Enlarge image

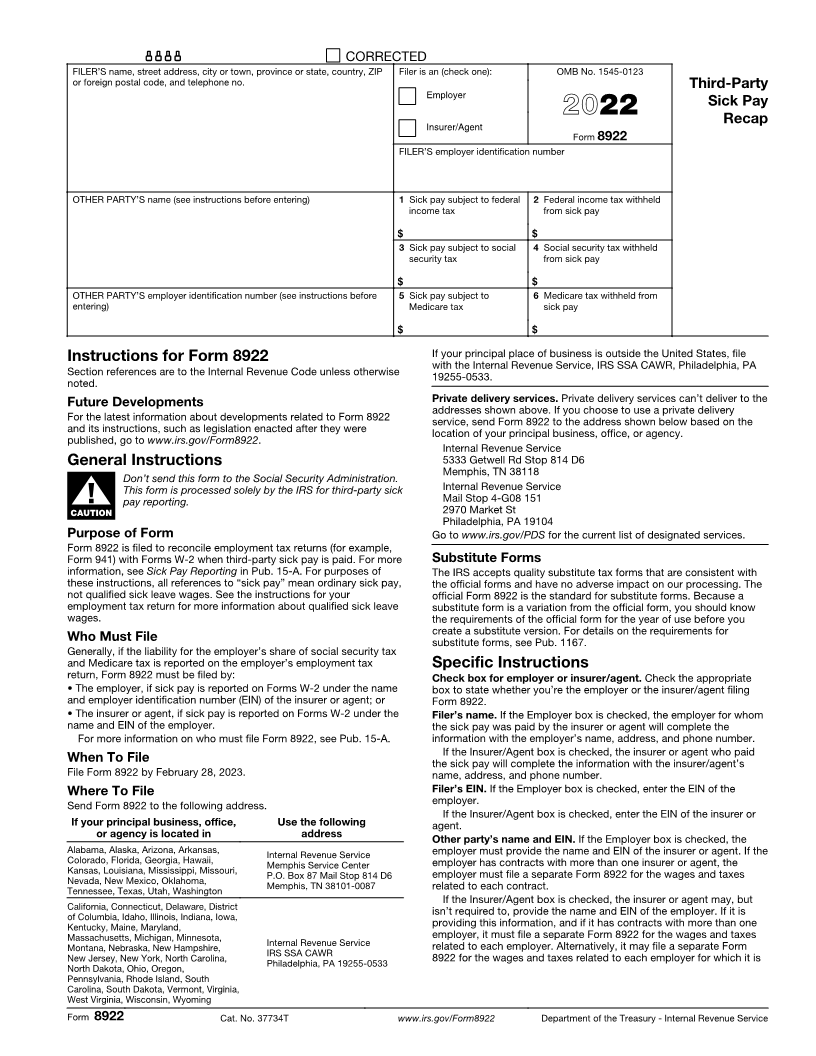

8888 CORRECTED

FILER’S name, street address, city or town, province or state, country, ZIP Filer is an (check one): OMB No. 1545-0123

or foreign postal code, and telephone no. Third-Party

Employer

Sick Pay

Insurer/Agent 2022 Recap

Form 8922

FILER’S employer identification number

OTHER PARTY’S name (see instructions before entering) 1 Sick pay subject to federal 2 Federal income tax withheld

income tax from sick pay

$ $

3 Sick pay subject to social 4 Social security tax withheld

security tax from sick pay

$ $

OTHER PARTY’S employer identification number (see instructions before 5 Sick pay subject to 6 Medicare tax withheld from

entering) Medicare tax sick pay

$ $

Instructions for Form 8922 If your principal place of business is outside the United States, file

Section references are to the Internal Revenue Code unless otherwise with the Internal Revenue Service, IRS SSA CAWR, Philadelphia, PA

noted. 19255-0533.

Future Developments Private delivery services. Private delivery services can’t deliver to the

addresses shown above. If you choose to use a private delivery

For the latest information about developments related to Form 8922 service, send Form 8922 to the address shown below based on the

and its instructions, such as legislation enacted after they were location of your principal business, office, or agency.

published, go to www.irs.gov/Form8922.

