Enlarge image

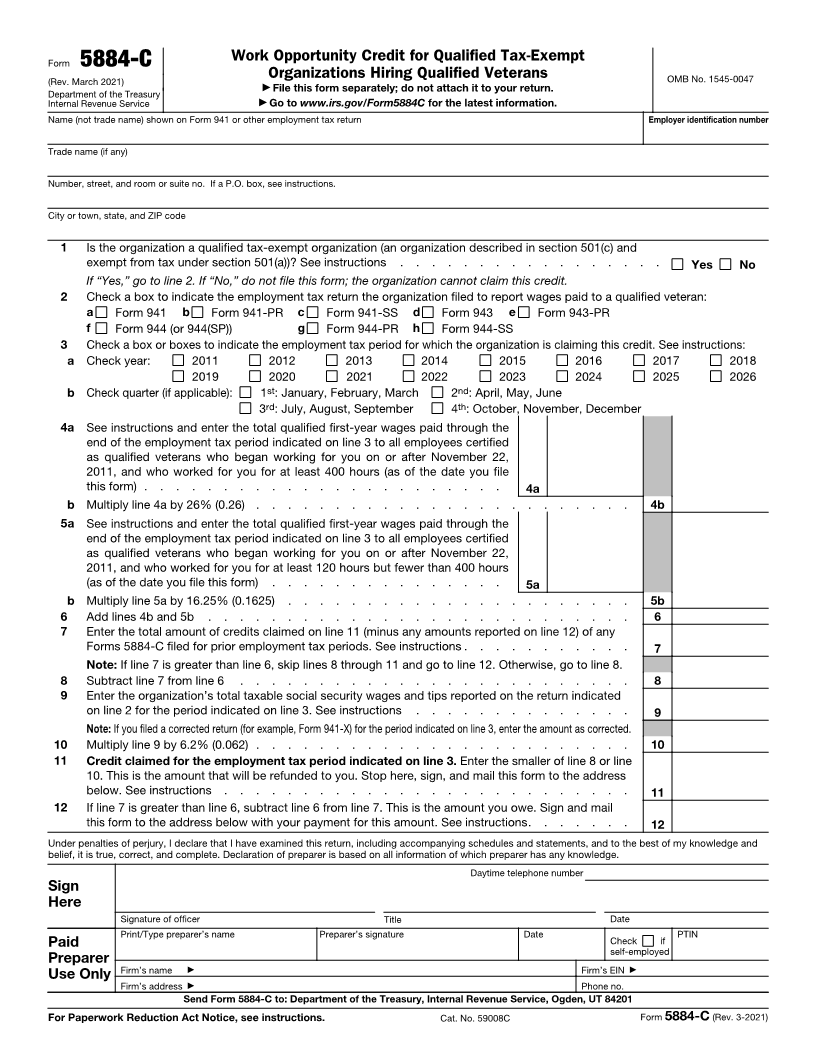

Work Opportunity Credit for Qualified Tax-Exempt

Form 5884-C

(Rev. March 2021) Organizations Hiring Qualified Veterans OMB No. 1545-0047

▶

Department of the Treasury File this form separately; do not attach it to your return.

Internal Revenue Service ▶ Go to www.irs.gov/Form5884C for the latest information.

Name (not trade name) shown on Form 941 or other employment tax return Employer identification number

Trade name (if any)

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

1 Is the organization a qualified tax-exempt organization (an organization described in section 501(c) and

exempt from tax under section 501(a))? See instructions . . . . . . . . . . . . . . . . . Yes No

If “Yes,” go to line 2. If “No,” do not file this form; the organization cannot claim this credit.

2 Check a box to indicate the employment tax return the organization filed to report wages paid to a qualified veteran:

a Form 941 b Form 941-PR c Form 941-SS d Form 943 e Form 943-PR

f Form 944 (or 944(SP)) g Form 944-PR h Form 944-SS

3 Check a box or boxes to indicate the employment tax period for which the organization is claiming this credit. See instructions:

a Check year: 2011 2012 2013 2014 2015 2016 2017 2018

2019 2020 2021 2022 2023 2024 2025 2026

b Check quarter (if applicable): 1st: January, February, March 2nd: April, May, June

3rd: July, August, September 4th: October, November, December

4a See instructions and enter the total qualified first-year wages paid through the

end of the employment tax period indicated on line 3 to all employees certified

as qualified veterans who began working for you on or after November 22,

2011, and who worked for you for at least 400 hours (as of the date you file

this form) . . . . . . . . . . . . . . . . . . . . . . . 4a

b Multiply line 4a by 26% (0.26) . . . . . . . . . . . . . . . . . . . . . . . . 4b

5a See instructions and enter the total qualified first-year wages paid through the

end of the employment tax period indicated on line 3 to all employees certified

as qualified veterans who began working for you on or after November 22,

2011, and who worked for you for at least 120 hours but fewer than 400 hours

(as of the date you file this form) . . . . . . . . . . . . . . . 5a

b Multiply line 5a by 16.25% (0.1625) . . . . . . . . . . . . . . . . . . . . . . 5b

6 Add lines 4b and 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Enter the total amount of credits claimed on line 11 (minus any amounts reported on line 12) of any

Forms 5884-C filed for prior employment tax periods. See instructions . . . . . . . . . . . 7

Note: If line 7 is greater than line 6, skip lines 8 through 11 and go to line 12. Otherwise, go to line 8.

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the organization’s total taxable social security wages and tips reported on the return indicated

on line 2 for the period indicated on line 3. See instructions . . . . . . . . . . . . . . 9

Note: If you filed a corrected return (for example, Form 941-X) for the period indicated on line 3, enter the amount as corrected.

10 Multiply line 9 by 6.2% (0.062) . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Credit claimed for the employment tax period indicated on line 3. Enter the smaller of line 8 or line

10. This is the amount that will be refunded to you. Stop here, sign, and mail this form to the address

below. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 If line 7 is greater than line 6, subtract line 6 from line 7. This is the amount you owe. Sign and mail

this form to the address below with your payment for this amount. See instructions. . . . . . . 12

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

Daytime telephone number

Sign

Here

Signature of officer Title Date

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no.

Send Form 5884-C to: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201

For Paperwork Reduction Act Notice, see instructions. Cat. No. 59008C Form 5884-C (Rev. 3-2021)