Enlarge image

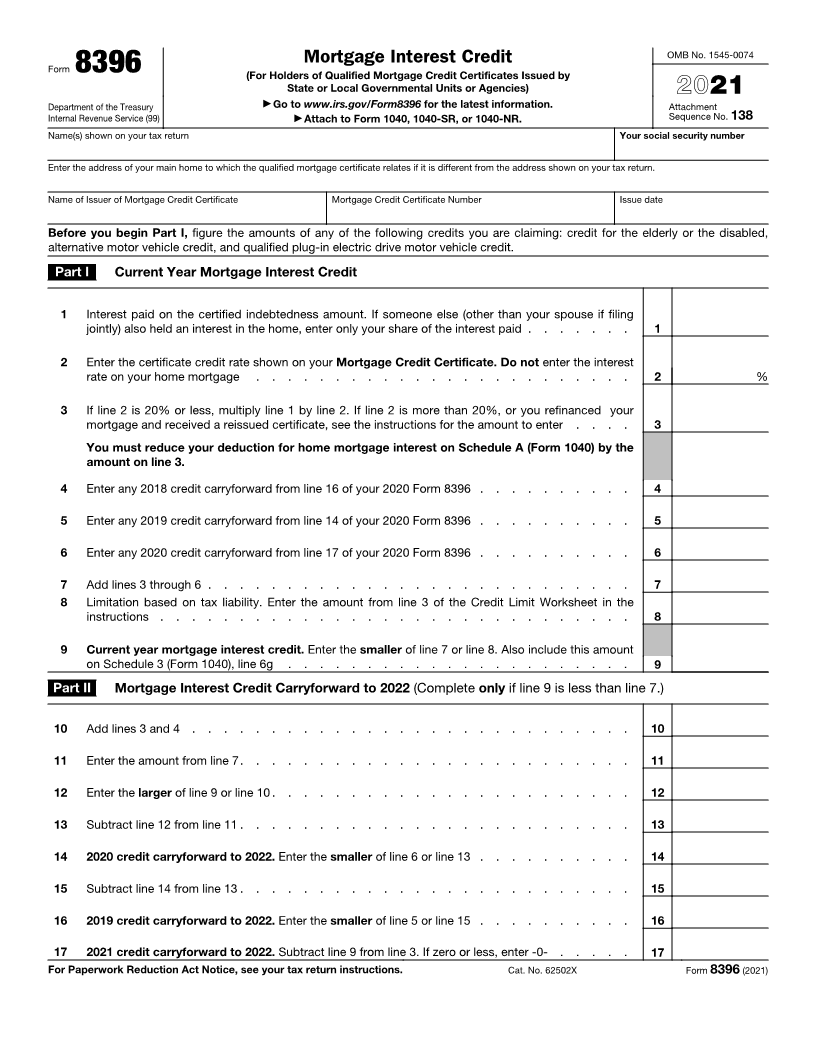

OMB No. 1545-0074

Mortgage Interest Credit

Form 8396 (For Holders of Qualified Mortgage Credit Certificates Issued by

State or Local Governmental Units or Agencies) 2021

Department of the Treasury ▶ Go to www.irs.gov/Form8396 for the latest information. Attachment

Internal Revenue Service (99) ▶ Attach to Form 1040, 1040-SR, or 1040-NR. Sequence No. 138

Name(s) shown on your tax return Your social security number

Enter the address of your main home to which the qualified mortgage certificate relates if it is different from the address shown on your tax return.

Name of Issuer of Mortgage Credit Certificate Mortgage Credit Certificate Number Issue date

Before you begin Part I, figure the amounts of any of the following credits you are claiming: credit for the elderly or the disabled,

alternative motor vehicle credit, and qualified plug-in electric drive motor vehicle credit.

Part I Current Year Mortgage Interest Credit

1 Interest paid on the certified indebtedness amount. If someone else (other than your spouse if filing

jointly) also held an interest in the home, enter only your share of the interest paid . . . . . . . 1

2 Enter the certificate credit rate shown on your Mortgage Credit Certificate. Do not enter the interest

rate on your home mortgage . . . . . . . . . . . . . . . . . . . . . . . . 2 %

3 If line 2 is 20% or less, multiply line 1 by line 2. If line 2 is more than 20%, or you refinanced your

mortgage and received a reissued certificate, see the instructions for the amount to enter . . . . 3

You must reduce your deduction for home mortgage interest on Schedule A (Form 1040) by the

amount on line 3.

4 Enter any 2018 credit carryforward from line 16 of your 2020 Form 8396 . . . . . . . . . . 4

5 Enter any 2019 credit carryforward from line 14 of your 2020 Form 8396 . . . . . . . . . . 5

6 Enter any 2020 credit carryforward from line 17 of your 2020 Form 8396 . . . . . . . . . . 6

7 Add lines 3 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Limitation based on tax liability. Enter the amount from line 3 of the Credit Limit Worksheet in the

instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Current year mortgage interest credit. Enter the smaller of line 7 or line 8. Also include this amount

on Schedule 3 (Form 1040), line 6g . . . . . . . . . . . . . . . . . . . . . . 9

Part II Mortgage Interest Credit Carryforward to 2022 (Complete only if line 9 is less than line 7.)

10 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Enter the amount from line 7. . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Enter the larger of line 9 or line 10 . . . . . . . . . . . . . . . . . . . . . . . 12

13 Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 2020 credit carryforward to 2022. Enter the smaller of line 6 or line 13 . . . . . . . . . . 14

15 Subtract line 14 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 2019 credit carryforward to 2022. Enter the smaller of line 5 or line 15 . . . . . . . . . . 16

17 2021 credit carryforward to 2022. Subtract line 9 from line 3. If zero or less, enter -0- . . . . . 17

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 62502X Form 8396 (2021)