Internal Revenue Service

General Instructions 5333 Getwell Rd Stop 814 D6

Memphis, TN 38118

Don’t send this form to the Social Security Administration.

This form is processed solely by the IRS for third-party sick Internal Revenue Service

▲! pay reporting. Mail Stop 4-G08 151

CAUTION 2970 Market St

Philadelphia, PA 19104

Purpose of Form Go to www.irs.gov/PDS for the current list of designated services.

Form 8922 is filed to reconcile employment tax returns (for example,

Form 941) with Forms W-2 when third-party sick pay is paid. For more Substitute Forms

information, see Sick Pay Reporting in Pub. 15-A. For purposes of The IRS accepts quality substitute tax forms that are consistent with

these instructions, all references to “sick pay” mean ordinary sick pay, the official forms and have no adverse impact on our processing. The

not qualified sick leave wages. See the instructions for your official Form 8922 is the standard for substitute forms. Because a

employment tax return for more information about qualified sick leave substitute form is a variation from the official form, you should know

wages. the requirements of the official form for the year of use before you

create a substitute version. For details on the requirements for

Who Must File substitute forms, see Pub. 1167.

Generally, if the liability for the employer’s share of social security tax

and Medicare tax is reported on the employer’s employment tax Specific Instructions

return, Form 8922 must be filed by: Check box for employer or insurer/agent. Check the appropriate

• The employer, if sick pay is reported on Forms W-2 under the name box to state whether you’re the employer or the insurer/agent filing

and employer identification number (EIN) of the insurer or agent; or Form 8922.

• The insurer or agent, if sick pay is reported on Forms W-2 under the Filer’s name. If the Employer box is checked, the employer for whom

name and EIN of the employer. the sick pay was paid by the insurer or agent will complete the

For more information on who must file Form 8922, see Pub. 15-A. information with the employer’s name, address, and phone number.

If the Insurer/Agent box is checked, the insurer or agent who paid

When To File the sick pay will complete the information with the insurer/agent’s

File Form 8922 by February 28, 2023. name, address, and phone number.

Where To File Filer’s EIN. If the Employer box is checked, enter the EIN of the

Send Form 8922 to the following address. employer.

If the Insurer/Agent box is checked, enter the EIN of the insurer or

If your principal business, office, Use the following agent.

or agency is located in address Other party’s name and EIN. If the Employer box is checked, the

Alabama, Alaska, Arizona, Arkansas, Internal Revenue Service employer must provide the name and EIN of the insurer or agent. If the

Colorado, Florida, Georgia, Hawaii, Memphis Service Center employer has contracts with more than one insurer or agent, the

Kansas, Louisiana, Mississippi, Missouri, P.O. Box 87 Mail Stop 814 D6 employer must file a separate Form 8922 for the wages and taxes

Nevada, New Mexico, Oklahoma, Memphis, TN 38101-0087 related to each contract.

Tennessee, Texas, Utah, Washington

California, Connecticut, Delaware, District If the Insurer/Agent box is checked, the insurer or agent may, but

of Columbia, Idaho, Illinois, Indiana, Iowa, isn’t required to, provide the name and EIN of the employer. If it is

Kentucky, Maine, Maryland, providing this information, and if it has contracts with more than one

employer, it must file a separate Form 8922 for the wages and taxes

Massachusetts, Michigan, Minnesota, Internal Revenue Service related to each employer. Alternatively, it may file a separate Form

Montana, Nebraska, New Hampshire, IRS SSA CAWR 8922 for the wages and taxes related to each employer for which it is

New Jersey, New York, North Carolina, Philadelphia, PA 19255-0533

North Dakota, Ohio, Oregon,

Pennsylvania, Rhode Island, South

Carolina, South Dakota, Vermont, Virginia,

West Virginia, Wisconsin, Wyoming

Form 8922 Cat. No. 37734T www.irs.gov/Form8922 Department of the Treasury - Internal Revenue Service