- 4 -

Enlarge image

|

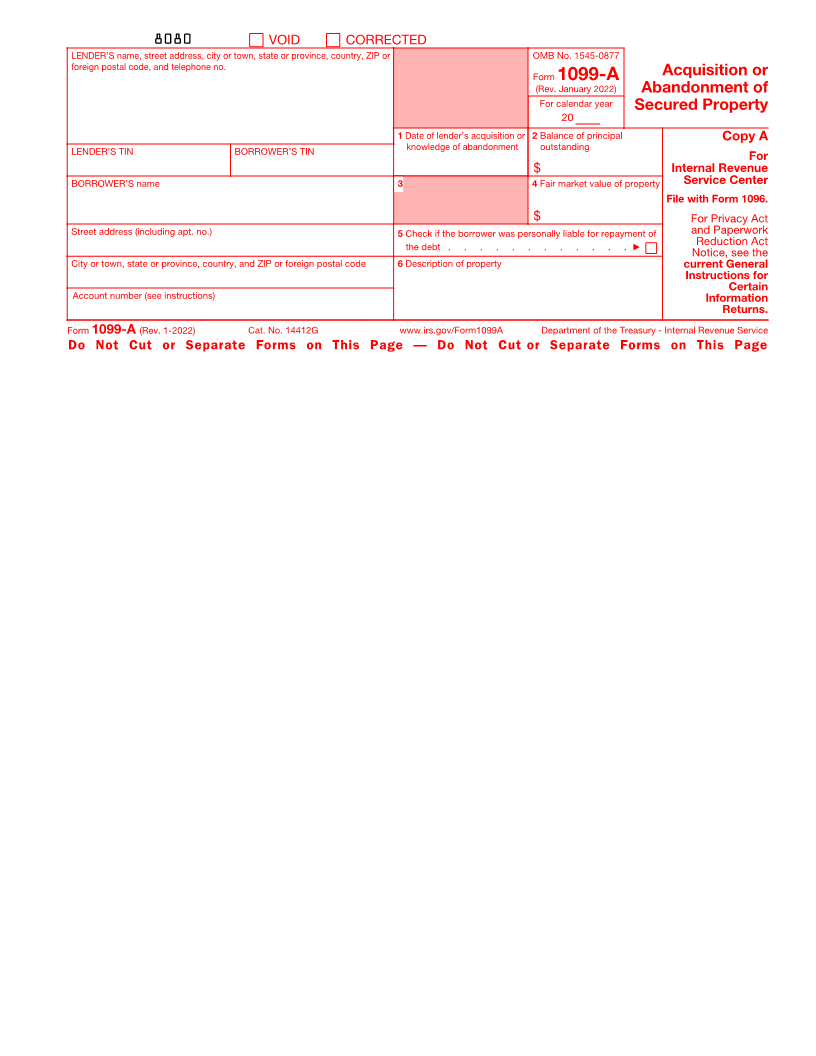

Instructions for Borrower or the date possession and the burdens and benefits of ownership were

transferred to the lender. This may be the date of a foreclosure or execution sale

Certain lenders who acquire an interest in property that was security for a loan or the date your right of redemption or objection expired. For an abandonment,

or who have reason to know that such property has been abandoned must the date shown is the date on which the lender first knew or had reason to know

provide you with this statement. You may have reportable income or loss that the property was abandoned or the date of a foreclosure, execution, or

because of such acquisition or abandonment. Gain or loss from an acquisition is similar sale.

generally measured by the difference between your adjusted basis in the

property and the amount of your debt canceled in exchange for the property or, Box 2. Shows the debt (principal only) owed to the lender on the loan when the

if greater, the sale proceeds. If you abandoned the property, you may have interest in the property was acquired by the lender or on the date the lender first

income from the discharge of indebtedness in the amount of the unpaid balance knew or had reason to know that the property was abandoned.

of your canceled debt. The tax consequences of abandoning property depend Box 3. Reserved for future use.

on whether or not you were personally liable for the debt. Losses on acquisitions Box 4. Shows the fair market value of the property. If the amount in box 4 is less

or abandonments of property held for personal use are not deductible. See Pub. than the amount in box 2, and your debt is canceled, you may have cancellation

4681 for information about your tax consequences. of debt income. If the property was your main home, see Pub. 523 to figure any

Property means any real property (such as a personal residence), any taxable gain or ordinary income.

intangible property, and tangible personal property that is held for investment or Box 5. Shows whether you were personally liable for repayment of the debt

used in a trade or business. when the debt was created or, if modified, when it was last modified.

If you borrowed money on this property with someone else, each of you Box 6. Shows the description of the property acquired by the lender or

should receive this statement. abandoned by you. If “CCC” is shown, the form indicates the amount of any

Borrower’s taxpayer identification number (TIN). For your protection, this Commodity Credit Corporation loan outstanding when you forfeited your

form may show only the last four digits of your TIN (social security number commodity.

(SSN), individual taxpayer identification number (ITIN), adoption taxpayer Future developments. For the latest information about developments related to

identification number (ATIN), or employer identification number (EIN)). However, Form 1099-A and its instructions, such as legislation enacted after they were

the issuer has reported your complete TIN to the IRS. published, go to www.irs.gov/Form1099A.

Account number. May show an account or other unique number the lender Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

assigned to distinguish your account. online federal tax preparation, e-filing, and direct deposit or payment options.

Box 1. For a lender’s acquisition of property that was security for a loan, the

date shown is generally the earlier of the date title was transferred to the lender

|