Enlarge image

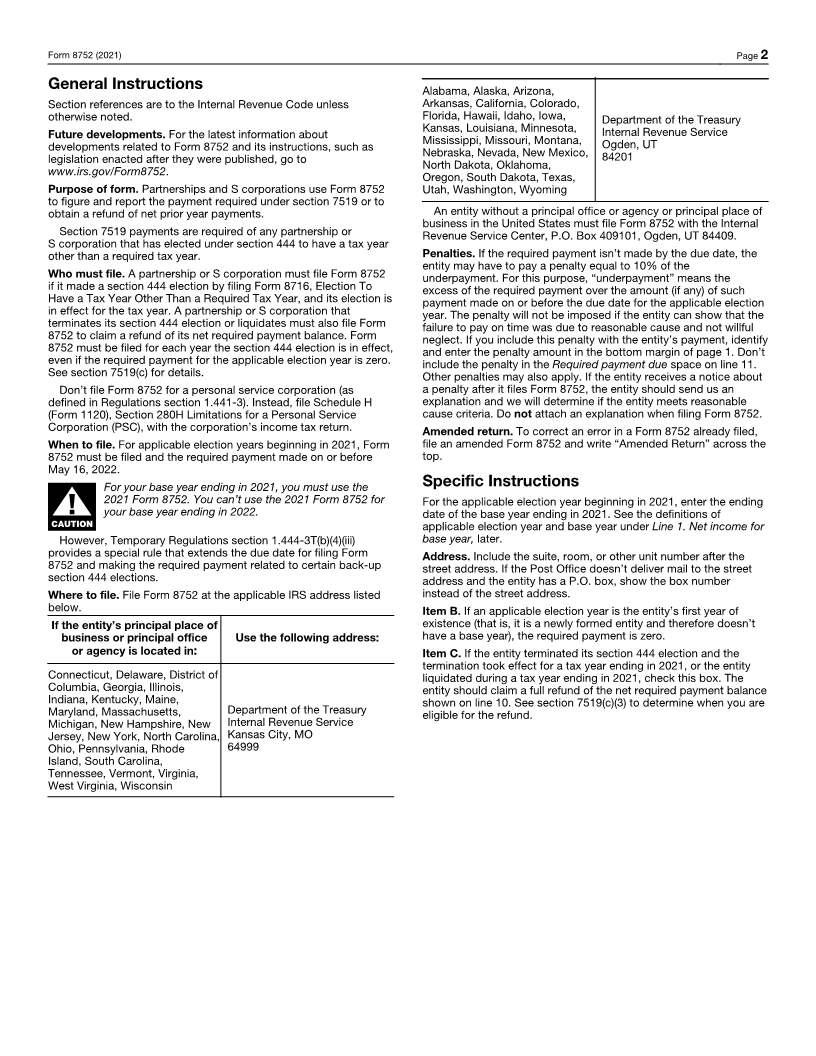

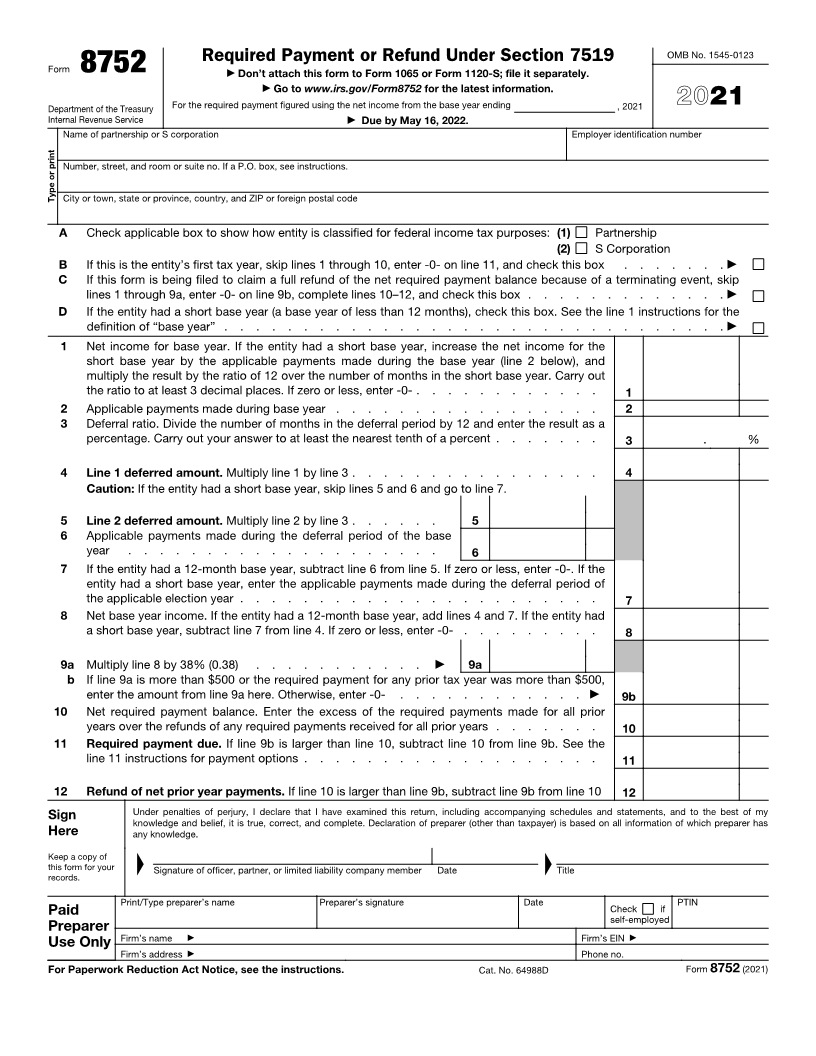

Required Payment or Refund Under Section 7519 OMB No. 1545-0123

Form 8752 ▶ Don’t attach this form to Form 1065 or Form 1120-S; file it separately.

▶ Go to www.irs.gov/Form8752 for the latest information.

Department of the Treasury For the required payment figured using the net income from the base year ending , 2021 2021

Internal Revenue Service ▶ Due by May 16, 2022.

Name of partnership or S corporation Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.

Type or print City or town, state or province, country, and ZIP or foreign postal code

A Check applicable box to show how entity is classified for federal income tax purposes: (1) Partnership

(2) S Corporation

B If this is the entity’s first tax year, skip lines 1 through 10, enter -0- on line 11, and check this box . . . . . . . ▶

C If this form is being filed to claim a full refund of the net required payment balance because of a terminating event, skip

lines 1 through 9a, enter -0- on line 9b, complete lines 10–12, and check this box . . . . . . . . . . . . . ▶

D If the entity had a short base year (a base year of less than 12 months), check this box. See the line 1 instructions for the

