Enlarge image

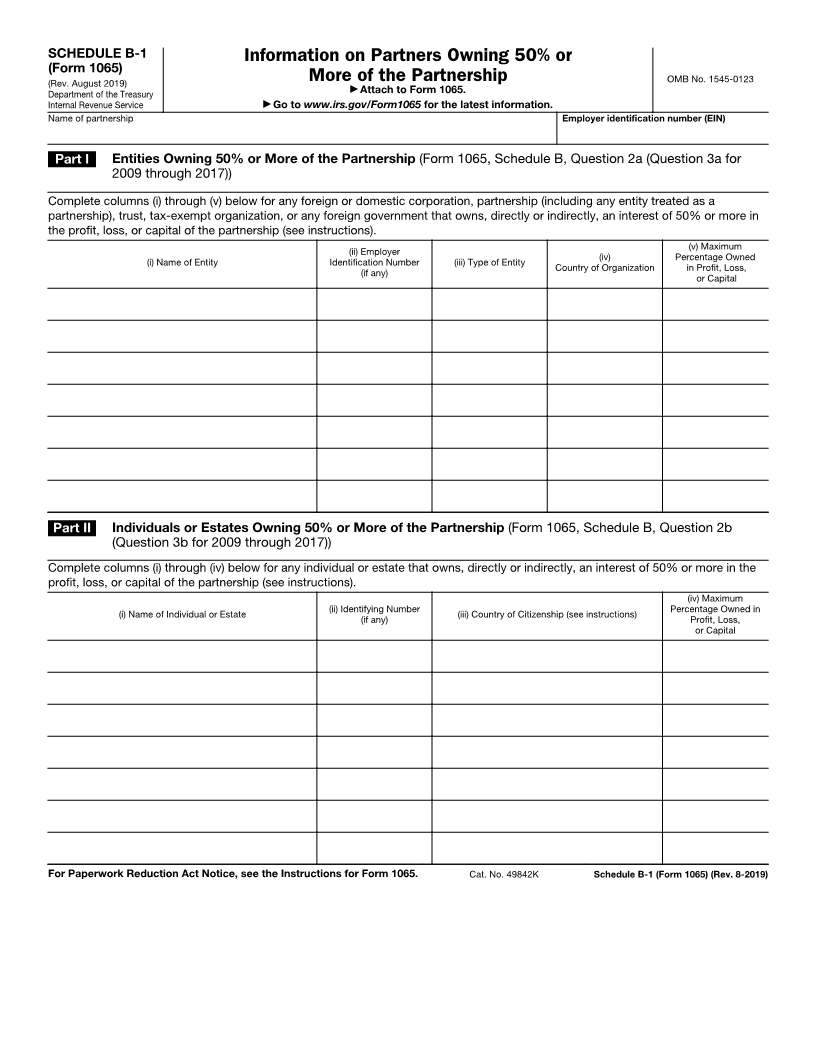

SCHEDULE B-1 Information on Partners Owning 50% or

(Form 1065)

(Rev. August 2019) More of the Partnership OMB No. 1545-0123

Department of the Treasury ▶ Attach to Form 1065.

Internal Revenue Service ▶ Go to www.irs.gov/Form1065 for the latest information.

Name of partnership Employer identification number (EIN)

Part I Entities Owning 50% or More of the Partnership (Form 1065, Schedule B, Question 2a (Question 3a for

2009 through 2017))

Complete columns (i) through (v) below for any foreign or domestic corporation, partnership (including any entity treated as a

partnership), trust, tax-exempt organization, or any foreign government that owns, directly or indirectly, an interest of 50% or more in

the profit, loss, or capital of the partnership (see instructions).

(ii) Employer (v) Maximum

(i) Name of Entity Identification Number (iii) Type of Entity (iv) Percentage Owned

(if any) Country of Organization in Profit, Loss,

or Capital

Part II Individuals or Estates Owning 50% or More of the Partnership (Form 1065, Schedule B, Question 2b

(Question 3b for 2009 through 2017))

Complete columns (i) through (iv) below for any individual or estate that owns, directly or indirectly, an interest of 50% or more in the

profit, loss, or capital of the partnership (see instructions).

(iv) Maximum

(i) Name of Individual or Estate (ii) Identifying Number (iii) Country of Citizenship (see instructions) Percentage Owned in

(if any) Profit, Loss,

or Capital

For Paperwork Reduction Act Notice, see the Instructions for Form 1065. Cat. No. 49842K Schedule B-1 (Form 1065) (Rev. 8-2019)