- 6 -

Enlarge image

|

Form 5316 (6-2011) Page 4

What’s New • United Parcel Service (UPS): UPS Next Day Air, UPS Next Day Air

Saver, UPS 2nd Day Air, UPS 2nd Day Air A.M., UPS Worldwide

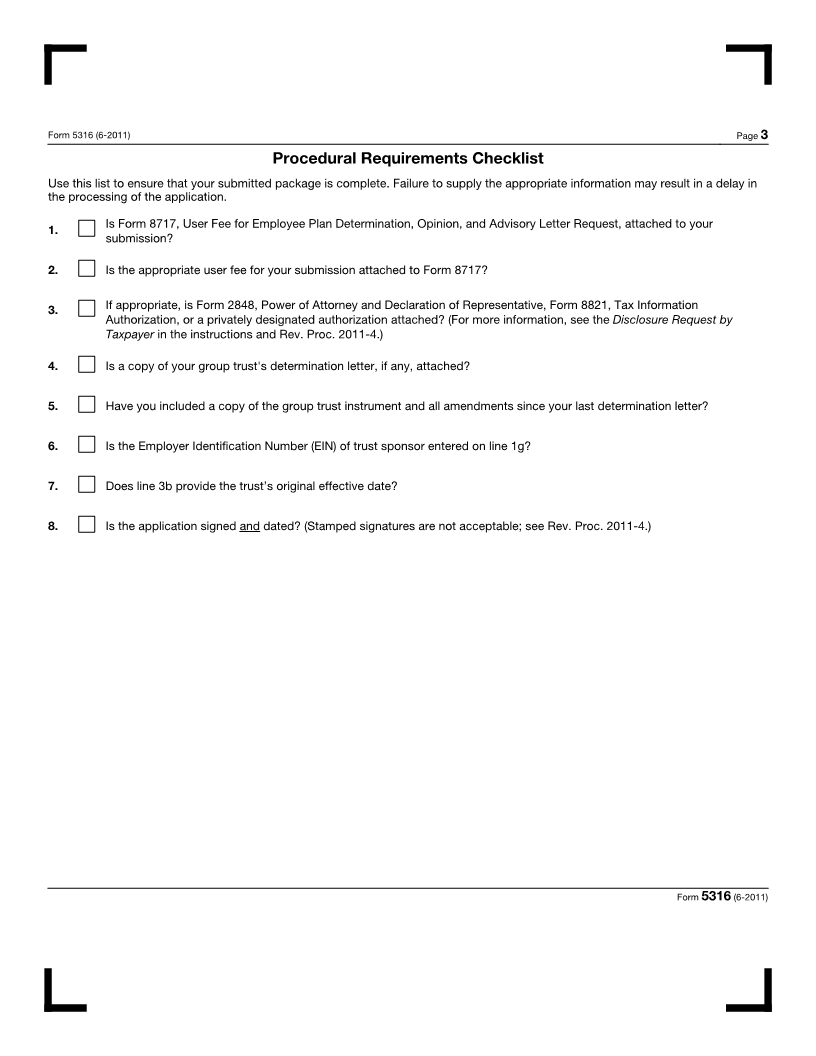

This is a new form. Prior to this form, a letter was submitted in lieu Express Plus, and UPS Worldwide Express.

of a form. Review the Procedural Requirements Checklist and these

instructions before completing the application. The private delivery service can tell you how to get written proof

of the mailing date.

Public inspection. The group trust is open to public inspection.

Disclosure request by taxpayer. The Tax Reform Act of 1976 How To Complete the Application

permits a taxpayer to request the IRS to disclose and discussthe Applications are screened for completeness. The application must

taxpayer’s return and/or return information with any person(s)the be signed by the employer or plan administrator.

taxpayer designates in a written request. Use Form 2848,Power of

Attorney and Declaration of Representative, if therepresentative is Stamped signatures are not acceptable; see Rev. Proc.

qualified to sign, or Form 8821, Tax InformationAuthorization, for 2011-4, 2011-1 I.R.B. 123, available at

this purpose. See Pub. 947, Practice Beforethe IRS and Power of ▲! www.irs.gov/irb/2011-01_IRB/ar09.html.

Attorney, for more information. CAUTION

Incomplete applications may be returned to the applicant. For this

reason, it is important that an appropriate response be entered for

General Instructions each line item (unless instructed otherwise). In completing the

Section references are to the Internal Revenue Code unless application, pay careful attention to the following:

otherwise noted. • N/A (not applicable) is accepted as a response only if an N/A

block is provided.

Purpose of Form • If a number is requested, a number must be entered.

Group/pooled trust sponsors file this form to request a • If an item provides a choice of boxes to check, check only one

determination letter from the IRS for a determination that the trust is box unless instructed otherwise.

a group trust arrangement as described in Rev. Rul. 81-100, 1981-1

C.B. 326, as clarified and modified by Rev. Rul. 2004-67, 2004-2 • If an item provides a box to check, written responses are not

C.B. 28, and as modified by Rev. Rul. 2011-1, 2011-2 I.R.B. 251, acceptable.

available at www.irs.gov/irb/2011-02_IRB/ar08.html. • The IRS may, at its discretion, require a plan restatement or

additional information any time it is deemed necessary.

Type of Trust • The application has formatted fields that will limit the number of

A group/pooled trust is a trust that meets the qualification characters entered per field.

requirements of Rev. Rul. 81-100 as modified and clarified by Rev. • All data input will need to be entered in Courier 10 point font.

Rul. 2004-67 and as modified by Rev. Rul. 2011-1.

• Alpha characters should be entered in all capital letters.

Who May File • Enter spaces between any words. Spaces do count as characters.

This form should be filed by the sponsor of a group/pooled trust. • All date fields are entered as an 8-digit field (MMDDYYYY).

Where To File The IRS annually updates the revenue procedure which sets forth

the procedures for issuing determination letters to qualified plans,

File Form 5316 at the address indicated below: including determination letters for group trusts. The annual revenue

Internal Revenue Service procedure may be found in the Internal Revenue Bulletin. For

P.O. Box 12192 example, the revenue procedure for 2011 is Rev. Proc. 2011-6,

Covington, KY 41012-0192 2011-1 I.R.B. 123, available at www.irs.gov/irb/2011-01_IRB/

ar11.html.

Requests shipped by express mail or a delivery service should be

sent to: What To File

Internal Revenue Service 1. A check for the appropriate user fee and Form 8717, User Feefor

201 West Rivercenter Blvd. Employee Plan Determination, Opinion, and Advisory Letter

Attn: Extracting Stop 312 Request. Attach a check or money order payable to the “United

Covington, KY 41011 States Treasury” for the full amount of the user fee.

Private delivery services. In addition to the U.S. mail,you can use 2. A completed Form 5316.

certain private delivery services designated by theIRS to meet the

“timely mailing as timely filing/paying” rule fortax returns and 3. A copy of the trust’s latest determination letter.

payments. The list of designated private deliveryservices includes 4. The trust instrument and related documents.

only the following:

• DHL Express (DHL): DHL Same Day Service.

• Federal Express (FedEx): FedEx Priority Overnight, FedEx

Standard Overnight, FedEx 2Day, FedEx International Priority, and

FedEx International First.

Form 5316 (6-2011)

|