Enlarge image

OMB No. 1545-1941

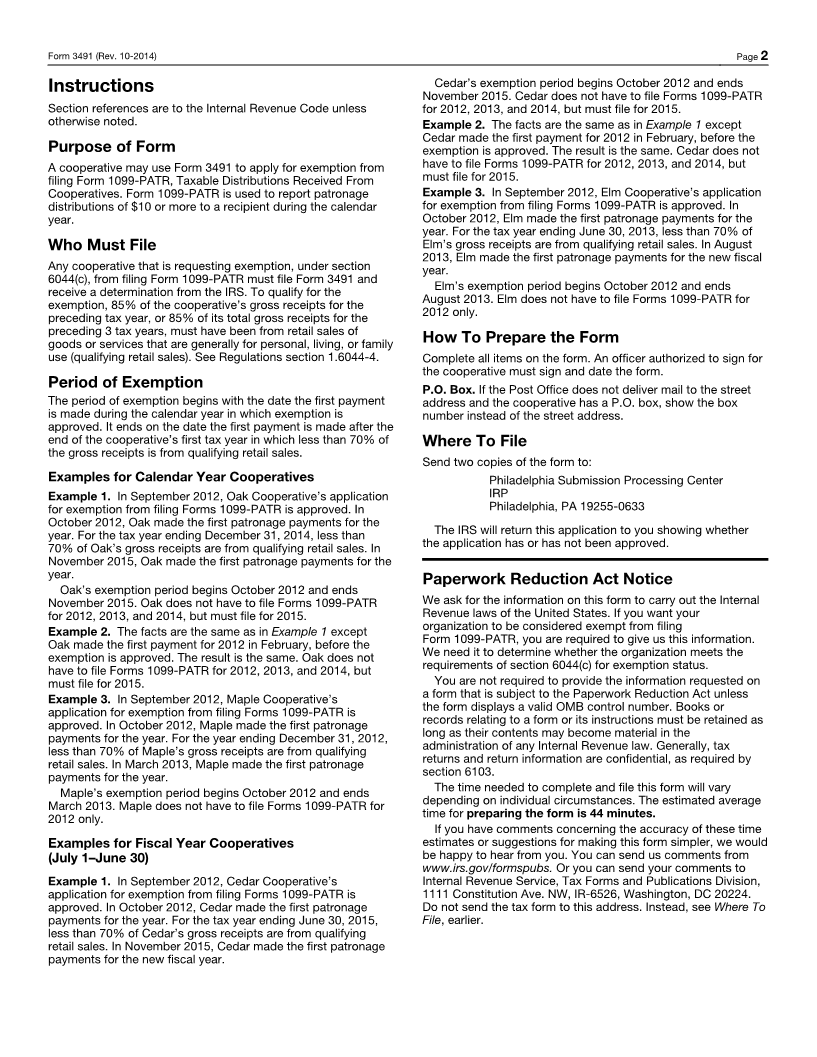

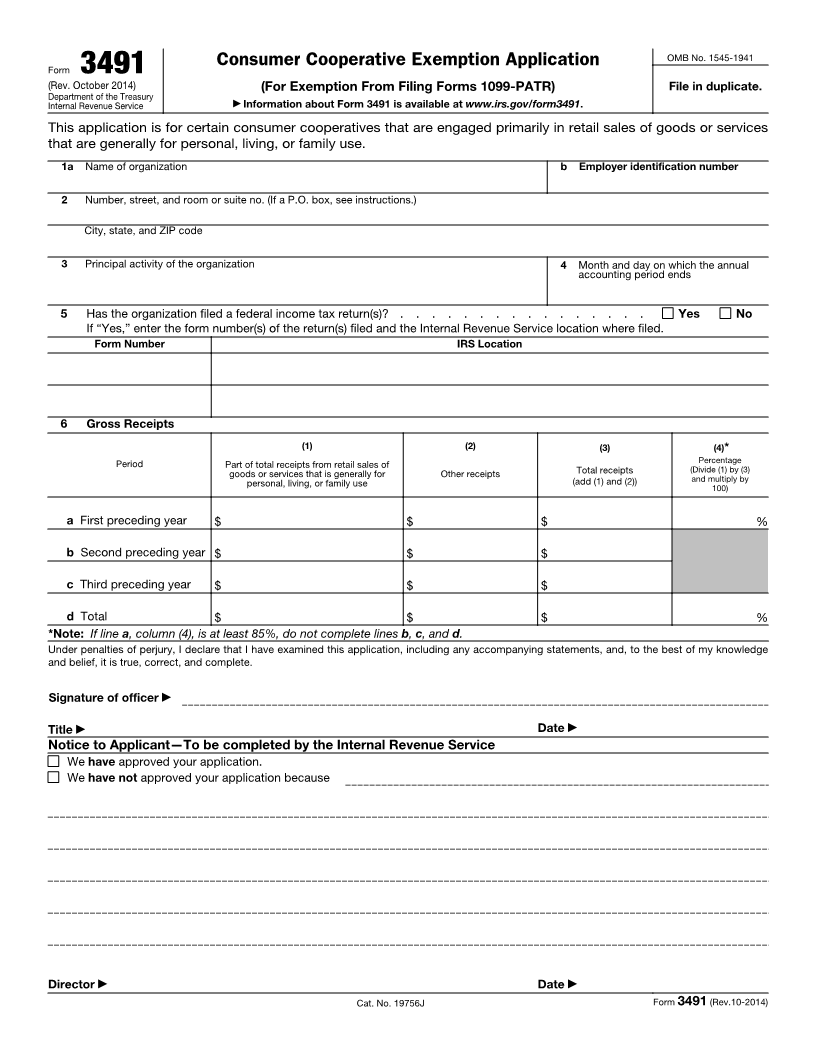

Consumer Cooperative Exemption Application

Form 3491

(Rev. October 2014) (For Exemption From Filing Forms 1099-PATR) File in duplicate.

Department of the Treasury ▶ Information about Form 3491 is available at www.irs.gov/form3491.

Internal Revenue Service

This application is for certain consumer cooperatives that are engaged primarily in retail sales of goods or services

that are generally for personal, living, or family use.

1a Name of organization b Employer identification number

2 Number, street, and room or suite no. (If a P.O. box, see instructions.)

City, state, and ZIP code

3 Principal activity of the organization 4 Month and day on which the annual

accounting period ends

5 Has the organization filed a federal income tax return(s)? . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the form number(s) of the return(s) filed and the Internal Revenue Service location where filed.

Form Number IRS Location

6 Gross Receipts

(1) (2) (3) (4) *

Period Part of total receipts from retail sales of Percentage

goods or services that is generally for Other receipts Total receipts (Divide (1) by (3)

personal, living, or family use (add (1) and (2)) and multiply by

100)

a First preceding year $ $ $ %

b Second preceding year $ $ $

c Third preceding year $ $ $

d Total $ $ $ %

*Note: If line a, column (4), is at least 85%, do not complete lines , ,band c . d

Under penalties of perjury, I declare that I have examined this application, including any accompanying statements, and, to the best of my knowledge

and belief, it is true, correct, and complete.

Signature of officer ▶

Title ▶ Date ▶

Notice to Applicant—To be completed by the Internal Revenue Service

We have approved your application.

We have not approved your application because

Director ▶ Date ▶

Cat. No. 19756J Form 3491 (Rev.10-2014)