Enlarge image

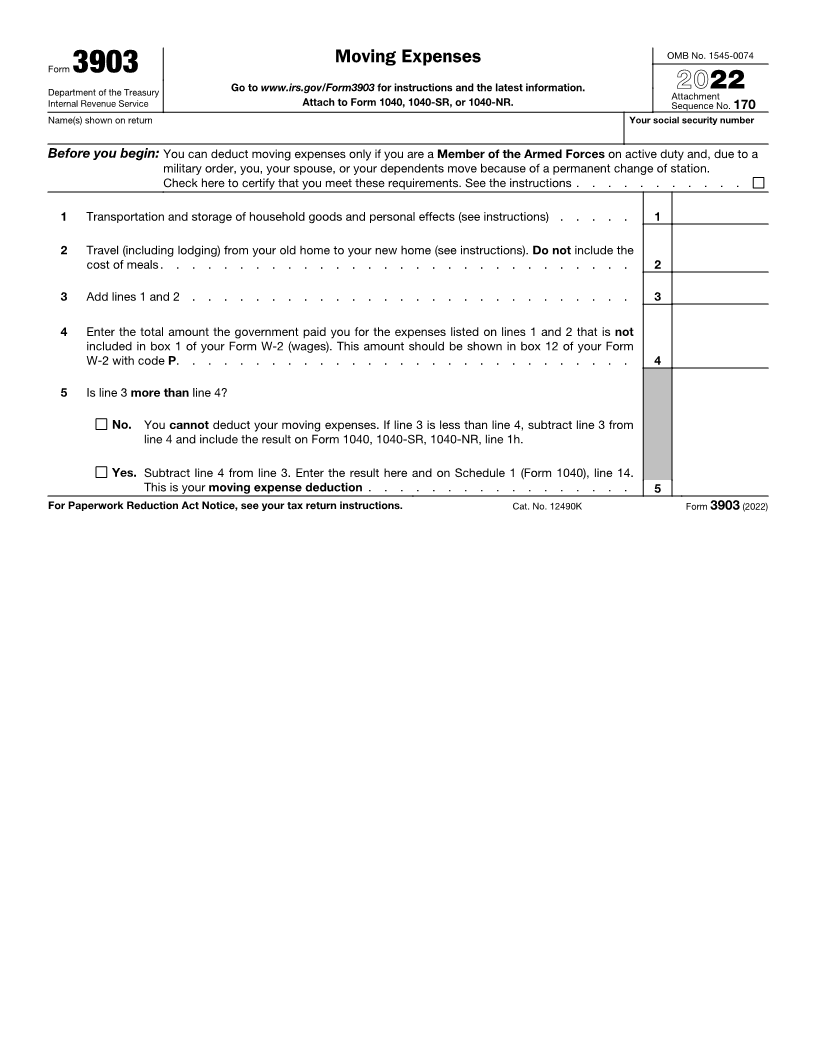

Moving Expenses OMB No. 1545-0074

Form 3903

Department of the Treasury Go to www.irs.gov/Form3903 for instructions and the latest information. 2022

Attachment

Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. Sequence No. 170

Name(s) shown on return Your social security number

Before you begin: You can deduct moving expenses only if you are a Member of the Armed Forces on active duty and, due to a

military order, you, your spouse, or your dependents move because of a permanent change of station.

Check here to certify that you meet these requirements. See the instructions . . . . . . . . . . .

1 Transportation and storage of household goods and personal effects (see instructions) . . . . . 1

2 Travel (including lodging) from your old home to your new home (see instructions). Do not include the

cost of meals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter the total amount the government paid you for the expenses listed on lines 1 and 2 that is not

included in box 1 of your Form W-2 (wages). This amount should be shown in box 12 of your Form

W-2 with code .P . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Is line 3 more than line 4?

No. You cannot deduct your moving expenses. If line 3 is less than line 4, subtract line 3 from

line 4 and include the result on Form 1040, 1040-SR, 1040-NR, line 1h.

Yes. Subtract line 4 from line 3. Enter the result here and on Schedule 1 (Form 1040), line 14.

This is your moving expense deduction . . . . . . . . . . . . . . . . . 5

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 12490K Form 3903 (2022)