Enlarge image

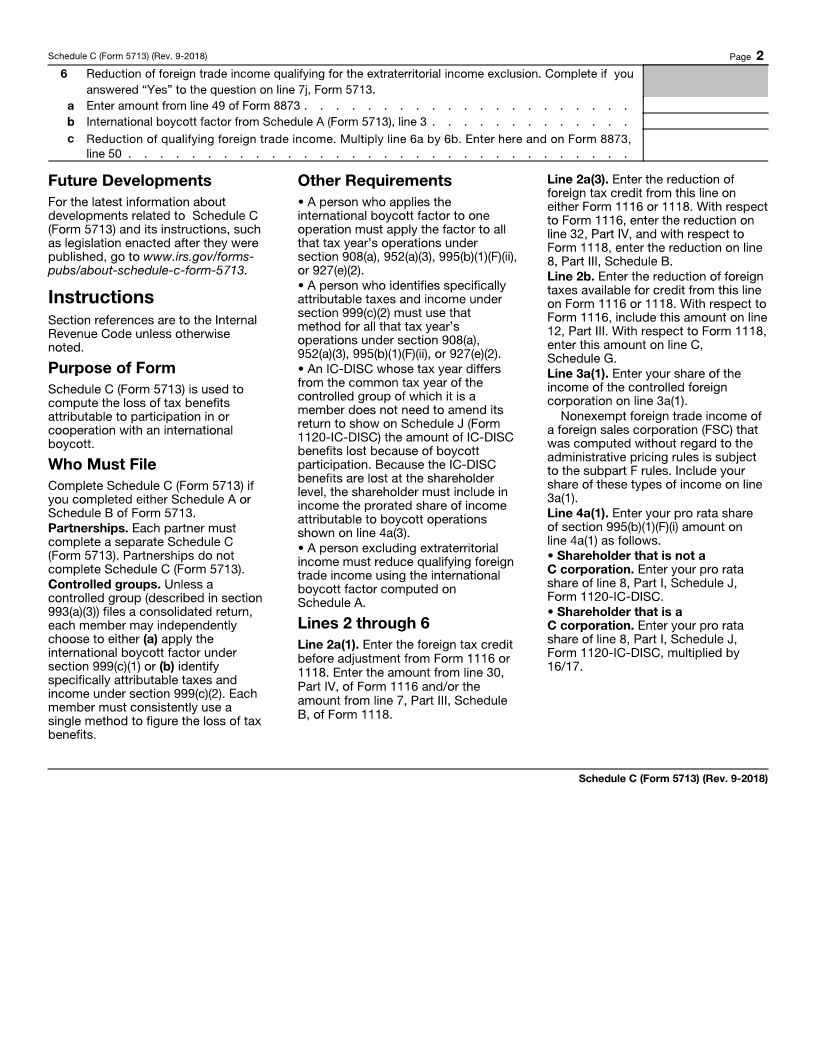

SCHEDULE C Tax Effect of the International Boycott Provisions

(Form 5713) ▶ Attach to Form 5713. OMB No. 1545-0216

(Rev. September 2018) ▶ See instructions on page 2.

Internal Revenue Service Go to

Department of the Treasury ▶ www.irs.gov/forms-pubs/about-schedule-c-form-5713 for the latest information.

Name Identifying number

1 Method used to compute loss of tax benefits (check one):

a International boycott factor from Schedule A (Form 5713). See lines 2a, 3a, 4a, and 5a below . . . . . . . . . ▶

b Identification of specifically attributable taxes and income from Schedule B (Form 5713). See lines 2b, 3b, 4b, and 5b

below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

2 Reduction of foreign tax credit (section 908(a)):

a International boycott factor. Complete if you checked box 1a above and answered “Yes” to the

question on line 7d, Form 5713.

(1) Foreign tax credit before adjustment from Form 1116 or 1118 (see instructions) . . . . . .

(2) International boycott factor from Schedule A (Form 5713), line 3 . . . . . . . . . . .

(3) Reduction of foreign tax credit. Multiply line 2a(1) by line 2a(2). Enter here and on Form 1116 or

1118 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

(4) Adjusted foreign tax credit. Subtract line 2a(3) from line 2a(1) . . . . . . . . . . . .

b Specifically attributable taxes and income. Complete if you checked box 1b above and answered

“Yes” to the question on line 7d, Form 5713. Enter the amount from line o, column (4), Schedule B

(Form 5713) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the appropriate part of this amount on Form 1116 or 1118 (see instructions).

3 Denial of deferral under subpart F (section 952(a)(3)):

a International boycott factor. Complete if you checked box 1a above and answered ‘‘Yes’’ to the

question on line 7b, Form 5713.

(1) Prorated share of total income of controlled foreign corporations (see instructions) . . . . .

(2) Prorated share of income attributable to earnings and profits of controlled foreign corporations

included in income under sections 951(a)(1)(A), 951(a)(1)(B), 952(a)(1), 952(a)(2), 952(a)(4), 952(a)(5),

and 952(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(3) Subtract line 3a(2) from line 3a(1) . . . . . . . . . . . . . . . . . . . . .

(4) International boycott factor from Schedule A (Form 5713), line 3 . . . . . . . . . . .

(5) Prorated share of subpart F international boycott income. Multiply line 3a(3) by line 3a(4). Enter

here and on line 22 of Worksheet A in the Form 5471 instructions . . . . . . . . . .

b Specifically attributable taxes and income. Complete if you checked box 1b above and answered

“Yes” to the question on line 7b, Form 5713. Enter the amount from line o, column (5), Schedule B

(Form 5713) here and on line 22 of Worksheet A in the Form 5471 instructions . . . . . . . .

4 Denial of IC-DISC benefits (section 995(b)(1)(F)(ii)):

a International boycott factor. Complete if you checked box 1a above and answered “Yes” to the

question on line 7c, Form 5713.

(1) Prorated share of section 995(b)(1)(F)(i) amount (see instructions) . . . . . . . . . . .

(2) International boycott factor from Schedule A (Form 5713), line 3 . . . . . . . . . . .

(3) Prorated share of IC-DISC international boycott income. Multiply line 4a(1) by line 4a(2). Enter this

amount here and the IC-DISC will include it on line 10, Part I, Schedule J, Form 1120-IC-DISC . .

b Specifically attributable taxes and income. Complete if you checked box 1b above and answered

“Yes” to the question on line 7c, Form 5713. Enter the amount from line o, column (6), Schedule B

(Form 5713) here and the IC-DISC will include it on line 10, Part I, Schedule J, Form 1120-IC-DISC .

5 Denial of exemption of foreign trade income (section 927(e)(2), as in effect before its repeal):

a International boycott factor. Complete if you checked box 1a above and answered “Yes” to the

question on line 7i, Form 5713.

(1) Add amounts from columns (a) and (b), line 10, Schedule B (Form 1120-FSC) . . . . . .

(2) International boycott factor from Schedule A (Form 5713), line 3 . . . . . . . . . . .

(3) Exempt foreign trade income of a FSC attributable to international boycott operations. Multiply

line 5a(1) by line 5a(2). Enter here and on line 2, Schedule F, Form 1120-FSC. . . . . . .

b Specifically attributable taxes and income. Complete if you checked box 1b above and answered

“Yes” to the question on line 7i, Form 5713. Enter the amount from line o, column (7), Schedule B

(Form 5713) here and on line 2, Schedule F, Form 1120-FSC . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see Instructions for Form 5713. Cat. No. 12070O Schedule C (Form 5713) (Rev. 9-2018)