- 2 -

Enlarge image

|

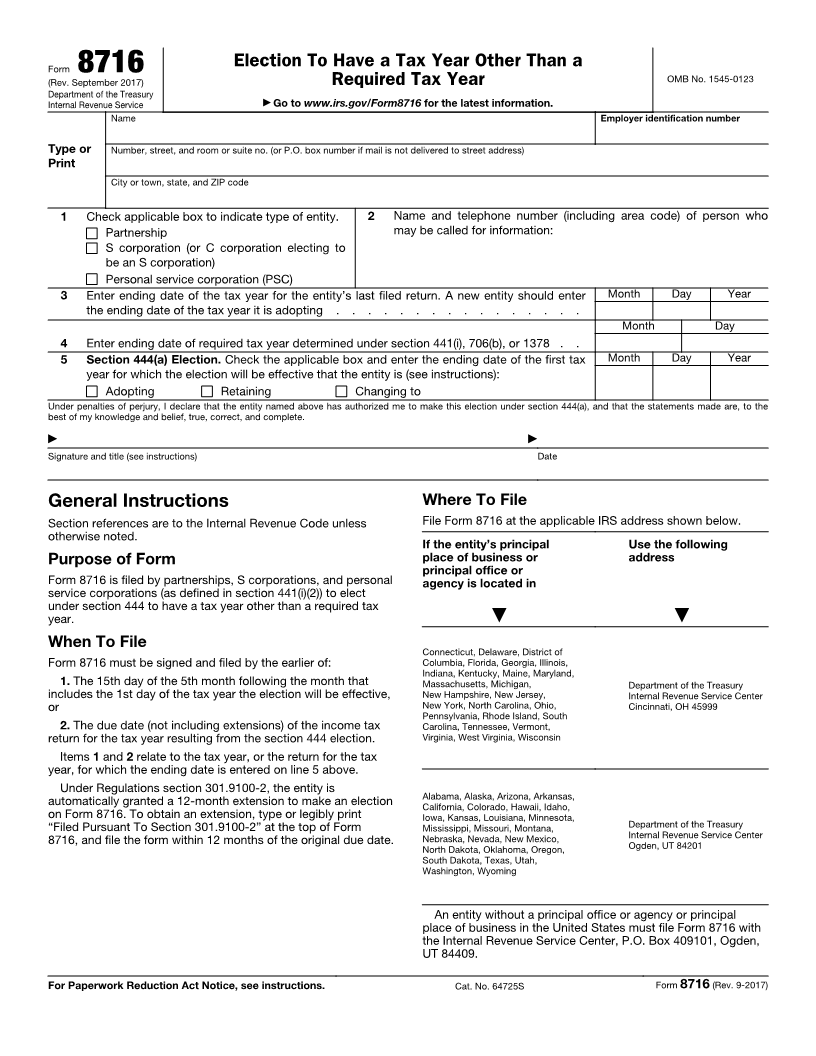

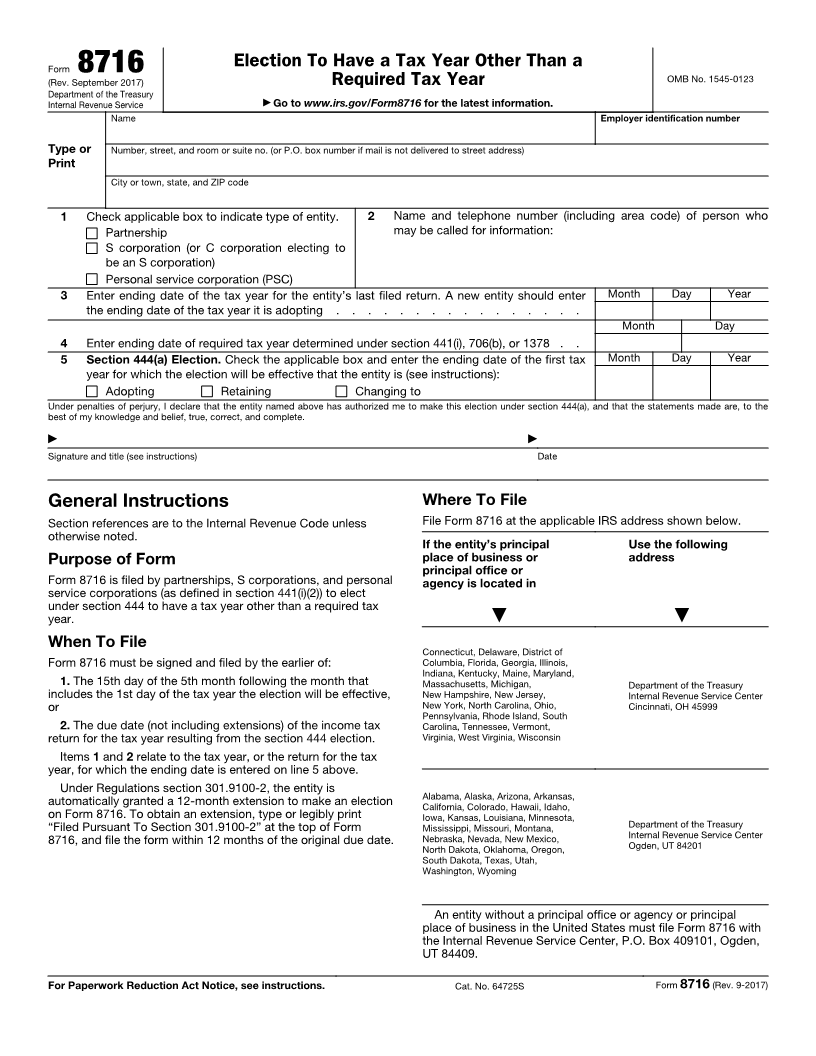

Election To Have a Tax Year Other Than a

Form 8716 OMB No. 1545-0123

(Rev. September 2017) Required Tax Year

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form8716 for the latest information.

Name Employer identification number

Type or Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

Print

City or town, state, and ZIP code

1 Check applicable box to indicate type of entity. 2 Name and telephone number (including area code) of person who

Partnership may be called for information:

S corporation (or C corporation electing to

be an S corporation)

Personal service corporation (PSC)

3 Enter ending date of the tax year for the entity’s last filed return. A new entity should enter Month Day Year

the ending date of the tax year it is adopting . . . . . . . . . . . . . . . .

Month Day

4 Enter ending date of required tax year determined under section 441(i), 706(b), or 1378 . .

5 Section 444(a) Election. Check the applicable box and enter the ending date of the first tax Month Day Year

year for which the election will be effective that the entity is (see instructions):

Adopting Retaining Changing to

Under penalties of perjury, I declare that the entity named above has authorized me to make this election under section 444(a), and that the statements made are, to the

best of my knowledge and belief, true, correct, and complete.

▶ ▶

Signature and title (see instructions) Date

General Instructions Where To File

Section references are to the Internal Revenue Code unless File Form 8716 at the applicable IRS address shown below.

otherwise noted.

If the entity’s principal Use the following

Purpose of Form place of business or address

principal office or

Form 8716 is filed by partnerships, S corporations, and personal agency is located in

