Enlarge image

Department of the Treasury - Internal Revenue Service

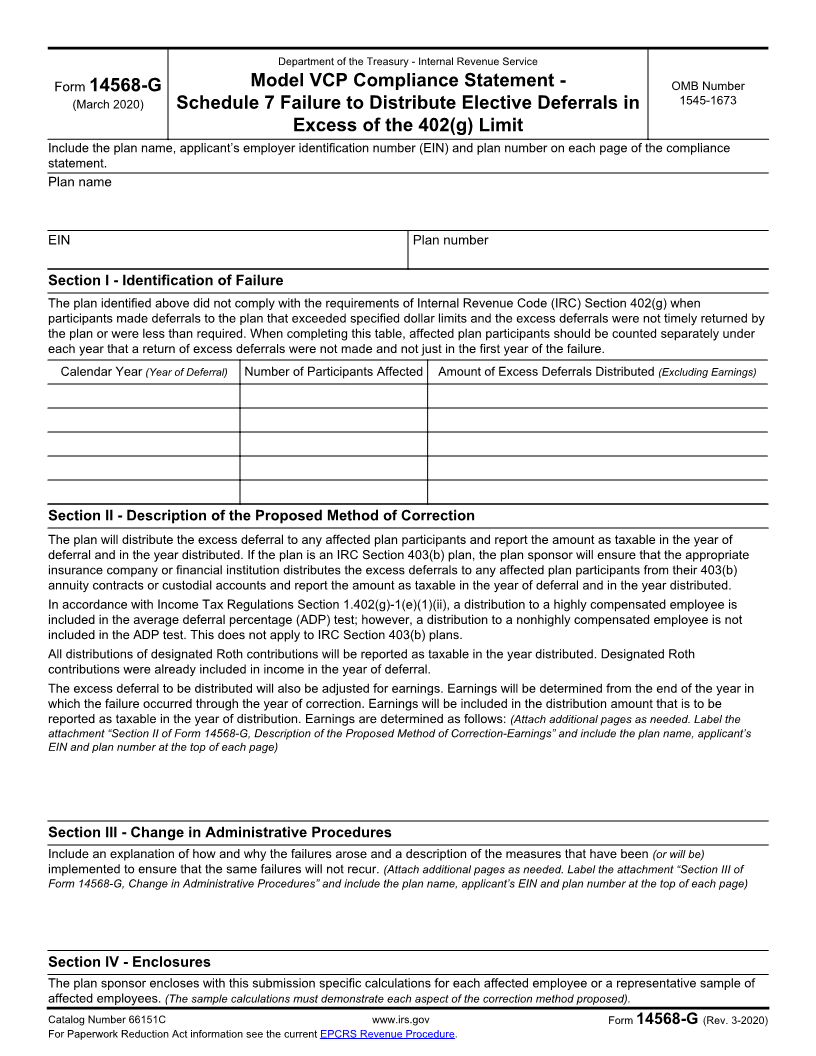

Form 14568-G Model VCP Compliance Statement - OMB Number

1545-1673

(March 2020) Schedule 7 Failure to Distribute Elective Deferrals in

Excess of the 402(g) Limit

Include the plan name, applicant’s employer identification number (EIN) and plan number on each page of the compliance

statement.

Plan name

EIN Plan number

Section I - Identification of Failure

The plan identified above did not comply with the requirements of Internal Revenue Code (IRC) Section 402(g) when

participants made deferrals to the plan that exceeded specified dollar limits and the excess deferrals were not timely returned by

the plan or were less than required. When completing this table, affected plan participants should be counted separately under

each year that a return of excess deferrals were not made and not just in the first year of the failure.

Calendar Year (Year of Deferral) Number of Participants Affected Amount of Excess Deferrals Distributed (Excluding Earnings)

Section II - Description of the Proposed Method of Correction

The plan will distribute the excess deferral to any affected plan participants and report the amount as taxable in the year of

deferral and in the year distributed. If the plan is an IRC Section 403(b) plan, the plan sponsor will ensure that the appropriate

insurance company or financial institution distributes the excess deferrals to any affected plan participants from their 403(b)

annuity contracts or custodial accounts and report the amount as taxable in the year of deferral and in the year distributed.

In accordance with Income Tax Regulations Section 1.402(g)-1(e)(1)(ii), a distribution to a highly compensated employee is

included in the average deferral percentage (ADP) test; however, a distribution to a nonhighly compensated employee is not

included in the ADP test. This does not apply to IRC Section 403(b) plans.

All distributions of designated Roth contributions will be reported as taxable in the year distributed. Designated Roth

contributions were already included in income in the year of deferral.

The excess deferral to be distributed will also be adjusted for earnings. Earnings will be determined from the end of the year in

which the failure occurred through the year of correction. Earnings will be included in the distribution amount that is to be

reported as taxable in the year of distribution. Earnings are determined as follows: (Attach additional pages as needed. Label the

attachment “Section II of Form 14568-G, Description of the Proposed Method of Correction-Earnings” and include the plan name, applicant’s

EIN and plan number at the top of each page)

Section III - Change in Administrative Procedures

Include an explanation of how and why the failures arose and a description of the measures that have been (or will be)

implemented to ensure that the same failures will not recur. (Attach additional pages as needed. Label the attachment “Section III of

Form 14568-G, Change in Administrative Procedures” and include the plan name, applicant’s EIN and plan number at the top of each page)

Section IV - Enclosures

The plan sponsor encloses with this submission specific calculations for each affected employee or a representative sample of

affected employees. (The sample calculations must demonstrate each aspect of the correction method proposed).

Catalog Number 66151C www.irs.gov Form 14568-G (Rev. 3-2020)

For Paperwork Reduction Act information see the current EPCRS Revenue Procedure.