Enlarge image

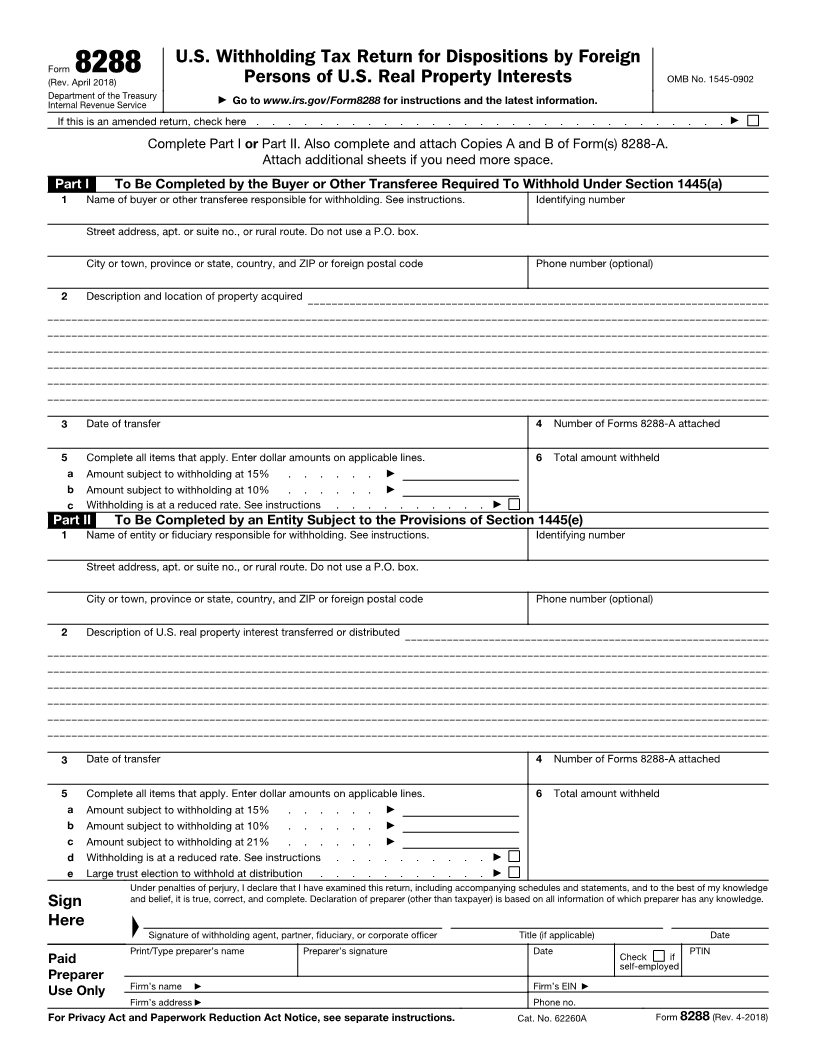

U.S. Withholding Tax Return for Dispositions by Foreign

Form 8288 OMB No. 1545-0902

(Rev. April 2018) Persons of U.S. Real Property Interests

Department of the Treasury ▶ Go to www.irs.gov/Form8288 for instructions and the latest information.

Internal Revenue Service

If this is an amended return, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶

Complete Part I or Part II. Also complete and attach Copies A and B of Form(s) 8288-A.

Attach additional sheets if you need more space.

Part I To Be Completed by the Buyer or Other Transferee Required To Withhold Under Section 1445(a)

1 Name of buyer or other transferee responsible for withholding. See instructions. Identifying number

Street address, apt. or suite no., or rural route. Do not use a P.O. box.

City or town, province or state, country, and ZIP or foreign postal code Phone number (optional)

2 Description and location of property acquired

3 Date of transfer 4 Number of Forms 8288-A attached

5 Complete all items that apply. Enter dollar amounts on applicable lines. 6 Total amount withheld

a Amount subject to withholding at 15% . . . . . . ▶

b Amount subject to withholding at 10% . . . . . . ▶

c Withholding is at a reduced rate. See instructions . . . . . . . . . . ▶

Part II To Be Completed by an Entity Subject to the Provisions of Section 1445(e)

1 Name of entity or fiduciary responsible for withholding. See instructions. Identifying number

Street address, apt. or suite no., or rural route. Do not use a P.O. box.

City or town, province or state, country, and ZIP or foreign postal code Phone number (optional)

2 Description of U.S. real property interest transferred or distributed

3 Date of transfer 4 Number of Forms 8288-A attached

5 Complete all items that apply. Enter dollar amounts on applicable lines. 6 Total amount withheld

a Amount subject to withholding at 15% . . . . . . ▶

b Amount subject to withholding at 10% . . . . . . ▶

c Amount subject to withholding at 21% . . . . . . ▶

d Withholding is at a reduced rate. See instructions . . . . . . . . . . ▶

e Large trust election to withhold at distribution . . . . . . . . . . . ▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

Sign and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲

Here

Signature of withholding agent, partner, fiduciary, or corporate officer Title (if applicable) Date

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer

Use Only Firm’s name ▶ Firm’s EIN ▶

Firm’s address ▶ Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 62260A Form 8288 (Rev. 4-2018)