service corporations (as defined in section 441(i)(2)) to elect

under section 444 to have a tax year other than a required tax

year. ▼ ▼

When To File

Connecticut, Delaware, District of

Form 8716 must be signed and filed by the earlier of: Columbia, Florida, Georgia, Illinois,

Indiana, Kentucky, Maine, Maryland,

1. The 15th day of the 5th month following the month that Massachusetts, Michigan, Department of the Treasury

includes the 1st day of the tax year the election will be effective, New Hampshire, New Jersey, Internal Revenue Service Center

or New York, North Carolina, Ohio, Cincinnati, OH 45999

Pennsylvania, Rhode Island, South

2. The due date (not including extensions) of the income tax Carolina, Tennessee, Vermont,

return for the tax year resulting from the section 444 election. Virginia, West Virginia, Wisconsin

Items 1and relate2 to the tax year, or the return for the tax

year, for which the ending date is entered on line 5 above.

Under Regulations section 301.9100-2, the entity is

automatically granted a 12-month extension to make an election Alabama, Alaska, Arizona, Arkansas,

California, Colorado, Hawaii, Idaho,

on Form 8716. To obtain an extension, type or legibly print Iowa, Kansas, Louisiana, Minnesota,

“Filed Pursuant To Section 301.9100-2” at the top of Form Mississippi, Missouri, Montana, Department of the Treasury

8716, and file the form within 12 months of the original due date. Nebraska, Nevada, New Mexico, Internal Revenue Service Center

North Dakota, Oklahoma, Oregon, Ogden, UT 84201

South Dakota, Texas, Utah,

Washington, Wyoming

An entity without a principal office or agency or principal

place of business in the United States must file Form 8716 with

the Internal Revenue Service Center, P.O. Box 409101, Ogden,

UT 84409.

For Paperwork Reduction Act Notice, see instructions. Cat. No. 64725S Form 8716 (Rev. 9-2017)

|