . ▶

Out of Noncompliance

11 Check the box(es) that applies: compliance corrected

a Household income above income limit upon initial occupancy . . . . . . . . . . . . . . . . .

b Owner failed to correctly complete or document tenant’s annual income recertification . . . . . . . . .

c Violation(s) of the UPCS or local inspection standards including casualty losses (see instructions) (attach explanation)

d Owner failed to provide annual certifications or provided incomplete or inaccurate certifications . . . . . . .

e Changes in Eligible Basis or the Applicable Percentage (see instructions) . . . . . . . . . . . . .

f Project failed to meet minimum set-aside requirement (20/50, 40/60, average income test) (see instructions) . . .

g Gross rent(s) exceeds limits . . . . . . . . . . . . . . . . . . . . . . . . . . .

h Project not available to the general public (see instructions) (attach explanation) . . . . . . . . . . .

i Violation(s) of the Available Unit Rule under section 42(g)(2)(D)(ii) . . . . . . . . . . . . . . . .

j Violation(s) of the Vacant Unit Rule under Reg. 1.42-5(c)(1)(ix) . . . . . . . . . . . . . . . . .

k Owner failed to execute and record extended-use agreement within time prescribed by section 42(h)(6)(J) . . . .

l Low-income units occupied by nonqualified full-time students . . . . . . . . . . . . . . . . .

m Owner did not properly calculate utility allowance . . . . . . . . . . . . . . . . . . . .

n Owner has failed to respond to agency requests for monitoring reviews . . . . . . . . . . . . . .

o Low-income units used on a transient basis (attach explanation) . . . . . . . . . . . . . . . .

p Building is no longer in compliance nor participating in the section 42 program. (Attach explanation.) . . . . .

q Other noncompliance issues (attach explanation) . . . . . . . . . . . . . . . . . . . .

12 Additional information for any line above. Attach explanation and check box . . . . . . . . . . ▶

13 a Building disposition by Sale Foreclosure Destruction Other (attach explanation)

b Date of disposition (MMDDYYYY) . . . . . . . . . . . . . . . . . . . . . . . . .

c New owner’s name d New owner’s taxpayer identification number

EIN SSN

Street address 14 Name of contact person

City or town, state, and ZIP code 15 Telephone number of contact person

Ext.

Under penalties of perjury, I declare that I have examined this report, including accompanying statements and schedules, and, to the best of my knowledge and belief, it is

true, correct, and complete.

▲ ▲ ▲

Signature of authorizing official Print name and title Date (MMDDYYYY)

For Paperwork Reduction Act Notice, see instructions. Cat. No. 12308D Form 8823 (Rev. 12-2019)