Enlarge image

Click on the question-mark icons to display help windows.

The information provided will enable you to file a more complete return and reduce the chances the IRS will need to contact you.

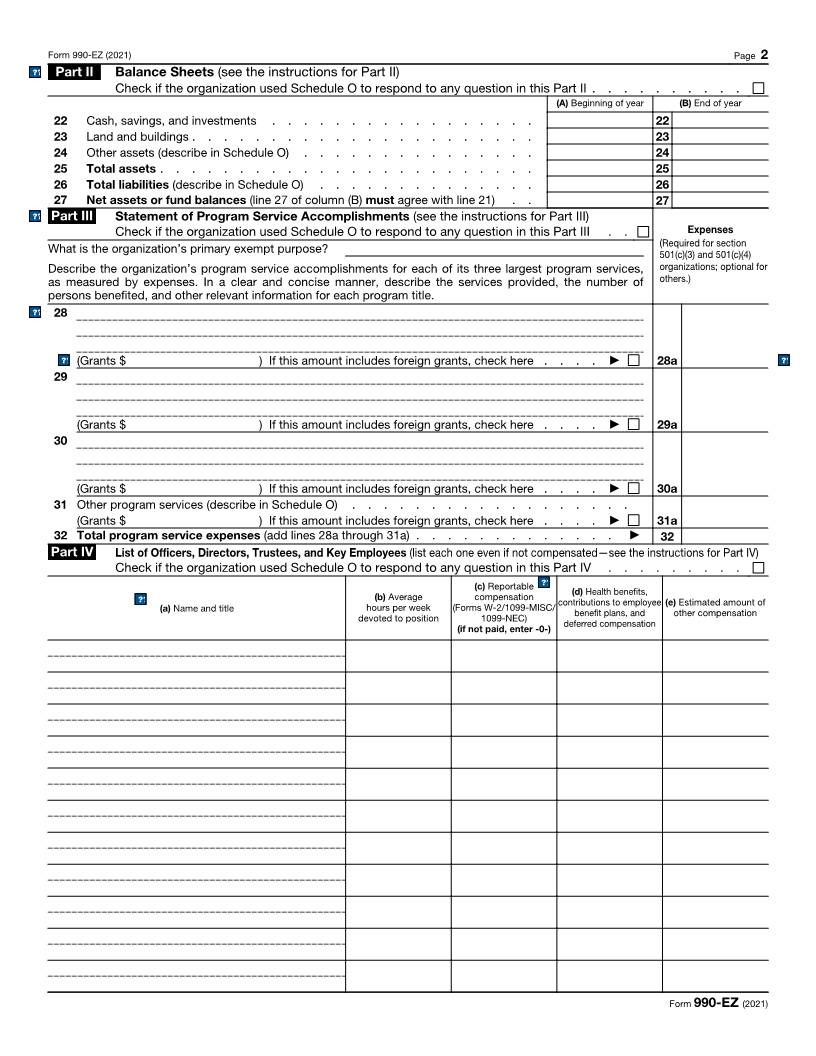

Short Form OMB No. 1545-0047

Form 990-EZ Return of Organization Exempt From Income Tax 21

20

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

▶ Do not enter social security numbers on this form, as it may be made public. Open to Public

Department of the Treasury ▶ Go to www.irs.gov/Form990EZ for instructions and the latest information. Inspection

Internal Revenue Service

A For the 2021 calendar year, or tax year beginning , 2021, and ending , 20

B Check if applicable: C Name of organization ?? help D Employer identification number ?? help

Address change

Name change Number and street (or P.O. box if mail is not delivered to street address) ?? help Room/suite E Telephone number

Initial return

Final return/terminated

Amended return City or town, state or province, country, and ZIP or foreign postal code F Group Exemption

Application pending Number ▶ ?? help

G Accounting Method: Cash Accrual Other (specify) ▶ H Check ▶ if the organization is not

I Website: ▶ required to attach Schedule B ?? help

J Tax-exempt status (check only one) — 501(c)(3) 501(c) ( ) ◀ (insert no.) 4947(a)(1) or 527 (Form 990).

K Form of organization: Corporation Trust Association Other

L Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total assets

(Part II, column (B)) are $500,000 or more, file Form 990 instead of Form 990-EZ . . . . . . . . . . . . ▶ $

Part I Revenue, Expenses, and Changes in Net Assets or Fund Balances (see the instructions for Part I) ?? help

Check if the organization used Schedule O to respond to any question in this Part I . . . . . . . . . .

?? help1 Contributions, gifts, grants, and similar amounts received . . . . . . . . . . . . . 1

?? help2 Program service revenue including government fees and contracts . . . . . . . . . 2

?? help3 Membership dues and assessments . . . . . . . . . . . . . . . . . . . . 3

?? help4 Investment income . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 a Gross amount from sale of assets other than inventory . . . . 5a

b Less: cost or other basis and sales expenses . . . . . . . . 5b

c Gain or (loss) from sale of assets other than inventory (subtract line 5b from line 5a) . . . . 5c

6 Gaming and fundraising events:

a Gross income from gaming (attach Schedule G if greater than

$15,000) . . . . . . . . . . . . . . . . . . . . 6a

b Gross income from fundraising events (not including $ of contributions

Revenue from fundraising events reported on line 1) (attach Schedule G if the

sum of such gross income and contributions exceeds $15,000) . . 6b

c Less: direct expenses from gaming and fundraising events . . . 6c

d Net income or (loss) from gaming and fundraising events (add lines 6a and 6b and subtract

line 6c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

7 a Gross sales of inventory, less returns and allowances . . . . . 7a

b Less: cost of goods sold . . . . . . . . . . . . . . 7b

c Gross profit or (loss) from sales of inventory (subtract line 7b from line 7a) . . . . . . . 7c

8 Other revenue (describe in Schedule O) . . . . . . . . . . . . . . . . . . . 8

9 Total revenue. Add lines 1, 2, 3, 4, 5c, 6d, 7c, and 8 . . . . . . . . . . . . . ▶ 9

10 Grants and similar amounts paid (list in Schedule O) . . . . . . . . . . . . . . 10

11 Benefits paid to or for members . . . . . . . . . . . . . . . . . . . . . 11

12 Salaries, other compensation, and employee benefits .?? help. . . . . . . . . . . . . 12

13 Professional fees and other payments to independent contractors .?? help. . . . . . . . . 13

14 Occupancy, rent, utilities, and maintenance . . . . . . . . . . . . . . . . . 14

Expenses 15 Printing, publications, postage, and shipping . . . . . . . . . . . . . . . . . 15

16 Other expenses (describe in Schedule O) .?? help. . . . . . . . . . . . . . . . . 16

17 Total expenses. Add lines 10 through 16 . . . . . . . . . . . . . . . . . ▶ 17

18 Excess or (deficit) for the year (subtract line 17 from line 9) . . . . . . . . . . . . 18

19 Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with

end-of-year figure reported on prior year’s return) . . . . . . . . . . . . . . . 19

20 Other changes in net assets or fund balances (explain in Schedule O) . . . . . . . . . 20

21 Net assets or fund balances at end of year. Combine lines 18 through 20 . . . . . .

Net Assets ▶ 21

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10642I Form 990-EZ (2021)