Enlarge image

Application for Approval of Prototype or Employer

Form 5306

(Rev. November 2019) Sponsored Individual Retirement Arrangement (IRA) OMB No. 1545-0390

(Under section 408(a), (b), (c), or (p) or section 408A of the Internal Revenue Code)

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form5306 for the latest information.

For IRS Use Only

1 Enter amount of user fee submitted. See Specific Instructions ▶ $ File folder number

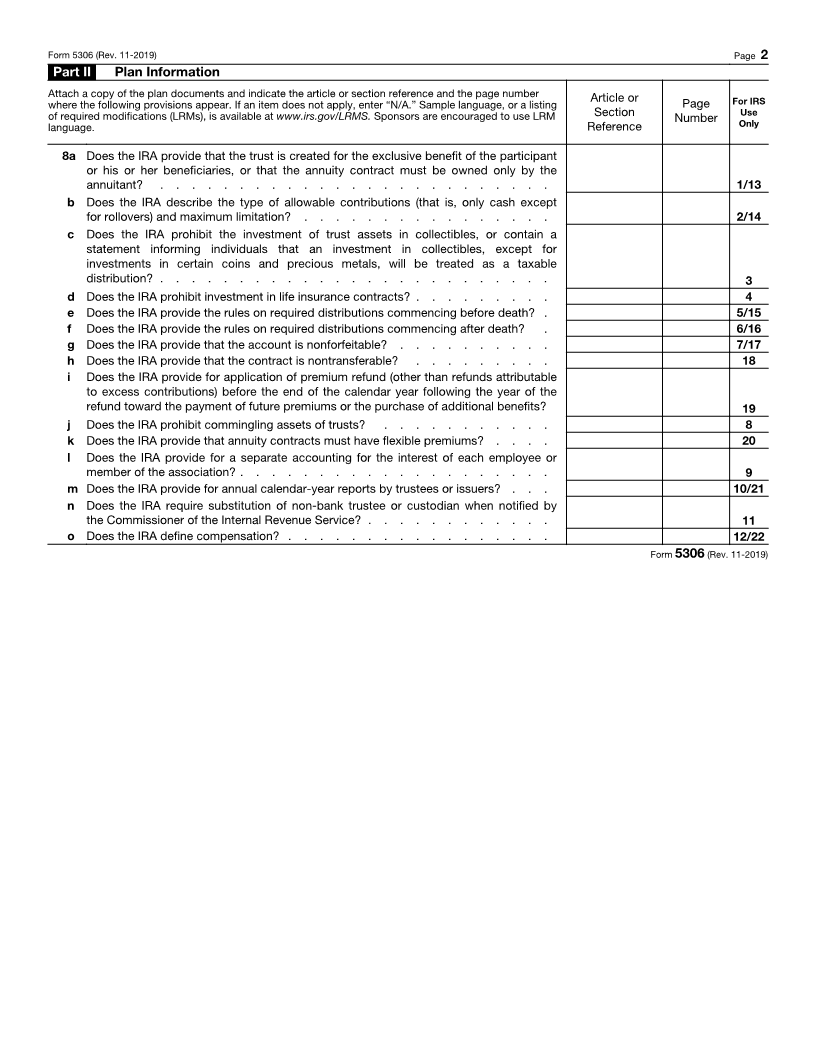

Part I Identifying Information (see instructions before completing this part)

2 Approval requested for:

a Type of individual retirement arrangement—

(1) Prototype traditional IRA under section 408(a) or 408(b) (2) Prototype Roth IRA under section 408A

(3) Prototype dual-purpose IRA (4) Prototype SIMPLE IRA under section 408(p)

(5) Roth or traditional IRA established by employer or

employee association under section 408(c)

b Initial application

c Amendment—Enter ▶ (1) Latest letter serial number (2) Date letter issued (3) File folder number

3a Name of applicant 3b Employer identification

number of applicant

Number, street, and room or suite no. (if a P.O. box, see instructions)

City or town, state, and ZIP code

4a Name of person to be contacted 4b Telephone number

4 c Email address

4d If a power of attorney is attached, check box . . ▶

5 a Type of sponsoring organization (if you are applying for a ruling under section 408(c), do not complete this item):

(1) Insurance company (5) Regulated investment company

(2) Trade or professional association (6) Federally insured credit union

(3) Savings and loan association that qualifies as a bank (7) Approved non-bank trustee (attach copy of approval letter)

(4) Bank

b Type of submission (check one box):

(1) Not a mass submitter (2) Mass submitter

(3) Identical adoption of a mass submitter (4) Minor modification of a mass submitter

6 Name of trustee or custodian

Number, street, and room or suite no. (if a P.O. box, see instructions)

City or town, state, and ZIP code

7 Type of funding entity:

a Trust c Insurance company

b Custodial account Annuity contract or endorsement number (see instructions) ▶

Under penalties of perjury, I declare that I have examined this application, including accompanying statements, and, to the best of my knowledge and belief,

it is true, correct, and complete.

Sign ▲ ▲

Here

Signature of officer Date Title

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 11830C Form 5306 (Rev. 11-2019)