definition of “base year” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

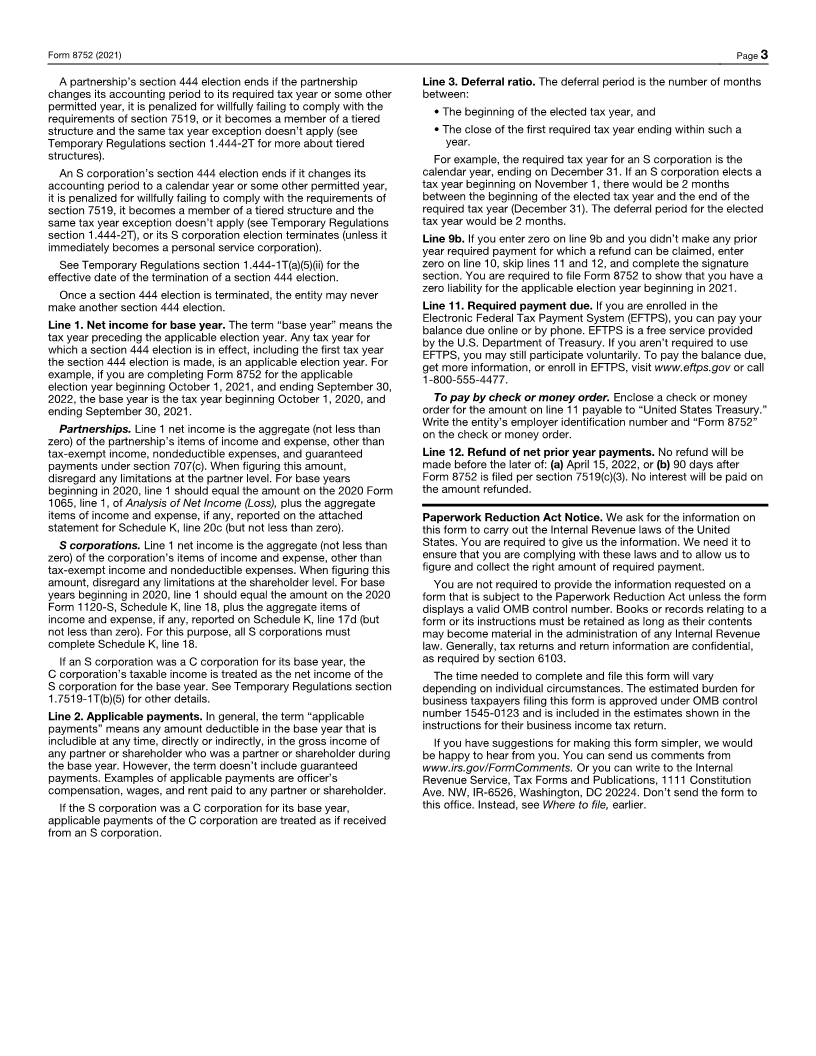

1 Net income for base year. If the entity had a short base year, increase the net income for the

short base year by the applicable payments made during the base year (line 2 below), and

multiply the result by the ratio of 12 over the number of months in the short base year. Carry out

the ratio to at least 3 decimal places. If zero or less, enter -0- . . . . . . . . . . . . 1

2 Applicable payments made during base year . . . . . . . . . . . . . . . . . 2

3 Deferral ratio. Divide the number of months in the deferral period by 12 and enter the result as a

percentage. Carry out your answer to at least the nearest tenth of a percent . . . . . . . 3 . %

4 Line 1 deferred amount. Multiply line 1 by line 3 . . . . . . . . . . . . . . . . 4

Caution: If the entity had a short base year, skip lines 5 and 6 and go to line 7.

5 Line 2 deferred amount. Multiply line 2 by line 3 . . . . . . 5

6 Applicable payments made during the deferral period of the base

year . . . . . . . . . . . . . . . . . . . . 6

7 If the entity had a 12-month base year, subtract line 6 from line 5. If zero or less, enter -0-. If the

entity had a short base year, enter the applicable payments made during the deferral period of

the applicable election year . . . . . . . . . . . . . . . . . . . . . . . 7

8 Net base year income. If the entity had a 12-month base year, add lines 4 and 7. If the entity had

a short base year, subtract line 7 from line 4. If zero or less, enter -0- . . . . . . . . . 8

9a Multiply line 8 by 38% (0.38) . . . . . . . . . . . ▶ 9a

b If line 9a is more than $500 or the required payment for any prior tax year was more than $500,

enter the amount from line 9a here. Otherwise, enter -0- . . . . . . . . . . . . ▶ 9b

10 Net required payment balance. Enter the excess of the required payments made for all prior

years over the refunds of any required payments received for all prior years . . . . . . . 10

11 Required payment due. If line 9b is larger than line 10, subtract line 10 from line 9b. See the

line 11 instructions for payment options . . . . . . . . . . . . . . . . . . . 11

12 Refund of net prior year payments. If line 10 is larger than line 9b, subtract line 9b from line 10 12

Sign Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has

Here any knowledge.

▲ ▲

Keep a copy of

this form for your Signature of officer, partner, or limited liability company member Date Title

records.

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no.

For Paperwork Reduction Act Notice, see the instructions. Cat. No. 64988D Form 8752 (2021)